What Makes the Search for Luxury Newport Beach Homes So Unique?

Imagine waking up to panoramic ocean views, the soft sound of waves, and the peaceful energy of Newport Beach—this isn’t just a dream for some, but a reality awaiting those who enter the high-end coastal real estate market. As the demand for luxury Newport Beach homes continues to surge, prospective buyers are faced with an ever-evolving landscape filled with opportunity—but also complexity. The stakes are high, and the rewards are extraordinary, as buyers are drawn to both the lifestyle and the investment potential woven into every property along this iconic stretch of California coastline.

The journey to finding or selling a luxury Newport Beach home doesn’t follow a typical path. It’s a process shaped by discerning tastes, exclusive neighborhoods, and an expectation for unmatched quality and privacy. The nuances of the local market—competitive offers, architectural standards, and unique community cultures—can become overwhelming without the right guidance. For anyone considering a move into this world, understanding what truly constitutes luxury in Newport Beach isn’t just helpful—it’s essential. In the following article, you’ll discover why every step of this process matters, what elevates these homes above the ordinary, and how expert strategies can bring extraordinary goals within reach.

Unpacking the Essence of Luxury Newport Beach Living

The phrase "luxury Newport Beach homes" carries with it a promise of exclusivity, refinement, and an effortlessly coastal lifestyle, but what does it really mean in practice? These aren't simply large or expensive houses—instead, luxury homes in Newport Beach represent a curated standard marked by architectural distinction, world-class amenities, and a seamless integration with Southern California’s prized natural beauty. From custom-built estates gracing the sands of West Oceanfront to gated properties on Linda Isle, each home tells its own story while sharing an underlying commitment to excellence, privacy, and comfort.

Beyond finishes and features, what distinguishes these homes is their ability to connect owners with the unique energy of Newport Beach itself. Whether set beside tranquil harbor waters or perched for sweeping views of the Pacific, every luxury property here is an invitation to experience daily life at a higher standard. But the path to securing this lifestyle is rarely straightforward—buyers who don’t grasp the pace, pricing, and nuance of the local market can find themselves left behind, missing rare opportunities that surface only for the most prepared and informed participants. With the stakes so high, an educated approach becomes more than an advantage—it’s a necessity.

How Luxury Newport Beach Homes Transform Everyday Living

Drawing on years of expertise in the heart of coastal Orange County, industry professionals recognize that luxury Newport Beach homes are more than prestigious addresses—they are transformative spaces that shape every aspect of their occupants’ lives. The value of these homes extends far beyond their physical boundaries, influencing health, happiness, and the rhythm of daily living. Whether it’s the calming effect of ocean breezes, the satisfaction of hosting family in elegant entertaining spaces, or the convenience of advanced smart home technologies, each residence offers tangible benefits that enhance comfort and elevate quality of life.

In addition, Newport Beach’s luxury real estate offerings provide unique gateways to thriving communities well known for security, social connection, and access to top-tier amenities—from yachting clubs and tennis courts to renowned schools and vibrant cultural landmarks. For investors and families alike, this means not just securing a beautiful home, but also establishing a long-term foundation in one of Southern California’s most stable and desirable markets. The opportunity for appreciation is substantial, as Newport Beach remains a coveted destination for both domestic and international buyers seeking rarity and prestige. Ultimately, purchasing luxury here is about investing in a way of life: one that delivers convenience, serenity, and a daily sense of arrival.

Architectural Excellence: Hallmarks of Newport Beach’s Most Desirable Estates

Architectural vision is a signature trait of the most sought-after luxury homes across Newport Beach. Communities like Linda Isle, Balboa Island, and West Oceanfront display a stunning range of designs—from sleek modern masterpieces crafted with glass and steel to elegantly updated classics with timeless appeal. What unites these varied properties is an unwavering commitment to innovation, comfort, and harmony with the landscape. Floor-to-ceiling windows frame breathtaking ocean and bay views, thoughtfully designed outdoor spaces extend living areas year-round, and meticulous craftsmanship ensures every detail reflects a higher standard of care.

Choosing a home in this market means unlocking possibilities that go well beyond square footage or the number of bedrooms. Many of Newport Beach’s luxury properties offer private docks, smart-home systems, spa-inspired bathrooms, and ample space for art or wine collections. For buyers, recognizing architectural quality is about more than aesthetics—it’s about embracing the spirit of California luxury living, where each estate is uniquely tailored for both privacy and community engagement. Understanding what truly sets these designs apart ensures you’re investing in something built to inspire for generations.

Beyond the 📍 Address: The Role of Community and Lifestyle in Value

While the physical home is central to luxury, it’s the surrounding community—and the distinctive Newport Beach lifestyle—that brings lasting value to any investment. Each neighborhood, from Corona Del Mar’s boutique shopping and dining to the easygoing elegance of East Bluff, cultivates a unique sense of belonging. Whether your interests lean toward sailing from a private dock, golfing on world-class courses, or enjoying quiet mornings along the Back Bay, Newport Beach’s coastal communities foster rich connections that endure well beyond a real estate transaction.

Lifestyle amenities, walkable neighborhoods, and curated local experiences further distinguish Newport Beach from other luxury markets. The area’s vibrant calendar—filled with boat parades, waterfront festivals, and outdoor adventures—adds depth to daily life. For discerning buyers, it’s not just about purchasing a home, but gaining access to a world where convenience and inspiration are part of the everyday experience.

From Market Savvy to Seamless Closings: Navigating the Purchase Process

The process of buying or selling a luxury Newport Beach home demands more than simply locating the right property. The timeline from home search to closing can be intense, requiring total command of the market, a fearless negotiation spirit, and attention to every detail. Leading experts in the field facilitate this journey by demystifying paperwork, anticipating regulatory shifts, and ensuring every aspect feels manageable for both first-timers and seasoned investors. Their local knowledge can mean the difference between success and missed opportunity, especially in highly competitive markets where timing and strategy are everything.

The importance of a personalized approach is evident throughout every stage—from aligning search criteria with lifestyle aspirations to leveraging advanced marketing for sellers. For buyers, expert representation offers access to off-market listings and insights that streamline decision-making. For sellers, the right guidance translates into maximized value and efficient sales timelines, even in complex, multi-offer scenarios. In Newport Beach, where every deal is as unique as the people involved, trusted expertise is the anchor supporting smooth, successful real estate experiences.

Expert Guidance Anchored in a Client-First Philosophy

A review of Newport Beach’s premier luxury real estate offerings reveals not only impressive property portfolios but also a distinctive approach rooted in client advocacy and local expertise. Seasoned professionals in this market blend attentive listening with market analysis, making the goals and lifestyles of clients central to every transaction. Their reputations are defined by patience, diligence, and transparency—the core qualities that differentiate a seamless experience from a stressful ordeal. Whether navigating the sale of a $27 million Linda Isle estate or guiding newcomers through their first home search, these experts prioritize clear communication and strategic guidance.

A commitment to professionalism goes hand in hand with deep community understanding and an unwavering focus on long-term satisfaction. Top agents leverage a background not only in real estate, but also in fields like corporate sales, bringing a fresh perspective and an ability to anticipate client needs. This philosophy translates into measurable outcomes: properties sold at or above asking price, smooth escrows, and buyers who feel empowered every step of the way. In every interaction, the client-first mentality ensures every detail is handled, providing a stable foundation for confident investing in Newport Beach’s luxury sector.

Real Client Experiences: Trust Earned Through Consistent Success

At the heart of the Newport Beach luxury real estate market lies the trust built between clients and their expert advisors. The experience isn’t defined solely by the properties bought or sold, but by the peace of mind and confidence clients feel throughout the journey from first showing to final signature. One client expressed just how impactful this steady guidance can be:

We’ve worked with Susie McKibben on multiple real estate transactions, and each experience has been outstanding. Susie is incredibly knowledgeable, detail-oriented, and always thorough in her approach. What we appreciate most is that she’s never pushy. She listens, offers thoughtful guidance, and genuinely has her clients’ best interests at heart. Her professionalism, responsiveness, and deep understanding of the market have made every step of the process smooth and stress-free. We highly recommend Susie to anyone looking for a truly exceptional real estate agent.

Reviews like these highlight the essential role of expertise and genuine care in the highly personal process of securing a luxury home in Newport Beach. With the right guidance, buyers and sellers alike enjoy not just smoother transactions, but an elevated experience, filled with clarity, confidence, and satisfaction at every stage.

Redefining Coastal Living Through Luxury Newport Beach Real Estate

As the world increasingly turns its eyes to Southern California’s premier coastal havens, the allure of luxury Newport Beach homes remains as compelling as ever. For those who aspire to elevate both their lifestyle and investment portfolio, understanding the market’s evolving nuances, architectural standards, and community culture is critical. Agents who consistently deliver superior results have become the cornerstones of the Newport Beach real estate experience, embodying the highest standards of professionalism and care. Ultimately, entering this market is about much more than acquiring an impressive address—it’s about stepping into a world where daily life is a seamless blend of comfort, creativity, and connection to one of the state’s most coveted landscapes.

This journey, made easier by industry expertise and thoughtful advocacy, offers the opportunity to experience the best of California coastal living. For anyone with an eye on the luxury Newport Beach homes market, the difference lies in both the caliber of available estates and the quality of guidance throughout the process.

Contact the Experts at Susie McKibben Real Estate - Newport Beach and Coastal Orange County

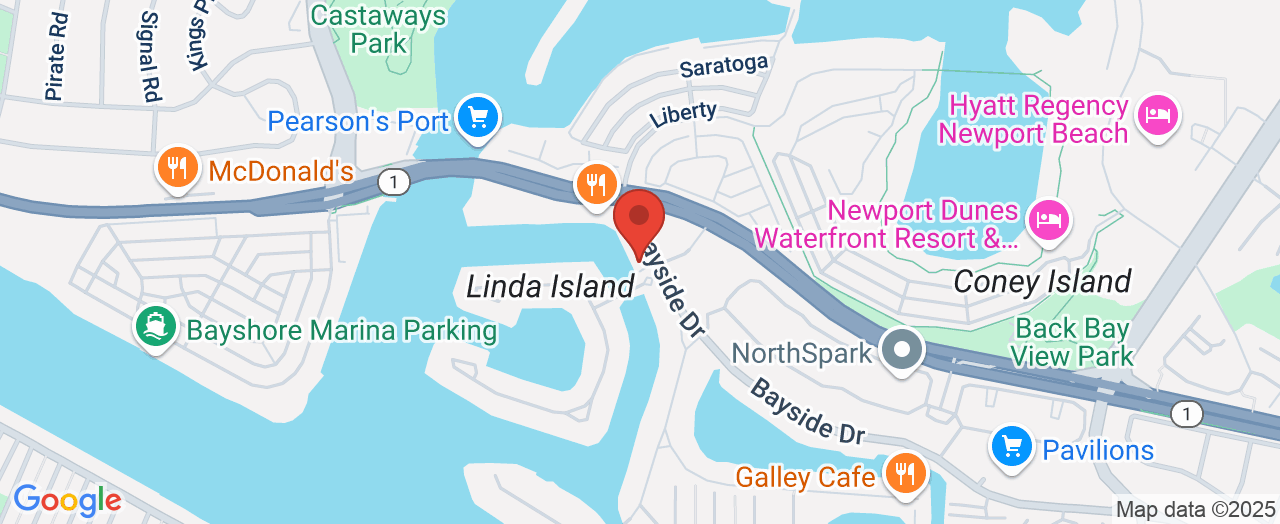

If you’d like to learn more about how luxury Newport Beach homes could benefit your coastal lifestyle or real estate investment strategy, contact the team at Susie McKibben Real Estate - Newport Beach and Coastal Orange County. 📍 Address: 341 Bayside Dr, Newport Beach, CA 92660 📞 Phone: +1 949-500-5327 🌐 Website: https://mckibbenrealestate.com/

Susie McKibben Real Estate – Newport Beach Location and Hours

Add Row

Add Row  Add

Add

Write A Comment