For Every Buyer, Orange County’s Housing Market Offers Promise—And Potential Pitfalls

Looking to buy a home in Orange County can feel like stepping onto the ultimate real estate stage: competition is fierce, opportunities are dazzling, and one wrong move could cost you dearly. Did you know that over 95% of homes represented by experienced agents in this region close in less than 14 days? This stat spotlights both the demand and the urgency buyers face here. But in a marketplace where stunning beaches, renowned schools, and career prospects draw buyers from across the country, getting swept up in the moment is all too easy.

For many, buying homes in Orange County marks not just a transaction but one of the largest investments of their lives. The landscape is dotted with attractive communities—like North Tustin, Newport Beach, Laguna Beach, and Irvine—each offering something distinct in lifestyle and affordability. Yet, beneath the promise lies complexity: fluctuating market conditions, fast-moving deals, and local nuances that can expose the unprepared to costly mistakes. Whether you are a first-time buyer, moving up for a growing family, or seeking an investment property, understanding what sets Orange County apart is essential to making a wise, secure purchase. Let’s unravel why this market commands special attention and how you can navigate it with confidence.

Understanding the Orange County Market: Why Knowledge Is Your Best Defense

Orange County is not a place where buying a home can be handled with generic advice or assumptions—this is a market defined by tight timelines, shifting demand, and nuanced neighborhood personalities. Those exploring buying homes in Orange County often encounter a maze of options, from waterfront properties to charming inland neighborhoods. While beauty and amenities abound, buyers sometimes overlook key issues: fluctuating price trends, hidden repair needs, or even how local school ratings can affect long-term value. Without a clear understanding of these elements, you might end up either overbidding or missing out entirely.

Even seasoned buyers can fall prey to the intensity of Orange County’s market. Overlooking details in contracts, neglecting due diligence on prospective communities, or failing to recognize future development trends can all lead to regret after the keys are handed over. When homes frequently close in under two weeks, hesitation can be costly, but so can rushing ahead without the right information. By learning about the unique dynamics and risks of the region—including neighborhoods that aren’t yet on most buyers’ radars—you position yourself to avoid disappointment now and regret later. The difference between a smooth transaction and a misstep may come down to being proactive and informed at every stage.

How Expert Guidance Turns Buyer Uncertainty Into Real-World Advantage

When it comes to navigating the challenges of buying homes in Orange County, informed guidance isn’t just helpful—it’s transformative. As highlighted by the approach at Coastal Real Estate Group, buyers benefit most when they work alongside detail-oriented and tech-savvy professionals who dedicate themselves to each step of the process. Drawing upon decades of local expertise, these agents don’t just guide buyers to the obvious communities; they introduce hidden gems and emerging neighborhoods that might be the perfect fit for unique needs and budgets.

The real advantages manifest in outcomes: more than 95% of transactions handled by seasoned professionals close within two weeks, dramatically reducing the stress and uncertainty of prolonged negotiations. Agents well-versed in the nuances of Orange County real estate can spot issues that others might miss—whether it’s a property with hidden maintenance concerns or understanding how future school rezonings could influence a home’s value. For clients, this expertise leads to not only time saved but also peace of mind and confidence that they’re making a sound investment. The value of buying homes in Orange County is maximized when buyers access professionals who anticipate hurdles, harness advanced search technologies, and keep their finger on the pulse of the region’s rapidly evolving market.

Neighborhoods with Nuance: Finding the Right Fit Beyond the Obvious Hotspots

Choosing where to plant roots is more complex in Orange County than scanning a list of popular cities. With areas like Aliso Viejo, Costa Mesa, Tustin, and Laguna Niguel, each community offers a distinctive blend of character, amenities, and price points. Experience from long-time local experts highlights the importance of venturing beyond the usual suspects: it’s often the lesser-known enclaves, not on every online list, that offer the best mix of affordability, growth potential, and lifestyle appeal. This is especially significant as local agents frequently access "pocket listings"—homes yet to be released to the public market—allowing buyers a first look at prime opportunities.

Beyond location, many Orange County buyers must factor in family needs, such as access to award-winning schools or proximity to employment centers. Success here depends on more than just budget; it’s about aligning lifestyle priorities, long-term aspirations, and future resale potential. Buyers who lean on seasoned perspectives are less likely to face disappointment due to hidden drawbacks or missed opportunities.

Smart Bidding Strategies: Fast Closings, Insider Access, and Beating the Competition

With homes selling in days rather than weeks, the Orange County market doesn’t reward hesitation. Instead, expert agents help buyers craft compelling offers and navigate bidding wars, leveraging insider knowledge to anticipate the moves of competing buyers. The ability to identify properties before they’re widely available—a strength of professionals with deep local connections—gives clients a tangible advantage, especially when low inventory makes bidding frenzies the norm.

Similarly, negotiating pitfalls—like unexpected inspection results or insurance setbacks—are more easily avoided with experienced guidance. The knowledge to foresee long-term issues and the tact to address them proactively allows buyers to move forward with confidence, even when deals become complex. Ultimately, a savvy strategy isn’t just about speed; it’s about thoroughness, clarity, and protecting client interests every step of the way.

Long-Term Value: What Drives Lasting Satisfaction in an Orange County Home

While Orange County’s sunshine and scenery might be what draw many buyers initially, the factors that determine long-term satisfaction—and return on investment—are more nuanced. Experts continually stress the importance of neighborhood research, understanding how local schools, transportation upgrades, or even planned commercial developments might influence a home’s value years down the line. The most fulfilled buyers are those who balance excitement with diligence, considering how their priorities might evolve over time and selecting communities that support those future changes.

Paying attention to these broader trends not only positions buyers to enjoy their home today, but also sets them up for future financial strength—whether holding onto the property for generations or selling in a market upswing. With Orange County’s reputation for steady appreciation, making informed, strategic decisions now lays the groundwork for lasting security and satisfaction.

The Coastal Real Estate Group Method: Deep Local Roots, Total Focus on Clients

Coastal Real Estate Group brings more than three decades of combined experience and an insider’s passion to the process of buying homes in Orange County. At the core of their philosophy is a commitment to giving every client undivided, personalized attention seven days a week—a testament to the belief that this life-changing decision deserves focus and care. They view every transaction as more than a number: it’s about helping families grow, investors succeed, and dreams take shape in the area they know and love.

A hallmark of their approach is attention to detail and adaptability. By staying ahead of market trends and leveraging cutting-edge technology, their agents handle the complexity of fast-paced deals without missing a beat. Whether clients are searching for their first home or an investment property, the group’s local perspective allows them to recommend communities and listings buyers might never find on their own. Every wrinkle in the buying process—be it contract negotiation, property evaluation, or handling unexpected challenges—is managed with seasoned expertise, ensuring clients are protected and empowered from start to finish.

The mission is clear: match people to the best opportunities Orange County has to offer by blending unrivaled knowledge, honesty, and commitment into every client relationship. It’s an approach that has garnered consistent top ratings and the trust of families and investors alike.

What Real Buyers Say: A Real-World Success Story That Builds Trust

The intricate reality of buying homes in Orange County isn’t just reflected in statistics or agent claims—it’s in the experiences of everyday buyers who navigated the process with expert support. One recent client described how working with a seasoned agent changed the game, thanks to insider tips, market savvy, and tenacity in the face of unexpected challenges.

David was a legend! He had a ton of local OC knowledge to guide me through which areas were worth looking at, and then helped me understand how I should be looking at homes to identify potential long-term issues and ways my home would appreciate over time. Once we found the right home, he helped me beat out 2 other offers and tackle a tricky insurance issue that almost prevented closing... but he figured it out and I move in this weekend! Thanks, David!

For many buyers, the outcome isn’t just a successful purchase, but peace of mind—knowing that every detail has been managed and every potential problem navigated by a caring, committed professional. Taking proactive steps and trusting knowledgeable experts can transform an intimidating process into a rewarding journey ending in a life-changing result.

Transform Your Buying Experience: Why Preparation and Expertise Define Orange County Real Estate

In an area as competitive and diverse as Orange County, the difference between a wise investment and an expensive misstep is knowledge—both of the region and of the process. By leaning on expert insights, examining neighborhoods deeply, and insisting on clear, personalized support, buyers can filter out confusion and uncover the opportunities that best align with their goals.

The authority and professionalism demonstrated by local experts like those at Coastal Real Estate Group continue to set the bar for high-value, low-stress home buying in Orange County. Their experience, attention, and technical know-how offer the support every buyer deserves in a high-stakes, fast-moving market. For anyone exploring the journey of buying homes in Orange County, preparation and trusted guidance are the ultimate safeguards against costly pitfalls—and the foundation of real estate success.

Contact the Experts at Coastal Real Estate Group | Orange County Realtors

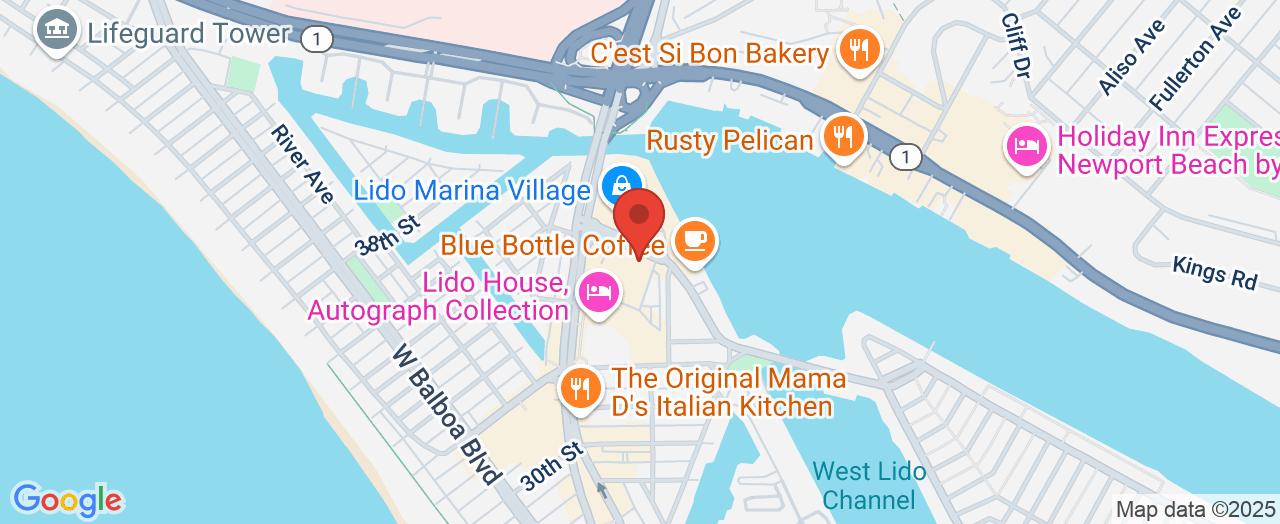

If you’d like to learn more about how buying homes in Orange County could benefit your real estate journey, contact the team at Coastal Real Estate Group | Orange County Realtors. 📍 Address: 3419 Via Lido #320, Newport Beach, CA 92663 📞 Phone: +1 949-371-8006 🌐 Website: http://www.coastalgroupoc.com/

Location and Hours for Coastal Real Estate Group | Orange County Realtors

🕒 Hours of Operation:📅 Monday: Open 24 hours📅 Tuesday: Open 24 hours📅 Wednesday: Open 24 hours📅 Thursday: Open 24 hours📅 Friday: Open 24 hours📅 Saturday: Open 24 hours📅 Sunday: Open 24 hours

Add Row

Add Row  Add

Add

Write A Comment