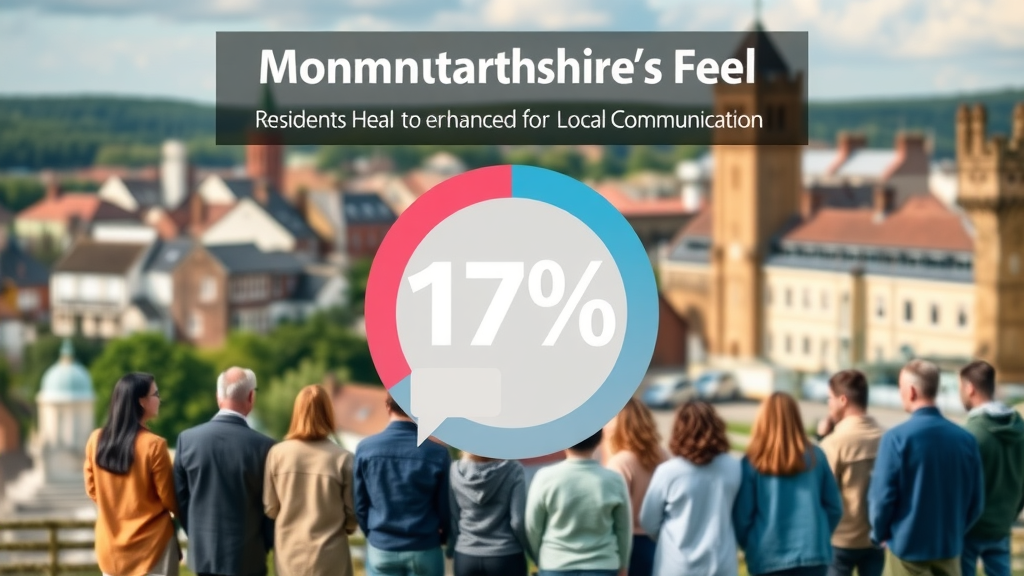

Did you know that only 17% of Monmouthshire residents feel their voices are heard by local authorities? This eye-opening figure highlights a communication gap that has persisted for too long. Now, as we prepare to launch dedicated platforms for every town in Monmouthshire, monmouthmedia.org emerges as a timely and crucial answer. Designed to empower residents, amplify local business, and build genuine community connections, this innovative site is setting the stage for a new era of inclusive communication. Read on to discover why it’s time to act—your town’s voice is about to be heard!

Startling Facts: The Need for monmouthmedia.org in Monmouthshire "Did you know that only 17% of residents feel their voices are heard by local authorities? monmouthmedia.org may be the solution for inclusive communication." The significance of monmouthmedia.org becomes clear when we confront the striking reality: a mere fraction of locals feel genuinely heard. This disconnect is about more than just numbers; it impacts daily life, community engagement, and the effectiveness of local governance. When most residents sense their concerns go unnoticed, trust in institutions fades, participation drops, and Monmouthshire’s towns lose opportunities to thrive together. The launch of personalised platforms through monmouthmedia.org marks a decisive step in reversing this trend, promising every resident, business owner, and community group a direct seat at the table.

In an era when reliable information and authentic connections are often drowned out by misinformation or apathy, monmouthmedia.org is positioned to serve as a trusted one-stop hub. This approach ensures that not only are the needs of the majority addressed, but even the quieter voices—the minority opinions, independent businesses, and grassroots projects—are amplified effectively. By bridging communication gaps, this platform addresses the long-standing demand for greater transparency and engagement across Monmouthshire. The forthcoming town-based launches are more than websites—they’re catalysts for local renewal.

What You'll Learn from This Article on monmouthmedia.org Why monmouthmedia.org is vital for local communities

How monmouthmedia.org empowers businesses and residents

Expert and resident opinions on the role of monmouthmedia.org

Ways you can engage with monmouthmedia.org right now Overview of monmouthmedia.org: The New Voice for Every Town monmouthmedia.org is much more than an online bulletin board; it's an ecosystem built for connection, representation, and empowerment. Each town in Monmouthshire will have its own unique space on the platform, designed to reflect local culture, news, issues, and opportunities. Unlike faceless, one-size-fits-all news outlets, monmouthmedia.org grounds itself in the everyday realities and aspirations of its users—residents, business owners, community leaders, and local groups. This model elevates r m and e m principles by recognising that true engagement comes when everyone has a clearly marked path for input and influence. The public square is evolving from posters and town meetings to digital noticeboards, real-time newsfeeds, and interactive forums. By offering specialist spaces for everything from f m and e o to n o and o b, monmouthmedia.org guarantees diversity of content and voice. Each section, managed by local editors and contributors, focuses on relevant updates, independent stories, and authentic reporting that can't be found in generic national media. This hyper-local approach strengthens ties, making each user not just a consumer but a participant and shaper. r m: A Platform for Residents, Businesses, and Community Every user—from long-standing residents to newly established shop owners—can find something tailored on monmouthmedia.org. Dedicated sections for resident stories (n m), business promotions (r p), community projects (d b), and local feedback (e y) foster rich interaction. By combining elements of e c (editorial collaboration) and e d (democratic input), the platform balances top-down structure with bottom-up participation. This balance is crucial for maintaining a sense of ownership and relevance for all Monmouthshire towns launching soon. Businesses benefit from the ability to reach a targeted local audience with meaningful promotions, while residents enjoy real-time access to updates and events tailored to their neighbourhood. By supporting everything from casual forum discussions about local news to actionable feedback on council initiatives, monmouthmedia.org embodies a fresh vision for community engagement in the digital age. f m and e m: Local News and Authentic Reporting In an age of news overload and misinformation, f m (factual media) and e m (editorial moderation) are non-negotiable. monmouthmedia.org delivers both—offering professionally curated local news, verified event reporting, and unbiased coverage. Every story, opinion piece, or business update is reviewed by local editors dedicated to accuracy and community standards. The focus remains on relevance: school board decisions, infrastructure projects, local sports, and public health updates all receive attention. The platform encourages local contributors, making reporting not just about disseminating information but about building collaborative understanding. By amplifying the voices of trusted locals alongside verified reporting, monmouthmedia.org raises standards of authenticity and anchors the news in community truth. n o and o b: Bridging Communication Gaps Far too many towns experience a disconnect between stakeholders—residents, authorities, and businesses—all operating in silos. Through tailored portals such as n o (neighbourhood outreach) and o b (opinion boards), monmouthmedia.org breaks down these barriers. Engagement is no longer a one-way street; instead, there is a dialogue where ideas, issues, and solutions can be discussed in real time. Feedback is actively encouraged, with comment sections on news, responsive Q&As, and collaborative polls. The result? Citizens see their perspectives reflected in both decision-making and reporting. This bridge-building translates statistics like “17% feel heard” into a future where the majority can influence and shape solutions, not simply witness them. How monmouthmedia.org Empowers Local Democracy

e d and r d: Increasing Engagement and Democratic Participation A thriving democracy depends on informed, engaged citizens—and monmouthmedia.org takes these ambitions seriously. Features like openly accessible forums, regular surveys, and town-specific news feeds foster active engagement (e d). This not only raises awareness but gives every resident the opportunity to participate in ongoing conversations about policies, projects, or even the town fair. Through direct reporting (r d) and feedback mechanisms, residents and business owners alike can voice opinions, propose initiatives, or join petitions. This wave of digital involvement reinvigorates local democracy, transforming apathy into action. No longer relegated to being passive recipients of policy decisions, Monmouthshire’s citizens gain the tools to both question and co-create with local leaders. e o: Transparency in Local Governance Transparency is not just a value—it's an operational principle for monmouthmedia.org. Every update, minutes from council meetings, or outcome from a public consultation is made easily accessible and understandable. e o (e-government openness) makes sure that residents no longer have to search in vain for crucial documents or rely on secondhand hearsay. Reporting on budgets, planning, and development is presented in everyday language, and supported by visual aids like charts and infographics. This openness demystifies decision-making, making it simpler for ordinary people to hold authorities accountable and participate fully in shaping the region’s future. The direct communication line between citizens and leaders sets a new benchmark for transparent governance. "monmouthmedia.org gives a direct line between citizens and decision-makers." The Business Benefit: monmouthmedia.org for Growth and Visibility

r p and y f: Connecting Local Businesses with Residents For small and medium-sized enterprises (SMEs) in Monmouthshire, visibility and connection are lifelines. monmouthmedia.org supports r p (retail promotion) and y f (your features), allowing shop owners, creators, and tradespeople to showcase their services, announce offers, and join local events seen by thousands of residents. The platform’s business directories and promotion tools mean local commerce is not buried beneath chain advertising or national campaigns. Instead, businesses are spotlighted in the context of shared community values—whether that’s celebrating a shop anniversary, publicising a new cafe menu, or rallying support for a charitable drive. Residents meet vendors as neighbours, not faceless brands. e h and e p: Feature Success Stories and Local Events A core aim of monmouthmedia.org is to amplify community pride and business achievement through e h (event highlights) and e p (excellence profiles). Regularly updated features document how local ventures succeed, celebrate milestones, and inspire others to participate or innovate. Upcoming events benefit from expert curation and prominent placement, ensuring strong attendance and lasting impact. Whether it’s an open-mic night, market day, or eco-cleanup, organisers have access to the audience that matters most. In this way, monmouthmedia.org becomes a rallying point for economic and cultural renewal, giving every business and event a fair shot at recognition. Business ChallengeHow monmouthmedia.org Helps

Low VisibilityDedicated business listings and promotions

Community EngagementInteractive forums and feedback channels Community Voices: How monmouthmedia.org Fosters a Shared Identity

n m and n b: Platforms for Resident Stories Shared stories form the heart of any tight-knit community. monmouthmedia.org actively promotes n m (neighbourhood memory) and n b (neighbourhood board) initiatives, offering a digital canvas for residents to share milestones, projects, hopes, and memories. These platforms are not just for major headlines but for the everyday interactions that define community living: welcoming new neighbours, solving shared challenges, and celebrating progress. Community-driven news, interviews, and photo diaries foster authenticity and inclusion. Residents from all backgrounds can participate, ensuring diversity is respected and every section of society has a window to express and be acknowledged. With visible participation, underrepresented groups gain voice, and the collective story of Monmouthshire grows richer. d b and y b: Community Projects and Recognition From volunteer cleanups to art installations and neighbourhood initiatives, monmouthmedia.org makes it easy for community projects (d b) and young builders (y b) to find support and recognition. Project pages, spotlights on volunteers, and galleries of success stories bring participants together and demonstrate best practices. These features attract attention to the real work happening behind the scenes and motivate others to join. A project that begins as a resident’s dream can scale with local awareness and shared resources. Through transparent updates, collaborators feel appreciated, and future leaders find inspiration in the stories of their neighbours. l f: Celebrating Local Heritage A deep respect for local heritage (l f) underpins monmouthmedia.org’s philosophy. Dedicated sections chronicle historical milestones, notable figures, scenic landmarks, and evolving customs. These resources serve schools, new residents, and long-time locals interested in what binds Monmouthshire together. By intertwining heritage celebration with forward-thinking reporting, the site balances tradition and innovation, keeping Monmouthshire’s past alive while guiding its digital future. Contributors are invited to submit photos, oral histories, or archival discoveries, making cultural preservation a collective act. "Every town needs a voice. With monmouthmedia.org, we finally have ours." Expert and Resident Insights on monmouthmedia.org Quote from a local councillor: “It’s not enough to broadcast decisions. We must listen and respond inclusively—monmouthmedia.org is a breakthrough platform for accountability and transparency.”

Business owner testimonial: “I’ve reached more local customers in three months on monmouthmedia.org than in years of print ads. The community feedback is invaluable for growth.”

Resident’s perspective: “I submitted a feature about our park renewal, and it sparked real debate and policy changes. I finally feel heard in my own town.” How to Get Involved with monmouthmedia.org

Easy Steps to Join and Participate Sign up for newsletters on monmouthmedia.org

Share your stories or events

Participate in local forums and feedback Current Opportunities for Collaboration Monmouthmedia.org is always on the lookout for passionate contributors, event organisers, youth reporters, and community leaders willing to drive positive change. Upcoming collaborations could include citizen journalism initiatives, digital town halls, collaborative local history projects, or youth engagement schemes. Whether you’re an individual, a business, or a local group, there’s a place for you. Reach out now to start shaping your town’s future. A short video montage highlighting community events, business achievements, and resident interviews, showcasing the real impact of monmouthmedia.org across Monmouthshire.

People Also Ask

What makes monmouthmedia.org different from traditional local news platforms?

How can businesses benefit from using monmouthmedia.org?

Is monmouthmedia.org free for residents?

How do I contribute or share my story on monmouthmedia.org?

What data does monmouthmedia.org collect about its users?

Answers to People Also Ask

monmouthmedia.org stands out by offering real-time, community-driven content and direct channels for resident input, unlike static traditional outlets. Traditional local news tends to be static, often slow to update, and rarely interactive. In contrast, monmouthmedia.org thrives on real-time submissions from residents, regular updates, and immediate feedback loops, making it the pulse of Monmouthshire’s day-to-day life. The platform encourages resident participation, prioritises local issues, and provides direct channels for community impact. This dynamic approach ensures the latest information reaches people when it matters most, and every voice—no matter how small—can find an attentive audience. Businesses can list promotions, participate in features, and access community feedback for better local engagement through monmouthmedia.org. Monmouthmedia.org offers businesses exclusive access to local directories, special promotion listings, coverage of new ventures, and interactive event calendars. They benefit from immediate exposure to target audiences and direct community feedback, strengthening their foothold and creating genuine connections that drive revenue and local loyalty. monmouthmedia.org is free for all residents, supporting open access to essential local information. There is no paywall or restrictive access for individuals. Residents across Monmouthshire can sign up, browse, participate, and contribute without monetary barriers, thanks to a commitment to inclusivity and open information sharing. To contribute on monmouthmedia.org, register an account, choose your town’s section, and submit your news or story for editorial review. Signing up is simple. Just register, pick your town, and start uploading stories, event details, or viewpoints. Dedicated editors ensure content standards are upheld, making publishing safe and trustworthy for the entire community. monmouthmedia.org values privacy; only minimal data necessary for account security and user contribution is collected, with transparent privacy policies. Your privacy is a priority. Only the information needed for secure registration and contribution is gathered, all under a clear privacy policy you can review at any time. There’s no sharing or selling of user data—just straightforward, ethical management. Hear directly from residents, business owners, and local officials about the transformation monmouthmedia.org is bringing to Monmouthshire’s towns, voices, and businesses.

Key Takeaways: Why Act Now on monmouthmedia.org monmouthmedia.org is critical for vibrant, engaged local communities

Businesses and residents benefit equally

Community projects thrive with shared voices FAQs About monmouthmedia.org Can I access monmouthmedia.org from a mobile device? Yes, monmouthmedia.org is fully mobile-optimised, letting you stay informed and get involved whether you’re at home or on the go. Responsive design ensures all features are easy to access.

Does monmouthmedia.org accept guest articles or event submissions? Absolutely! Guest articles, event announcements, and resident-led initiatives are encouraged. This is your platform—bring your voice and ideas.

How often is monmouthmedia.org updated? The platform is updated daily, with new stories, events, and opportunities appearing regularly so there’s always something new to explore or contribute to. Conclusion: monmouthmedia.org – The Future of Local Information in Monmouthshire The launch of monmouthmedia.org marks a turning point for local democracy, business growth, and community pride. Join now, be heard, and help shape Monmouthshire’s future. Ready to be heard? Contact the monmouthmedia.org Team Today Call: 07549988991

Email: gary@weacton.com

Get involved now at: monmouthmedia.org In exploring the significance of monmouthmedia.org for local communities, it’s valuable to consider similar platforms that have successfully connected residents and businesses. For instance, the Monmouth Journal offers dedicated editions for various regions, providing localized news and fostering community engagement. (themonmouthjournal.com) Additionally, the Monmouth County section of Community Magazine highlights local events, features, and philanthropic activities, serving as a hub for community information. (monmouthcommunity.com) These examples underscore the potential of monmouthmedia.org to become a central resource for Monmouthshire, enhancing communication and collaboration among its residents.

Add Row

Add Row  Add

Add

Write A Comment