Transforming Stress into Simplicity: Why Home Buying Services Matter More Than Ever

Buying a home is widely recognized as one of the most significant milestones—and largest investments—a person or family can make. Yet, amidst soaring prices, tight competition, and changing economic currents, the journey from initial search to closing can feel overwhelming and riddled with uncertainty. Did you know that a typical homebuyer in the U.S. begins the process already bracing for stress, with nearly 40% reporting high anxiety about decision-making and paperwork? In such a climate, clarity and confidence are priceless commodities, making the framework and reliability of professional home buying services an essential lifeline, not just a convenience.

Beyond finding the right house, today’s home buying services act as trusted navigators—offering deep market insights, negotiation expertise, and tailored advice to help buyers avoid costly mistakes. At a time when hidden pitfalls and fluctuating prices can derail even the most prepared, it’s clear that expert guidance isn’t just a luxury for first-timers. With so much on the line, understanding what home buying services truly entail, and how they can tip the scales in your favor, is a crucial step for anyone entering the market. Read on to uncover the practical value, critical benefits, and transformative outcomes of working with specialized home buying professionals.

What Sets Modern Home Buying Services Apart? Unlocking Clarity in a Complex Process

Home buying services, especially in a fast-paced and competitive environment, go far beyond simply matching buyers with listings. At their core, these services encompass a comprehensive range of support, including personalized property searches, market analysis, expert negotiation, and step-by-step guidance throughout the purchase—from initial consultation to post-closing support. By incorporating support elements such as targeted home searches and in-depth market knowledge, home buying services help buyers identify undervalued opportunities, navigate competing offers, and avoid common pitfalls that can cost time and money. The outcome is a streamlined experience tailored to the buyer’s unique goals, often resulting in better deals and fewer surprises along the way.

Too many buyers enter the market unprepared, risking missteps such as overpaying, missing crucial contingencies, or failing to spot red flags during inspection and escrow. Home buying services exist to reduce these risks by leveraging the expertise of professionals who understand local inventory trends, pricing dynamics, and transaction strategies. Without this guidance, buyers may face prolonged searches, transactional delays, or even financial setbacks—turning what should be an exciting life chapter into an ordeal of anxiety and regret. The result is clear: gaining advance knowledge, skilled advisory, and practical support isn’t merely helpful—it can spell the difference between success and disappointment for today’s homebuyers.

How Expert Home Buying Services Deliver Real Impact for Savvy Buyers

Drawing from more than fifteen years of real estate experience and a track record of over 400 successful transactions, Jennifer Matsumoto - Coldwell Banker Realty offers a distinctive perspective and powerful outcomes as an expert contributor in home buying services. Comprehensive guidance from skilled professionals introduces a new level of security and efficiency into every purchase. Buyers benefit from far more than access to listings; they gain a meticulous advocate who personally invests in understanding client needs—from desired location to price point and lifestyle fit—helping transform aspirations into actionable, successful outcomes.

The expertise embedded in professional home buying services ensures that buyers receive trusted, data-driven advice at every critical turn: from evaluating fair market values to negotiating for favorable terms and inspections. An agent’s experience, like Jennifer Matsumoto’s, enables buyers to move swiftly and confidently, even in competitive multiple-offer scenarios or when unique circumstances, such as investment properties or short sales, are involved. This level of support not only helps protect financial interests but also truly simplifies the journey, translating complexity into clarity and results.

Most importantly, the human touch and commitment to client-centered service—hallmarks of seasoned home buying professionals—add an extra dimension of reassurance during what can otherwise feel like an uncertain process. Real-world relevance is found in practical solutions and thoughtful, honest counsel, ensuring buyers make informed choices, avoid costly errors, and end up in a home that genuinely suits their needs and aspirations.

Navigating a Changing Market: Home Buying Services as Your Strategic Advantage

As real estate markets shift in response to economic trends and local demand, today’s buyers are contending with both unprecedented opportunity and unpredictable competition. Home buying services, grounded in up-to-date market data and local expertise, provide invaluable strategic insight. Buyers benefit from a clear-eyed perspective on neighborhood trends, school districts, zoning regulations, and investment potential—tools essential not just for finding a home, but for long-term peace of mind and financial wellbeing.

Consider how swiftly market dynamics can change. A seasoned advisor provides more than reassurance—they anticipate challenges, offer contingency planning, and help buyers act decisively in time-sensitive situations. This adaptability is critical for success, whether navigating complex bidding wars or selecting properties with the greatest future value.

From Search Portals to Closing Tables: Home Buying Services that Streamline Every Step

Home buying services are no longer limited to the offline matchmaking of decades past. Modern buyers, especially in active environments like Newport Beach and Orange County, can access comprehensive search portals, current listings, and tailored recommendations—all backed by real-time data on home values and local competition. These digital assets empower clients to explore properties strategically, schedule showings on their terms, and curate wish lists that reflect real needs and budget realities.

Of equal importance is the detailed transaction management that home buying experts provide—from advising on home inspections to guiding contract negotiations, facilitating mortgage approval, and ensuring a seamless close. This holistic approach not only saves buyers time and effort but also provides confidence that no detail is overlooked. By focusing on client communication and continuous availability, well-organized home buying services leave clients with more time to plan their future with certainty and excitement.

Why Informed Buyers Have the Advantage: Education, Transparency, and Peace of Mind

Education stands as a foundational pillar within leading home buying services. Resources, such as home valuation advice and customized market analysis, empower clients to make data-informed decisions rather than emotional or rushed choices. The process is as much about demystifying legal paperwork and inspection requirements as it is about finding the “perfect” house. When buyers understand each phase—from earnest money deposits to appraisal and closing—they build confidence and avoid unexpected setbacks.

The result is a harmonious blend of transparent communication, candid advice, and advocacy that reduces stress and protects long-term interests. Buyers who access educational support, either through one-on-one consultations or curated digital resources, report greater satisfaction and adjust more seamlessly to their new life chapter. Ultimately, informed buyers are able to approach the purchase with more enthusiasm and less apprehension, unlocking both immediate and lasting enjoyment from their investment.

Purposeful Guidance: Jennifer Matsumoto’s Method for Empowering Home Buyers

With a career marked by over 400 satisfied families and award-winning achievements in Orange County, Jennifer Matsumoto’s home buying services stand out for their combination of precision, empathy, and tireless commitment to client success. Her approach is built upon a foundation of both attentive listening and practical advice, ensuring that each buyer’s unique circumstances and dreams are respected and realized. Whether guiding first-time buyers with patient instruction or partnering with seasoned investors, her diligence transforms what is often seen as a daunting process into a journey where every detail is proactively managed.

Jennifer’s method is distinguished by care for both standard and complex sales, including extensive experience in remodels and real estate investment. This depth of knowledge translates into a discerning eye for value, an ability to foresee challenges before they arise, and the agility to negotiate optimal terms. Her philosophy centers on advocacy and results: buyers can trust that their interests are protected and their goals prioritized. This holistic and hands-on approach is repeatedly echoed by those who have relied on her expertise to successfully navigate challenging markets and realize their homeownership dreams.

The dedication to availability, unwavering support, and thoughtful guidance defines her leadership in the field—setting a new bar for what home buying services should achieve in both outcomes and client experience. The cumulative effect is a process that feels both personal and professional, making the dream of homeownership accessible, transparent, and ultimately rewarding.

Real Stories, Real Results: A Client’s Perspective on Home Buying Service Success

The truest measure of any home buying service lies in the lived experiences of those it serves. One recent client, navigating both a purchase and subsequent sale, highlighted the significance of expertise and advocacy through every twist and turn. Their journey illustrates the tangible value skilled professionals provide—and the peace of mind that expert guidance brings to the table:

My wife and I have now partnered with Jennifer on two transactions. One was for the purchase of our home and the other was for the sale of the same property. She was recommended to us by another agent, which was a big green flag for us.

Stories like this capture the reassurance and exceptional performance associated with truly effective home buying services. When choosing guidance backed by experience, responsiveness, and client advocacy, buyers can take the next step with certainty, knowing they will be protected, well-informed, and set up for lasting satisfaction.

Home Buying Services: Elevating Expectations in Every Step of the Journey

For those on the path to a new home, the difference that professional home buying services make is unmistakable. By blending education, negotiation, and personalized advocacy, these services do far more than streamline transactions—they transform uncertainty into confidence and opportunity. Through steadfast guidance, market insights, and attention to detail, expert-led approaches pave the way for positive, lifelong outcomes. Jennifer Matsumoto - Coldwell Banker Realty’s significant contributions underscore how deep expertise and authentic client partnership redefine what home buying services can accomplish for individuals and families alike.

As you consider your next move, remember: the empowerment and security provided by high-quality home buying services are not only assets for today’s purchase, but for tomorrow’s peace of mind as well.

Contact the Experts at Jennifer Matsumoto - Coldwell Banker Realty

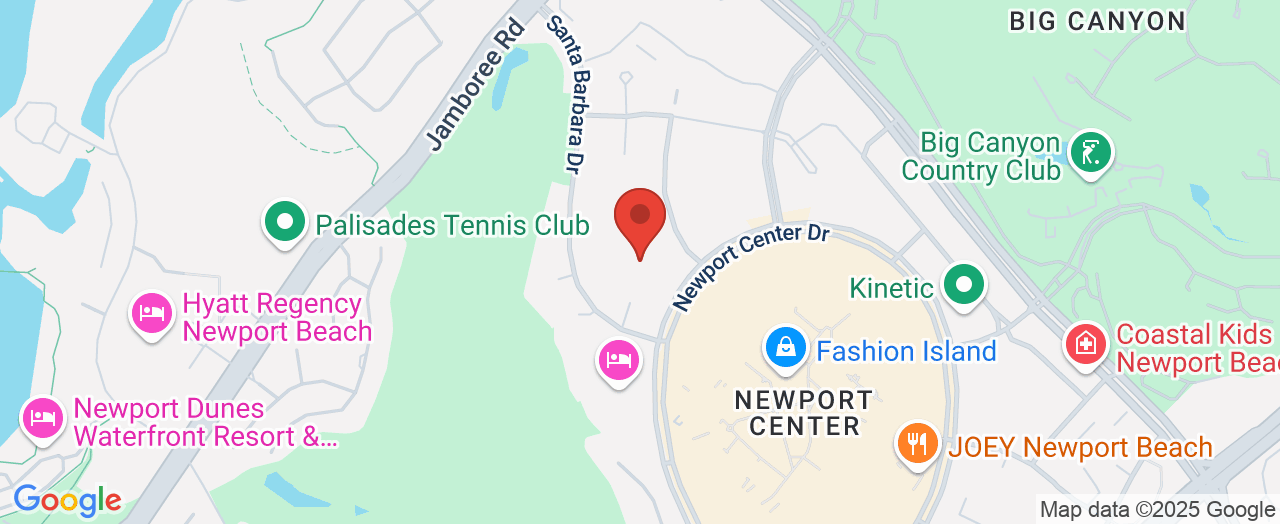

If you’d like to learn more about how home buying services could benefit your experience, contact the team at Jennifer Matsumoto - Coldwell Banker Realty. 📍 Address: 840 Newport Center Dr #100, Newport Beach, CA 92660 📞 Phone: +1 949-502-1036 🌐 Website: http://matsumotorealestate.com/

Jennifer Matsumoto - Coldwell Banker Realty Location and Availability

🕒 Hours of Operation:📅 Monday: Open 24 hours📅 Tuesday: Open 24 hours📅 Wednesday: Open 24 hours📅 Thursday: Open 24 hours📅 Friday: Open 24 hours📅 Saturday: Open 24 hours📅 Sunday: Open 24 hours

Add Row

Add Row  Add

Add

Write A Comment