Calls for Accountability: The Pressure on Jerome Powell

On July 2, 2025, Federal Housing Finance Agency (FHFA) Director Sandra Pulte directly challenged the credibility of Federal Reserve Chairman Jerome Powell, calling for Congressional investigations into his conduct. In a statement shared on X, Pulte accused Powell of exhibiting political bias and deception during Senate testimonies, igniting a firestorm of controversy around the Federal Reserve's operations amidst rising interest rates.

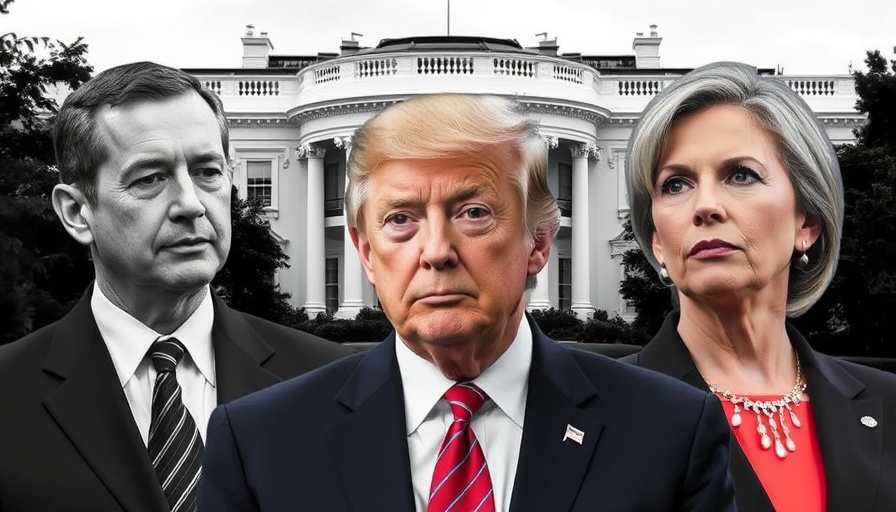

“Chairman Powell needs to be investigated by Congress immediately,” stated Pulte, reflecting a growing discontent that has bubbled over in recent months as interest rates continue to pinch homebuyers and challenge economic recovery. The pressure to resign has also been amplified by prominent political figures, including President Donald Trump, who has long criticized Powell’s policies since appointing him in 2017.

Understanding the Controversy: What Sparked Pulte's Accusations?

Pulte's accusations are anchored in claims that Powell misled Congress regarding expensive renovations at the Federal Reserve's headquarters in Washington, D.C. Allegedly costing $2.5 billion, these renovations have raised eyebrows, leading Pulte to emphasize that Powell’s statements, described as factually inaccurate, warrant further investigation. Senator Cynthia Lummis chimed in, underscoring concerns about Powell’s management style and transparency about federal spending.

Pulte’s statement calls out the $2.5 billion capitalizations related to the renovation, describing Powell’s responses during Congressional hearings as “malfeasance” and suggesting they justify removal “for cause.” This argument bears on a legal premise: members of the Fed's board can only be removed under specific circumstances, which fuels the legal and political debates surrounding Powell’s position.

Impact on the Housing Market: The Broader Implications

The fallout from these disputes points towards potential ramifications for home buyers and the broader housing market. While the Fed has the ability to alter short-term interest rates, the effects ripple through mortgage rates primarily based on investor demand for mortgage-backed securities. Recent history shows that even as the Fed cuts rates, mortgage rates can rise, complicating the relationship between federal financial policies and real estate dynamics.

Current rates, set against a backdrop of increasing pressures on Powell from both Pulte and Trump, indicate a precarious balance for mortgage applicants. As interest rates linger at elevated levels, the housing market risks cooling further, straining buyers who are already grappling with affordability challenges.

Political Context: Why It Matters Now

This confrontation also coincides with an increasingly polarized political landscape regarding monetary policy. In recent years, as economic uncertainties continue to loom, the relationship between the Federal Reserve and the administration has grown fraught with contention. Powell argues that the Fed’s policies prioritize economic data and uphold its dual mandate of maximizing employment while keeping inflation in check. However, this approach often draws fire from political figures seeking immediate relief for constituents.

Moreover, the ongoing assertion that the Fed is out of touch with everyday Americans emphasizes the significance of understanding both sides of this financial tug-of-war: the necessity for fiscal prudence set against the urgent demand for economic revitalization.

Future Predictions: What’s Next for the Federal Reserve?

As advocates like Pulte rally for accountability, we must consider the possible outcomes for the Federal Reserve and its leadership. A Congressional investigation could lead to significant administrative changes, potentially reshaping monetary policy in ways that resonate across the housing market and broader economy.

Additionally, if pressure mounts for rate adjustments, Powell might face increased scrutiny at a time when steady decision-making is paramount. Should Congress act on Pulte's request, it would mark a notable shift, possibly effective enough to alter the course of fiscal policy.

This environment lends itself to speculation about who might fill Powell's shoes should the need arise for new leadership. Any change at the Fed could profoundly affect economic strategies moving forward, illuminating the often-complex interplay between political and financial governance.

In Conclusion: An Unfolding Drama

Pulte’s robust criticism of Powell represents not just a singular conflict but a larger narrative around accountability in financial governance. As the landscape evolves, stakeholders across the real estate market must stay informed and prepared for changes that may come as a result of these political pressures.

Stay updated with the ongoing developments, as this issue continues to unfold. Engaging with these insights and understanding the broader context will help navigate the intricacies of today’s turbulent economic climate.

Add Row

Add Row  Add

Add

Write A Comment