Why the Allure of Luxury Coastal Living Captivates Dream Home Seekers

Imagine waking up to the rhythm of ocean waves, sunlight glinting off the water just outside your window, and an invigorating breeze promising a new adventure each morning. For many, luxury coastal living isn’t just about a residence—it’s about embracing a transformative lifestyle rooted in tranquility, prestige, and a undeniable connection to nature. Yet, the world of upscale beachfront life is filled with both promise and complexity, from exclusive negotiations to the unique culture of beachside communities. What makes the idea of living beside the shore so enchanting, and what secrets lie beneath its sun-dappled surface?

These questions resonate with homeowners, dreamers, and savvy investors alike. Luxury coastal living blends the tangible beauty of scenic vistas with the promise of premium amenities, desirable communities, and a lifestyle that feels like an endless vacation. But this aspirational dream also brings challenges: finding the perfect property, navigating escalating market values, and securing a sought-after spot among Orange and Los Angeles County’s vibrant coastal enclaves. Understanding what sets luxury coastal homes apart—and how coastal living shapes daily experience—requires more than just admiration from afar. It demands a deeper look at the narratives, values, and practical considerations that define beachfront life at its best.

Understanding Luxury Coastal Living: More Than Just Ocean Views

At its heart, luxury coastal living is a celebration of choice, quality, and a distinct kind of everyday comfort. Although the ocean views and salty air are universal, coastal living transforms depending on the community, architecture, and lifestyle crafted within. In places such as Orange and Los Angeles Counties, luxury is defined not just by square footage, but by access to walkable beaches, exclusive amenities, and curated communities like Beachwalk and Seacliff on the Greens. Here, nuanced differences in location, style, and culture create a spectrum of experiences—all underpinned by a sense of escapism and ease.

However, this dream isn’t without its intricacies. For those unfamiliar with the coastal real estate landscape, the nuances can be daunting. Navigating fluctuating market trends, understanding the appeal of private enclaves versus lively downtowns, and recognizing the value of historic or newly developed communities all require savvy insight. Choosing luxury coastal living means balancing lifestyle aspirations with practical considerations—location, home design, community amenities, and market investment. Missing these subtleties can lead not just to disappointment, but to missed opportunities in an environment where desirability and exclusivity drive both value and long-term satisfaction.

How Upscale Beachfront Homes Redefine Everyday Wellbeing and Value

As seasoned specialists in prestigious communities such as Huntington Beach’s Beachwalk, experts at PK Real Estate understand the tangible and intangible rewards of luxury coastal living. Upscale beachfront homes deliver far more than remarkable curb appeal—these properties are designed to elevate daily experiences. Imagine returning from a sunset stroll along the Pacific, unwinding in a private courtyard, and knowing the sand and surf are always mere steps away. With communities built around natural beauty, safety, and accessibility, the benefits extend far beyond individual home features.

Luxury coastal living also brings an unmatched sense of security and connection. The communities that define Huntington Beach and neighboring areas foster bonds among neighbors, often centered around shared amenities, events, and a mutual appreciation for the region’s laid-back yet sophisticated culture. Properties range from contemporary single-family homes to timeless townhomes and estates, ensuring there’s a match for any vision of comfort, investment, and long-term happiness. For families, retirees, and discerning buyers alike, coastal living delivers on the promise of work-life balance and enduring value—combining daily pleasure with a sound, appreciating investment.

Location, Lifestyle, Legacy: Choosing the Right Coastal Community

The journey to luxury coastal living begins with understanding what each community uniquely offers. Enclaves such as Beachwalk, Seacliff on the Greens, and The Waterfront in Huntington Beach are more than just developments—they are lifestyle microcosms. Beachwalk, for example, is a hidden gem built across 66 acres with thoughtfully planned homes and six distinct floor plans, cultivating both diversity and exclusivity. Meanwhile, Seacliff on the Greens combines manicured grounds with proximity to surf and golf, appealing to those who want unrivaled amenities at their fingertips.

Whether seeking the vibrancy of a downtown cottage near Main Street or the peaceful privacy of canal-side estates in Huntington Harbour, each community possesses its own rhythm, history, and sense of belonging. The variety ensures that buyers can find their desired blend of leisure, convenience, and prestige—be it with gated security, direct sand access, or peaceful views. Making this choice is as much about lifestyle legacy as it is about location, with the assurance that each property is embedded in a culture of quality and enduring neighborhood pride.

Architectural Beauty Meets Coastal Innovation: What Sets These Homes Apart

The hallmark of luxury coastal living lies in the harmonious blend of architectural excellence and intuitive design. Homes featured in communities like Boardwalk, Peninsula Park, and Surfcrest fuse modern amenities with timeless elegance—featuring expansive windows to capture every ocean breeze, outdoor living spaces conceived for both privacy and entertaining, and sustainable materials that withstand the unique climate of the California coast. Floor plans are curated to maximize natural light and flow, with options ranging from classic beach cottages to grand contemporary retreats.

Beyond visual appeal, every aspect of these properties emphasizes both innovation and comfort. Communities invest in robust infrastructure, communal pools, spas, and landscaped walkways that prioritize wellness and relaxation. Whether choosing a family-friendly enclave with top-tier schools like Peninsula Park or a lock-and-go lifestyle in a gated community such as The Waterfront, buyers can expect a blend of luxury and practicality designed for long-term delight and peace of mind.

Investment Insight: Why Coastal Properties Stand the Test of Time

Investing in luxury coastal living isn’t just about securing a picturesque retreat; it’s a strategy anchored in history and future promise. PK Real Estate’s long-standing expertise in Orange and Los Angeles Counties highlights that waterfront and near-beach properties traditionally hold—and often increase—their value through market shifts. Limited land supply, protected vistas, and strict zoning keep inventory exclusive, making these homes not just desirable but also resilient during economic fluctuations.

For buyers and investors, this translates to confidence in both immediate enjoyment and long-term returns. Luxury coastal real estate offers more than a roof over one’s head; it is an asset that enhances quality of life while securing intergenerational wealth. The legacy of beachfront ownership is a powerful draw, attracting those who want their investment to deliver both daily lifestyle dividends and enduring financial security.

PK Real Estate’s Commitment: Living, Working, and Thriving by the Coast

PK Real Estate brings over two decades of personal and professional expertise to the world of luxury coastal living. Their approach centers on deep community knowledge, hands-on service, and a belief that clients deserve to feel like family. As both residents and brokers in some of Orange County’s most sought-after enclaves, PK Real Estate’s philosophy is to match each client’s dream with integrity, attention to detail, and insider insight.

The firm is broker-owned, so clients always work directly with knowledgeable owners and decision-makers. The team’s local roots and relationships within the coastal community ensure guidance is rooted in authenticity, from introducing clients to hidden neighborhood gems to facilitating seamless transactions in competitive markets. Commitment to comfort, transparency, and long-term happiness shapes every interaction, setting a standard for what excellence in luxury coastal real estate should feel like.

Client Stories: How One Experience Exemplifies Community and Care

For many, the ultimate reassurance comes from hearing how others felt supported and empowered while pursuing luxury coastal living. With specialists who guide new neighbors and effortless transitions, the journey is as important as the destination. One recent client shared their appreciation, reflecting both the ease and thoroughness that defines a standout experience in the Beachwalk community.

Great experience with Team Diana and her team. Huge shoutout to Lisa as well who has been exceptional throughout the community and neighborhood introduction. I got connected to PK Real Estate through a referral who bought home inside this community one month prior to myself. Would highly recommend Diana and team!

The value of expert guidance—coupled with authentic community connections—transforms the home search into a genuinely joyful experience. Those who choose to work with established coastal specialists experience not just successful outcomes but the peace of mind that comes from being welcomed, understood, and prioritized throughout the process.

Will Luxury Coastal Living Remain the Ultimate Dream? Exploring Its Enduring Appeal

The timeless allure of luxury coastal living goes beyond fleeting trends or surface-level amenities. Its enduring appeal lies in the promise of a lifestyle defined by daily beauty, community, and the unique vibrancy of the Southern California coast. With premier firms such as PK Real Estate guiding buyers through every nuance, the opportunity to secure a legacy home or investment is both attainable and rewarding. As beachfront and near-ocean communities continue to flourish, luxury coastal living remains a standard-bearer for comfort, prestige, and long-term value in the real estate world.

Engaging with experts who call these communities home ensures buyers not only find their ideal property, but also join a tradition of thoughtful stewardship and elevated living. For anyone considering the leap into the world of upscale beachside real estate, luxury coastal living stands as a testament to enduring quality, connection, and dream-fulfilled existence.

Contact the Experts at PK Real Estate

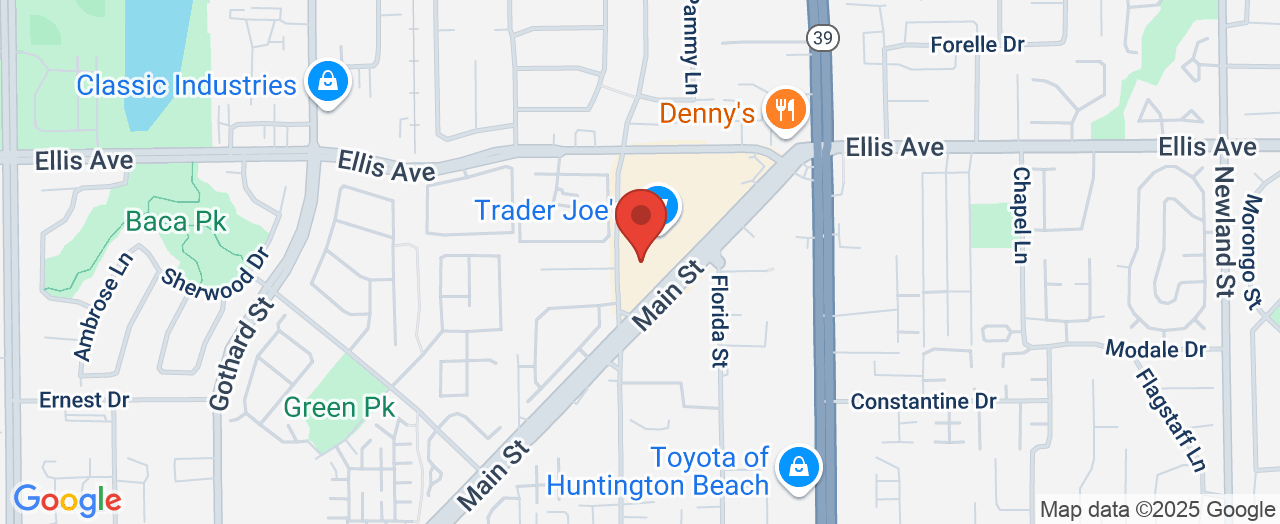

If you’d like to learn more about how luxury coastal living could benefit your lifestyle and investment strategy, contact the team at PK Real Estate. 📍 Address: 18685 Main St #101-103, Huntington Beach, CA 92648 📞 Phone: +1 714-319-2042 🌐 Website: http://www.pkrealestate.net/

PK Real Estate’s Huntington Beach Location and Full Week Availability

Add Row

Add Row  Add

Add

Write A Comment