Unlock the Secrets to Selling Your Home Successfully—And for More

Every year, thousands of homeowners are caught off guard by the challenges of selling a property. What appears to be a straightforward process often morphs into a high-stakes balancing act, with timing, presentation, and negotiation all playing pivotal roles in the outcome. Many discover, sometimes too late, that unprepared homes linger on the market, sell below their potential value, or spark stressful disagreements between buyers and sellers. If you’ve ever wondered why some homes attract bidding wars while others languish, or why your neighbor’s house sold for $100,000 over list price while similar properties did not, you’re not alone.

This is where strategic, informed home selling tips can change the game. Implementing the right strategies from the outset can mean the difference between a stressful, drawn-out transaction and a smooth, lucrative sale that closes quickly. In today’s fast-paced market, understanding how to prepare, price, stage, and present your home isn’t just helpful—it’s essential. This article unpacks proven methods that have helped countless sellers elevate their homes, navigate tricky negotiations, and maximize their final sale price. If you’re thinking of selling, these practical home selling tips could transform your experience and financial result—read on to discover how.

The Must-Know Principles of Home Selling: Preparation, Price, and Presentation

Selling a home is about more than sticking a “For Sale” sign in the yard and hoping for offers. At its heart, it’s an intersection of psychology, negotiation, and market knowledge. Home selling tips consistently emphasize the need for detailed planning—preparing your home so that it appeals to both the heart and mind of prospective buyers. This preparation includes decluttering, making cost-effective improvements, and ensuring curb appeal. Simple cosmetic updates can have a surprising impact on perceived value, capturing buyers’ interest the moment they first pull up to the curb. Neglecting these essentials can lead to lackluster showings, fewer offers, and ultimately, lost dollars at closing.

Equally important is the art of setting the right price. A well-priced home garners attention and may spark bidding wars, while an overpriced listing risks stagnating—leading many to eventually accept less than if they had priced it accurately from the beginning. Presentation rounds out the trifecta: professional photos, compelling descriptions, and strategic marketing. Today’s buyers are tech-savvy and expect high-quality online listings; blurry photos or incomplete details can instantly send them scrolling past. Understanding each of these phases and executing them thoroughly are essential home selling tips for anyone wanting not just a sale, but an optimal outcome in today’s competitive real estate landscape.

How Strategic Home Selling Sets the Stage for Multiple Offers and Maximum Return

Drawing on years of local experience, Lily Campbell’s approach to selling is grounded in strategic planning and expert execution—qualities that resonate in real outcomes, not just promises. Detailed home evaluations are the first step, allowing sellers to get a clear snapshot of their property’s position within the market landscape. Leveraging professional resources and data-driven market analysis, sellers can set prices that encourage competition while still maximizing profit. Equally, thoughtful investments in staging and minor renovations elevate the perceived value, making positive first impressions both online and during in-person showings.

Real-world evidence underscores the results. Recent listings and testimonials highlight multiple offers, speedy transactions, and sale prices tens of thousands above asking. The formula isn’t complicated: sellers who prepare, price, and present their homes using expert guidance consistently achieve higher returns with less hassle. This approach isn’t about extravagant spending or taking unnecessary risks—it’s about applying proven home selling tips that deliver measurable outcomes, meeting buyers where they are and anticipating every question or objection before it arises.

Remodeling and Staging: Key Home Selling Tips That Drive Value Fast

Among the most effective ways to boost sale price quickly are select remodeling and staging strategies. Sellers often ask which improvements matter most; the answer lies in understanding buyer psychology. Fresh paint in neutral tones, updated fixtures, and minor kitchen or bathroom enhancements can have an outsized impact on how buyers perceive a home’s value. Professional staging brings in an objective eye, arranging furnishings and accessories to highlight space and flow, while removing distractions that might cloud a buyer’s imagination. These touches modernize even older homes, creating a sense of possibility and move-in readiness that ignites buyer urgency.

Staging isn’t just for luxury listings. Even modestly priced homes benefit from decluttering, furniture rearrangement, and carefully curated décor. In many recent success stories, sellers reported offers above asking price after these changes—often within days of listing. If the goal is to maximize value without extensive investment, focusing on presentation through targeted updates and smart staging remains an indispensable home selling tip for every market.

Timing and Market Insight: Why Local Knowledge Makes All the Difference

Understanding timing is particularly critical in dynamic markets like Orange County and Fountain Valley. Local trends influence everything from buyer demand to competition among similar listings. Sellers who pay attention to market cycles—such as peak spring or fall months—often find more motivated buyers and stronger offers. Equally, selecting the right listing week or even day can have a snowball effect, driving web traffic and social media shares at just the right moment for maximum exposure.

Market insight also informs negotiation. Recognizing when to entertain multiple offers, how to handle counteroffers, and when to adjust strategy if needed requires experience. Leveraging these home selling tips, informed by deep local expertise, aligns every part of the process with current reality—not just theory or national trends. The outcome? A tailored approach that delivers on the promise of a smooth, lucrative sale, customized for your neighborhood.

The Emotional Side of Selling: Tips for a Stress-Free Transition

While numbers and strategy are central, selling a home is often an emotional journey—especially when life changes prompt urgency or additional stress. It’s easy to underestimate the anxiety that can arise from showings, negotiations, and uncertainty. Wise home selling tips acknowledge this side and provide frameworks for minimizing disruption: flexible showing schedules, clear communication about expectations, and boundaries to protect your peace during the process.

Compassionate support, coupled with organized systems, creates a sense of stability for sellers at every stage. When seasoned professionals offer empathy and proactive solutions, transitions become not just manageable, but surprisingly positive. Sellers move forward with confidence, knowing every detail—from the first step to the final signature—has been handled with care and respect.

Lily Campbell’s Professional Approach: The Power of Expert Guidance in Home Sale Outcomes

Grounded in a commitment to excellent service and local expertise, Lily Campbell’s team exemplifies how focused, professional guidance enhances the selling experience. Their methods rest on listening—to both market signals and client goals—then translating that understanding into actionable steps. They offer consultation not just on pricing and comparable sales, but on which improvements will yield the strongest return and how to coordinate timelines for seamless transitions.

Drawing from a proven track record and deep market knowledge, their philosophy combines data-driven strategies with genuine care. The multilingual capacity of the team—serving speakers of English, Vietnamese, Spanish, and Chinese—fosters inclusivity, ensuring more buyers can connect with each listing. From high-quality listing photography to detailed marketing and responsive communication, Lily Campbell’s approach minimizes seller stress and maximizes reward, reinforcing the value of investing in true professionalism during one of life’s most significant transactions.

Real Results: Clients Explain How the Right Home Selling Tips Lead to Outstanding Outcomes

Time and again, homeowners voice how expert strategy and support translate into measurable, life-changing outcomes. One recent client, Lisa H., outlined how trusted advice, compassionate communication, and an unwavering commitment to going above and beyond turned a difficult selling situation into remarkable success. Genuine care, market acumen, and proactive solutions created more than just a smooth sale—they delivered peace of mind and exceptional results.

I don't know where to start with my accolades for Lily Campbell and Sarah Frost. The circumstances around selling my home were not happy ones, and Lily and Sarah came in with genuine care and compassion. I've experienced people saying they would help and then not showing up when push came to shove. Not Lily and Sarah. Lily and Sarah saw my distress and overwhelm and came in with solutions, support, and expertise. They jumped in and literally saved the day, ensuring my house was presented in the best light - they weren't lip service to get the listing - they were of genuine care and service. Going above and beyond is an understatement for the help they provided me. Both went out of their way to make sure I could get the best price possible and smoothest closing ever. The results were outstanding. We received 11 offers, 6 counter offers, and I got more than $100k over list price with a 21 day close. Lily and Sarah have the ratings they do because they get results. But they have the reviews and accolades because they are two of the most compassionate professionals I have ever worked with. If you're considering buying or selling a home, there are no others you should consider - the best is right here with Lily and Sarah.

Stories like this reinforce how the right strategy, combined with genuine human support, has the power to transform not just the sales outcome, but the journey itself. Success isn’t simply about price—it’s about achieving the best result and experiencing clarity and care from start to finish. For those ready to embark on the journey, following these expert home selling tips opens the door to similar achievement and satisfaction.

Is Expert-Led Home Selling the Key to Unlocking Rapid, Top-Dollar Results?

In today’s real estate environment, following standard advice is rarely enough to deliver extraordinary outcomes. The value of precise, practical home selling tips—from staging and strategic pricing to well-timed market entry and skillful negotiation—can be the catalyst that differentiates a routine sale from a remarkable one. Sellers benefit from drawing on the expertise of dedicated professionals with deep local knowledge and a client-centered approach. Authority in the local market, as evidenced in the work of professionals like Lily Campbell, guides sellers toward informed decisions and financial reward.

The stakes are too high to leave a home sale to chance. The best outcomes result from preparation, partnership, and expert insight. By embracing these proven home selling tips, homeowners maximize their prospects for a swift, profitable, and positive transaction.

Contact the Experts at Lily Campbell

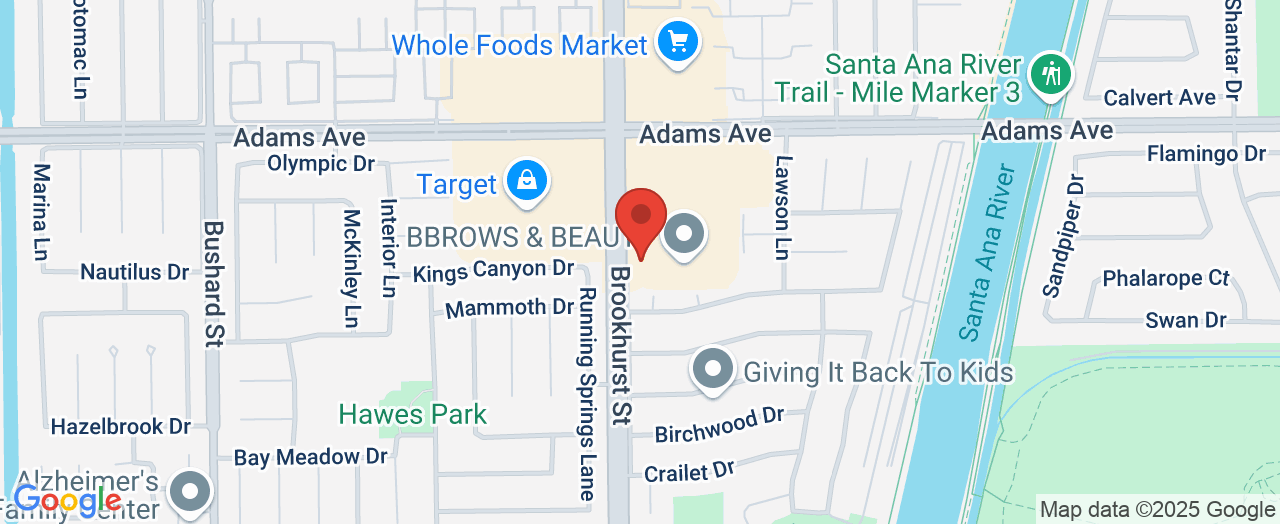

If you’d like to learn more about how home selling tips could benefit your property sale, contact the team at Lily Campbell. 📍 Address: 10072 Adams Ave, Huntington Beach, CA 92646 📞 Phone: +1 714-717-5095 🌐 Website: http://www.lilycampbellteam.com/

Lily Campbell Team’s Location and Hours

🕒 Hours of Operation: 📅 Monday: 8:00 AM – 8:30 PM📅 Tuesday: 8:00 AM – 8:30 PM📅 Wednesday: 8:00 AM – 8:30 PM📅 Thursday: 8:00 AM – 8:30 PM📅 Friday: 8:00 AM – 8:30 PM📅 Saturday: 8:00 AM – 8:30 PM📅 Sunday: 8:00 AM – 8:30 PM

Add Row

Add Row  Add

Add

Write A Comment