Why Understanding Home Valuation Services is the Key to Smarter Moves

Imagine putting your home on the market, only to receive offers far below your expectations. Or worse, realizing you’ve undervalued your property, leaving money on the table. It’s a scenario thousands of homeowners face every year, and it all boils down to the crucial first step in the selling or buying process: obtaining an accurate home valuation. In today’s dynamic real estate market, the difference between a correct and incorrect valuation can mean months of additional stress, wasted opportunity, or financial loss.

The complexities of pricing a home aren’t always apparent at first glance. Factors like recent neighborhood sales, home improvements, market demand, and even small location nuances can dramatically shift a property’s value. Home valuation services have become essential tools for both buyers and sellers looking to make informed choices. By leveraging these services, individuals can unlock critical data and insights that shape the trajectory of their real estate journey. Understanding how these services work, and why precision matters, can offer peace of mind—and a significant edge—before making one of life’s biggest financial decisions.

What Sets Modern Home Valuation Services Apart in Today’s Real Estate Market?

Home valuation services offer much more than a generic price tag—they provide a comprehensive, data-driven assessment that factors in every aspect influencing a property’s worth. Unlike outdated estimation methods, today’s services leverage recent market trends, comparable sales, and neighborhood analytics to create a tailored, transparent valuation. For buyers, this evaluation can illuminate bargain opportunities or hidden red flags, while sellers gain clarity on setting an asking price that attracts serious offers without leaving potential gains behind. Incorporating related insights like “market trends” and “comparative analysis,” these services are the starting point for anyone serious about maximizing their investment.

Failing to understand or utilize effective home valuation services often leads to pitfalls: overpriced listings that languish unsold, underestimated homes that sell too quickly, or negotiations bogged down by misaligned expectations. Without a true picture of value, both buyers and sellers find themselves navigating the market blindly, risking financial setbacks or missed opportunities. In a region like Orange County, where real estate values can swing significantly within a single neighborhood, relying on the right valuation services isn’t just helpful—it’s essential. Those who overlook this vital step may find that hope and guesswork can’t compete with expert insight and local market knowledge.

Unlocking the Real Advantages of Expert Home Valuation Services for Sellers and Buyers

One look at seasoned real estate agents in the Huntington Beach area demonstrates the immediate benefits that come from professional home valuation. These specialists do far more than simply run the numbers—they consistently put relationships and client goals first, seeking to understand homeowners’ unique circumstances ahead of any transaction. An accurate home value assessment is not just a one-time figure; it’s a strategic tool that empowers sellers to maximize their return and buyers to negotiate confidently.

Beyond the numbers, the practical benefits of skilled home valuation services ripple throughout the buying and selling process. Sellers who rely on robust, up-to-date assessments can avoid the frustration of overpricing or undervaluing their homes. They also gain leverage when negotiating, backed by clear, market-driven data. Buyers, on the other hand, can confirm that they’re making competitive offers supported by local trends and property histories, removing uncertainty and providing room for smarter negotiations. Accurate valuations ensure every party makes well-informed decisions, saving time, reducing stress, and often accelerating successful closings.

The impact of these benefits extends to long-term outcomes as well. Whether planning a next purchase, an investment strategy, or simply making sense of the changing real estate landscape, home valuation services offer clients ongoing clarity and security in a fluctuating market. This transparency is unmatched—building trust and confidence in each critical step, and keeping both new and experienced buyers and sellers aligned with their goals.

From Guesswork to Precision: The Evolution of Home Valuation in Real Estate

The methods used to determine home values have undergone a dramatic transformation over the past few decades. In earlier years, home pricing relied heavily on basic comparisons and often subjective appraisals, which could prove inconsistent or incomplete. With the advent of technology and better access to sales data, valuation services today can offer pinpoint accuracy by synthesizing neighborhood analytics, home condition, and buyer demand trends. Homes in Orange County, for instance, are evaluated not only by square footage but by unique neighborhood attributes, recent improvements, and proximity to sought-after schools and amenities—all factored into the final appraisal.

This evolution has empowered clients with confidence in an otherwise complex process. By shifting from guesswork to precision, homeowners and buyers avoid uncertainty and make smarter choices backed by real evidence. As real estate markets become more nuanced, the availability of comprehensive home valuation services stands as one of the most important innovations— shielding individuals from costly mistakes and giving them control over some of their most significant financial moments.

The Mistakes Homeowners Often Make—and How Home Valuation Services Prevent Them

A surprising number of homeowners fall into common traps—overlooking key upgrades, misjudging market timing, or failing to recognize how neighborhood shifts impact their property’s value. These missteps, while understandable, can derail even the most well-intentioned sales or purchases. Home valuation services counteract these pitfalls by bringing every variable into sharp focus, ensuring that what matters most—location, timing, improvements, and market demand—is given proper weight in determining a property’s real worth.

Homeowners and buyers equipped with detailed valuation reports can enter negotiations with confidence and clarity, avoiding regret that may come from emotional or misinformed decision-making. Whether selling a home that’s appreciated after thoughtful renovations or buying into a neighborhood on the rise, trusted valuation services keep clients ahead of the curve and minimize unforeseen complications.

Local Insight: The Power of Neighborhood Expertise in Home Valuation

Not every valuation is created equal—especially in a dynamic region like Huntington Beach, where nuanced differences can create major shifts in home value. Experienced real estate professionals in the area bring hyper-local knowledge to the table, interpreting recent market changes, hidden gems, and community features that could impact a home’s final sale price. This type of insight can make all the difference in competitive markets, where quick, informed actions set successful buyers and sellers apart.

Neighborhood guides and recent market analyses provide invaluable context to clients, ensuring each valuation is grounded in real-time data, not generic assumptions. The result? Empowered clients able to make confident decisions in the current market, defining their homeownership journey on their own terms.

A Client-Focused Philosophy: Building Lasting Relationships Through Accurate Home Valuation

True real estate expertise goes beyond numbers—it’s rooted in an unwavering commitment to understanding each client’s story and putting their needs first. The most trusted home valuation services begin with a conversation, taking time to learn what clients want to achieve before moving into any assessment or pricing strategy. By always “putting first things first,” leading professionals cultivate enduring relationships, positioning themselves as advocates for both current and future moves.

Local firms with strong reputations in Orange County and the Huntington Beach area are known for taking a genuinely empathetic approach. Their mission centers on helping clients make better decisions—whether buying, selling, or planning ahead—by offering the right tools, guides, and personalized attention. This philosophy of relationship-building ensures that every transaction, from initial valuation to closing, is handled with precision and genuine care, creating trust and delivering the outcomes clients deserve.

Through an emphasis on open communication, personalized guidance, and ongoing education, these experts reshape what it means to value a home. Instead of a transactional process, they deliver a holistic, consultative experience that enables clients to “return home” with confidence and peace of mind.

What Clients Say: Success Stories from Those Who’ve Experienced the Difference

Behind every smooth real estate journey is a team of experts whose dedication makes the process seamless and rewarding. For those seeking true confidence in their next move, firsthand experiences reveal exactly how professional home valuation services can make all the difference. One recent client captured this perfectly:

Our experience with Christine was second to none! We were looking for a new home from 3 hours outside of Orange County, not sure what we wanted or where we wanted to be. Christine and her team did an excellent job communicating with us, providing us with options, being patient as we battled traffic to arrive late, and walking us through the buying process. We could not imagine having a process go any smoother than what Christine and her team led us through! She will be our first call the next time we need to buy or sell!

Navigating the intricacies of home buying or selling can be overwhelming, but with the right guidance and precise valuation, clients often find themselves moving forward confidently—no matter where they begin their search. Success stories like this illustrate how the impact of a dedicated, expert-driven approach can transform anxiety and uncertainty into trust and satisfaction for anyone ready to take the next steps in real estate.

Why Accurate Home Valuation Services Will Continue to Shape Your Real Estate Success

As real estate markets grow increasingly complex, the value of dependable home valuation services has never been clearer. For buyers and sellers alike, an accurate and timely understanding of a property’s worth forms the backbone of every smart move—preventing setbacks, optimizing results, and fostering enduring success. Professionals in the Huntington Beach area have demonstrated that with the right combination of expertise and genuine client focus, these services become more than a single transaction—they’re a foundation for lifelong real estate confidence.

With the real estate landscape in constant flux, relying on expert home valuation services not only protects your investment, but ensures you’re always informed, empowered, and ready to make decisions that make sense for your unique goals. As trusted contributors to the field, local experts have proven that transparent guidance and a client-first approach are essential for thriving in today’s market—and tomorrow’s.

Contact the Experts at Huntington Beach Realtor - Christine DiCarlo - Reméo Realty

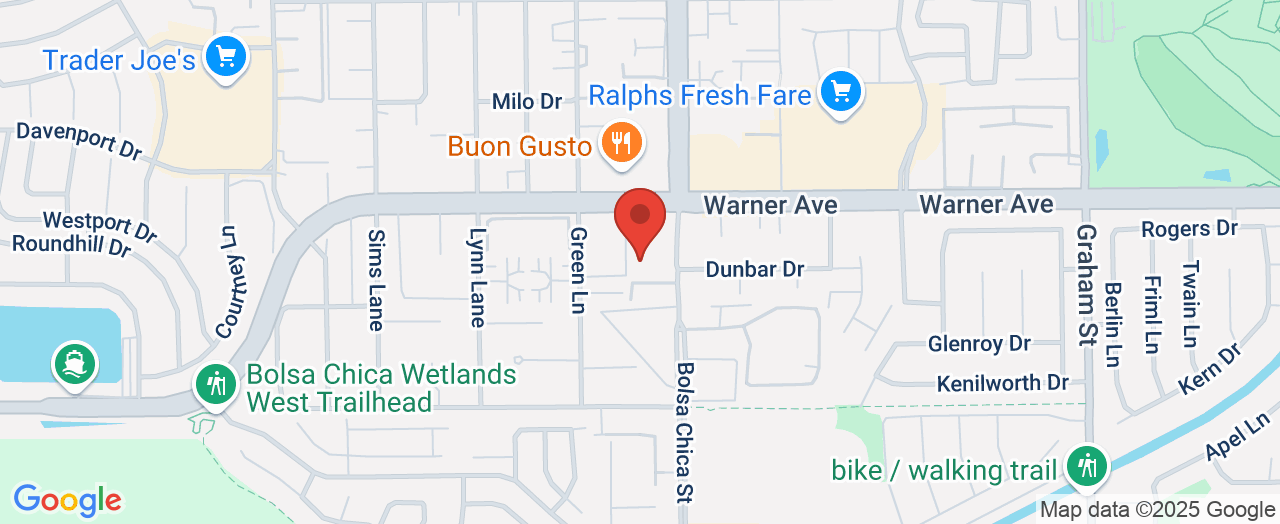

If you’d like to learn more about how home valuation services could benefit your real estate journey, contact the team at Huntington Beach Realtor - Christine DiCarlo - Reméo Realty. 📍 Address: 4952 Warner Ave #210, Huntington Beach, CA 92649 📞 Phone: +1 949-433-4372 🌐 Website: http://www.remeorealty.com/

Huntington Beach Realtor - Christine DiCarlo - Reméo Realty Location and Availability

🕒 Hours of Operation:📅 Monday: 8:00 AM – 9:00 PM📅 Tuesday: 8:00 AM – 9:00 PM📅 Wednesday: 8:00 AM – 9:00 PM📅 Thursday: 8:00 AM – 9:00 PM📅 Friday: 8:00 AM – 9:00 PM📅 Saturday: 8:00 AM – 9:00 PM📅 Sunday: 8:00 AM – 9:00 PM

Add Row

Add Row  Add

Add

Write A Comment