Making the Move: Why Huntington Beach Homes Are Catching Everyone’s Attention

Imagine waking up to the sound of surf rolling onto the sand, steps from a bike trail that snakes along the coastline, and a neighborhood that blends California cool with small-town charm. That’s the reality awaiting those who explore Huntington Beach homes. In recent years, the coastal city has seen a steady influx of new residents—both first-timers and seasoned buyers—drawn to the promise of surfing, sun, and a vibrant social scene. But this isn’t just another SoCal destination; the Huntington Beach real estate market is a unique ecosystem where lifestyle aspirations intersect with ever-evolving market trends.

For those considering a move or investment, understanding what makes Huntington Beach homes distinct is critical. The search isn’t solely about property specs or price per square foot; it’s about embracing a lifestyle where the best roads truly do lead home. Whether you're hoping for panoramic ocean views, a walkable community near shops and entertainment, or a backyard built for sunset barbecues, the options are as diverse as the people who call this area home. But in a competitive landscape like this, being equipped with expert guidance and insider knowledge can make all the difference. That’s why diving more deeply into what defines Huntington Beach homes—and why this coastal enclave has captured so many hearts—can transform your search from daunting to inspiring.

A Closer Look at Huntington Beach Homes: What Makes This Market Stand Out?

What separates Huntington Beach homes from other Southern California properties is their foundation in a lifestyle-first approach. Beyond the ocean breeze and iconic piers, the area boasts a variety of homes—ranging from cozy surf cottages to sprawling luxury estates. Every neighborhood holds its own flavor and history, fitting buyers with a wide range of priorities, whether it’s walkability, access to top-rated schools, or close-knit community events. This is why searching for Huntington Beach homes should never be treated as a one-size-fits-all endeavor.

In addition to the significant lifestyle advantages, buyers must consider real estate fundamentals like market value, long-term investment potential, and shifting demand. With rising interest in coastal living and changing buyer expectations in the post-pandemic era, Huntington Beach homes have become an even more dynamic commodity. Those unaware of local nuances—such as fluctuating inventory, seasonal buying patterns, or neighborhood micro-markets—can easily miss opportunities or make costly mistakes. The stakes are particularly high when decisions impact not just your finances but your quality of life for years to come.

Why Huntington Beach Homes Offer More Than Just a Place to Live

Local real estate experts consistently emphasize the transformative impact of finding your ideal Huntington Beach home—not simply as a financial investment, but as a way to elevate daily living. Drawing on more than two decades of experience in the market, the team at Team Etem Real Estate illustrates how their client-first philosophy turns challenges into triumphs. Their approach is rooted in open communication and deep community knowledge, ensuring clients are never left without answers or critical support during stressful times. The emotional side of home buying is just as important as the numbers, and guiding clients through tough decisions with empathy is woven into their method.

The benefits of choosing the right Huntington Beach home ripple outward: a peaceful retreat after long days, a gathering spot for friends and family, and a source of enduring pride. With the area’s reputation for laid-back luxury, outdoor adventure, and neighborly spirit, residents often find that moving here isn’t just about square footage or location, but about embracing a new chapter. Access to top-notch schools, quick trips to the beach, and an undercurrent of excitement—from downtown festivals to local farmers’ markets—means that every day brings fresh possibilities. Making an informed choice in Huntington Beach homes is about more than winning a bidding war; it’s about setting the stage for life’s best memories.

The Evolution of Surf City Living: How Huntington Beach Became a Real Estate Destination

Huntington Beach’s transformation from a humble seaside village to an in-demand real estate hub took decades, guided by visionary city planning and a love of surf culture. What once was a retreat for 20th-century vacationers has blossomed into a dynamic year-round community, balancing tradition with trendsetting energy. Today’s buyers are drawn not only by the legendary waves and pier, but also by well-kept parks, thriving local businesses, and a sense of belonging steeped in decades of caring stewardship.

This evolution means buyers now expect more from their Huntington Beach homes—energy efficiency, smart layouts, and architectural details that honor the city’s fun-loving essence. Many newer properties cater to sustainability and seamless indoor-outdoor living, reflecting wider California trends. With this blend of heritage and innovation, those searching for a home here should be mindful of both market history and the future trajectory of the city. Making a home purchase in Huntington Beach is not just a choice for today, but a stake in tomorrow’s way of life.

Tips for Navigating Your Huntington Beach Home Search

Finding your dream home in a highly competitive market can feel overwhelming, but arming yourself with the right knowledge and resources makes the process smoother. Start by clarifying your priorities, such as proximity to schools, commute routes, and the type of neighborhood culture you want to join. Approach each viewing with a list of must-haves and dealbreakers, but remain flexible—sometimes a home surprises you by exceeding expectations in ways you hadn’t considered.

Leverage tools like local property searches and consultation services, which help turn your wish list into reality. Real estate professionals recommend taking advantage of community insights—whether that’s checking out local blogs for up-to-date advice or downloading free guides that break down the buying process. Being proactive and informed, paired with guidance from a dedicated, high-communication team, ensures you avoid common pitfalls and make empowered decisions throughout your Huntington Beach homes journey.

The Lasting Value of Community Knowledge and Personalized Real Estate Guidance

There’s a difference between simply making a transaction and truly finding a place to call home. Team Etem Real Estate, for instance, stands out for its legacy of open conversation, transparent process, and personalized service that extends far beyond closing day. Their experience navigating complex family transitions, intricate paperwork, and delicate timing means clients get real solutions during sensitive moments. This philosophy is about making the impossible simple, demystifying every part of the process with a steady, knowledgeable hand.

As Huntington Beach’s property market continues to evolve, this commitment to high-touch, empathetic service remains vital. Buyers and sellers alike benefit from the confidence that comes from knowing their needs will always be heard and addressed promptly. The team’s extensive database, local referrals, and insight-laden guides blend traditional know-how with tech-savvy convenience. In a world where real estate dealings can feel impersonal or rushed, a more personal, invested approach makes the milestones all the sweeter, anchoring every transaction in trust and mutual respect.

Real Homebuyer Experiences: The Difference Personalized Help Makes

Finding your perfect fit among Huntington Beach homes can be both exhilarating and emotional—especially during periods of transition. One recent seller found the experience made far easier by the support, empathy, and effective communication offered by their real estate team. Personal stories like these underline how impactful the right guidance can be, moving beyond checklists and contracts to make space for confidence, comfort, and a sense of belonging.

Pam and Darren provided exceptional service in managing the sale of my family home after my mother passed away in September. Their knowledge of the industry and attention to detail in ensuring all involved parties were on the same page, documents signed and dated in a timely manner, gave me complete confidence in their handling of the transaction. Additionally, I cannot say enough about how kind and empathetic they were in guiding me through the process at a time when I was still grieving the loss of my mother. Communication rates high in their skill set, as texts and phone calls were returned without delay, a rare commodity in these times. I would not hesitate recommending Team Etem to my closest friends and relatives. Go Team Etem!

This level of care and professionalism is what distinguishes a good experience from a great one. Navigating change—whether buying or selling—becomes easier when you have people on your side who are both highly skilled and truly compassionate. For anyone setting out to discover the possibilities among Huntington Beach homes, testimonials like these offer powerful reassurance that your journey is in capable hands.

Setting New Standards for Huntington Beach Homes and Coastal Living

The ongoing appeal of Huntington Beach homes lies in the seamless combination of lifestyle, investment potential, and authentic community connection. In a dynamic market, informed choices save time, maximize value, and deliver years of satisfaction and belonging. Expert contributors like Team Etem Real Estate underscore the importance of a personalized, open, and educational approach for anyone entering the search for a Huntington Beach home.

As the city grows and real estate expectations change, the future looks bright for Huntington Beach homes—where surf, sun, and superior guidance come together to create a living experience that exceeds the ordinary. The result? Homeowners who are more than satisfied: they’re genuinely at home.

Contact the Experts at Team Etem Real Estate

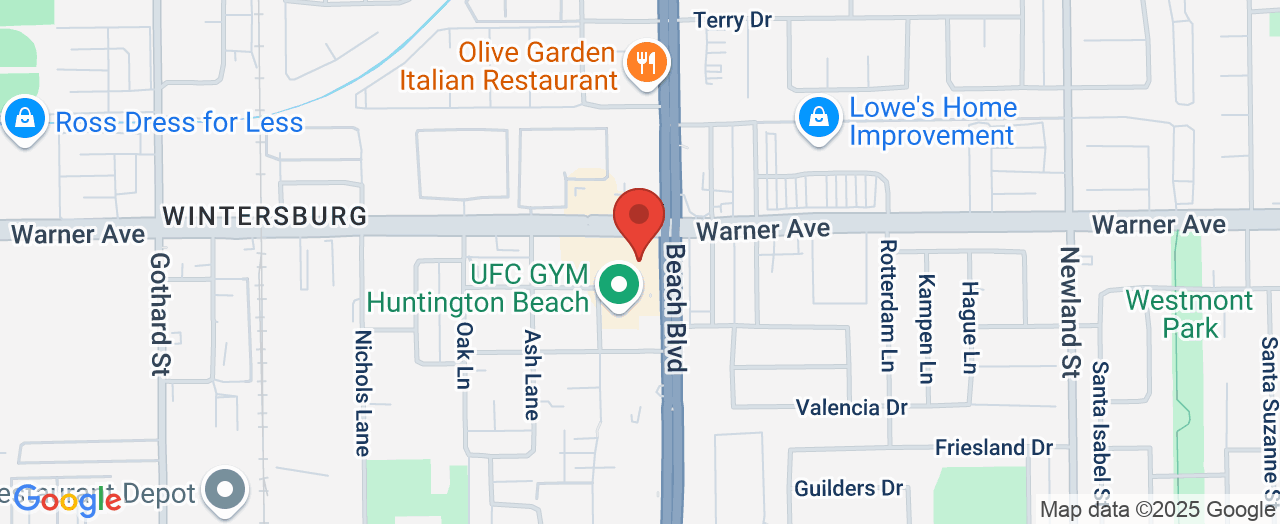

If you’d like to learn more about how Huntington Beach homes could benefit your property search or homeownership journey, contact the team at Team Etem Real Estate. 📍 Address: 17011 Beach Blvd 9th floor, Huntington Beach, CA 92647 📞 Phone: +1 714-406-3838 🌐 Website: http://www.theocrealestate.com/

Team Etem Real Estate: Location and Hours

🕒 Hours of Operation: 📅 Monday: Open 24 hours📅 Tuesday: Open 24 hours📅 Wednesday: Open 24 hours📅 Thursday: Open 24 hours📅 Friday: Open 24 hours📅 Saturday: Open 24 hours📅 Sunday: Open 24 hours

Add Row

Add Row  Add

Add

Write A Comment