Unlocking a Successful Sale: Why the Home Selling Process Demands Your Full Attention

Selling a home isn’t just a milestone—it’s one of the largest financial decisions most people ever make. Yet, the home selling process is often underestimated in complexity and importance. Far too many homeowners approach it as a simple exchange, only to encounter unexpected obstacles that cost them time, money, and peace of mind. In a real estate market where every detail can shift the outcome, understanding the critical steps isn’t just helpful—it’s essential.

With property values fluctuating and buyer expectations evolving, each stage of the home selling process carries unique stakes. Missing a key step can mean leaving significant value on the table, or worse, derailing the transaction altogether. That’s why it’s so crucial to educate yourself before for-sale signs appear on the lawn. In this feature, you’ll find a clear, step-by-step roadmap to selling your home, paired with actionable insights and real-world context—enabling you to sell with both confidence and clarity.

Decoding the Home Selling Process: What Every Seller Needs to Know Now

So, what exactly does the home selling process involve—and why is mastering it so crucial? At its core, the process consists of far more than simply listing a home and waiting for offers. It includes expert market assessment, personalized marketing, precise pricing, meticulous property preparation, negotiation strategies, and navigating legal obligations every step of the way. For homeowners, skipping or mishandling any stage can result in longer time on the market, lost profits, or even failed deals.

An effective home selling process carefully addresses each of these components to ensure your property stands out in a competitive market. In Orange County and similar areas, buyers are savvier than ever and often have instant access to comprehensive listings and data. Sellers who overlook detailed preparation, or who fail to lean on expert experience, risk being overshadowed by more prepared competitors. It’s not just about moving out—it’s about moving forward with the best possible outcome for your investment and your next chapter.

Why a Thoughtful Home Selling Process Translates to Higher Value and Fewer Headaches

Expert contributors with decades of experience, such as those at the Sackin-Stone Team, understand that selling property is both financial and deeply personal. Their approach emphasizes a stress-free experience, guided by proven processes that are designed to extract the highest value while minimizing friction. By leveraging techniques honed over thirty years, these professionals ensure every home—whether a cozy condo or a luxury estate—benefits from a tailored, full-service strategy.

For sellers, this means more than just access to up-to-date MLS listings or broad marketing exposure. It means a well-orchestrated plan that includes expert market insights, customized marketing strategies, and precise transaction management. The result: homes often command stronger offers, sell faster, and transition more smoothly from listing to closing. By understanding the holistic benefits of an expertly managed sale, sellers can confidently hand off complexity and focus on their future—knowing every critical detail is managed with care.

How Personalized Guidance Shapes Every Step of Your Home Sale Journey

No two sellers—or properties—are ever the same. That’s why experience-driven teams place a premium on guiding each client through a tailored home selling process, rather than relying on generic formulas. With six dedicated agents, transaction support staff, and a Director of Marketing on board, these professionals bring targeted expertise to each transaction. They recognize the power of listening, adapting to unique needs, and anticipating challenges before they arise, all in pursuit of a worry-free seller experience.

Just as every home deserves its own narrative, every transaction benefits from a concierge-level commitment. Expert teams combine client care, transparent communication, and technical know-how to create an environment where sellers always stay informed and empowered. By connecting each step—from initial valuation to final paperwork—sellers can trust that nothing is left to chance, even when the market feels unpredictable.

From Preparation to Closing: What Sellers Gain from an All-in-One Real Estate Solution

The most impactful home sales aren’t the result of luck, but rather of deliberate, guided preparation. One hallmark of top-performing real estate teams is their integrated approach: supporting sellers through every phase of the home selling process, not just the eye-catching moments. This includes developing personalized marketing plans to ensure listings are seen by the right buyers, preparing properties so they shine in person and online, and handling negotiations with both diligence and sensitivity.

Moreover, transaction coordinators and client care directors work behind the scenes so that sellers avoid pitfalls, paperwork errors, and communication hiccups. The advantage of an all-in-one service shows itself at every stage: faster sales, smoother negotiations, and an easier transition at closing—making life simpler, and results more impressive, for everyday homeowners.

The Hidden Power of Experience: Why Market Savvy Makes All the Difference

Sellers often underestimate how market knowledge and local experience can radically shift outcomes. Three decades in the Orange County market, for example, reflect not just tenure but honed intuition about timing, buyer psychology, and economic trends. Trusted real estate teams are constantly attuned to shifts in inventory, changing buyer profiles, and the nuances that set neighborhoods apart—from beachside enclaves to family-friendly communities.

This expertise means sellers benefit from precise pricing strategies, targeted recommendations on repairs or staging, and timely adjustments when market winds change. Rather than guessing or second-guessing, sellers equipped with proven guidance from experienced professionals see pathways others might miss—turning knowledge into measurable advantage.

The Sackin-Stone Team Philosophy: Service, Expertise, and a Commitment to Individual Success

At the heart of every effective home selling process lies a relational, service-first philosophy. The Sackin-Stone Team operates on the foundational belief that each client's goals are unique and deserving of individualized attention. By blending the strengths of six dedicated agents, a robust marketing strategy, and a concierge-level system perfected over thirty years, the team creates an all-inclusive experience that reduces seller anxiety while maximizing value.

The approach isn’t about shortcuts or one-size-fits-all advice. Each home and homeowner is met with respect, careful listening, and step-by-step expert involvement. From pricing strategy sessions to closing table guidance, the team’s collective expertise ensures that sellers always feel heard, understood, and protected from common real estate pitfalls. In a market as dynamic as Orange County, this service-forward model stands as a clear differentiator—and a reassurance that seller interests remain the top priority.

When Experience Matters Most: Real Stories of Trust and Success

One of the clearest ways to appreciate the power of an expert-led home selling process is to hear directly from those who’ve lived it. Demonstrated by decades of community engagement and client care, the right approach guides homeowners through every challenge—sometimes in ways that go far beyond contracts or showings. The following client account reveals just how much difference experience, compassion, and dedication can make.

I have known Scott & Phillip both personally and professionally for many years. They have been very instrumental in helping numerous people I know get their homes ready to sell. They went above and beyond spending many hours helping clean up the property of one person who was a hoarder to be able to help her put her home on the market. They are dedicated to helping whenever they can. When my husband died, Phillip was kind enough to do a comparative market analysis of my home, saving me the cost of having it appraised. Recently I asked Phillip to meet with me, as a friend, to discuss an issue that I was having trouble with. Because of his caring and compassionate nature, he did not hesitate and we met the very next day. He was a great listener and gave good advice. The Sackin Stone Team host some wonderful free community events such as an open house at Christmas, skating parties and, coming up in just a few weeks, their Spring Social Client Appreciation Event and Green & Clean Shred Event. There is no doubt in my mind what real estate agency I will be using when it comes time to sell my home.

This level of trust is built through consistent, reliable service and genuine investment in client success—not just transactional efficiency. When sellers choose to work with a team that values community, listens deeply, and delivers on its promises, they gain more than a successful sale. They gain confidence, peace of mind, and the assurance their home journey will be respected at every step.

The Road Ahead: Mastery of the Home Selling Process Sets Sellers Up for Success

As the property market continues to evolve, understanding and expertly navigating the home selling process remains the surest path to selling with strength. By investing in a structured approach—supported by knowledgeable, service-driven teams like the Sackin-Stone Team—homeowners position themselves to maximize value, avoid setbacks, and transition seamlessly to the next chapter. For those considering selling, now is the time to study the process, connect with genuine experts, and transform what could be overwhelming into a journey marked by clarity and reward.

In a competitive landscape, the precision and care provided by real estate leaders make the difference between ordinary and extraordinary results. Let the home selling process work for you—guided by experience, shaped by vigilance, and always designed to achieve the best possible outcome.

Contact the Experts at Sackin-Stone Team - Realtor - Real Estate

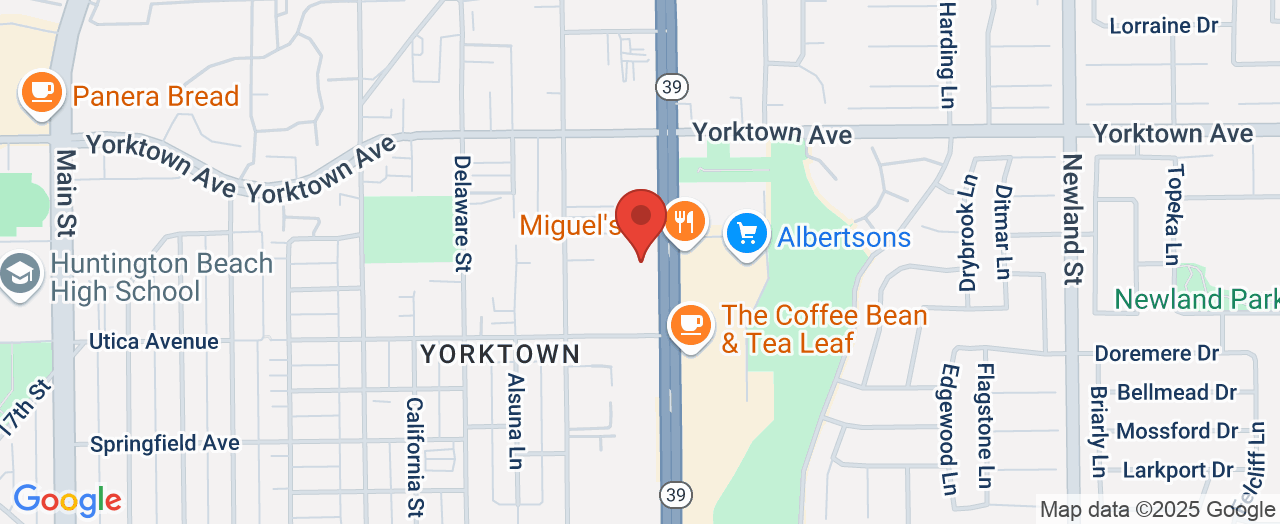

If you’d like to learn more about how the home selling process could benefit your real estate plans, contact the team at Sackin-Stone Team - Realtor - Real Estate. 📍 Address: 19671 Beach Blvd Ste 100, Huntington Beach, CA 92648 📞 Phone: +1 714-374-3535 🌐 Website: https://www.sackinstoneteam.com/

Sackin-Stone Team - Realtor - Real Estate Location and Availability

🕒 Hours of Operation: 📅 Monday: Open 24 hours📅 Tuesday: Open 24 hours📅 Wednesday: Open 24 hours📅 Thursday: Open 24 hours📅 Friday: Open 24 hours📅 Saturday: Open 24 hours📅 Sunday: Open 24 hours

Add Row

Add Row  Add

Add

Write A Comment