Unlocking the Secrets Behind Every Successful Luxury Real Estate Sale

Stepping into the world of luxury real estate sales is more than just a transaction—it’s an intricate dance of timing, precision, and savvy navigation through legal and tax intricacies. Whether you’re preparing to sell a multi-million dollar coastal home or purchase a discreet estate in Orange County, each step carries profound consequences. The stakes are high: a single oversight not only risks significant financial loss but can threaten your privacy, legacy, and peace of mind in ways that ripple far beyond closing day.

Luxury properties are the crescendo of the real estate marketplace, commanding attention from discerning buyers, demanding sellers, and an audience that entertains nothing less than seamless execution. Yet, even seasoned participants can be tripped up by overlooked legal details or miss timely market opportunities. To safeguard your investment and future, it’s essential to understand the landscape, equip yourself with expert knowledge, and recognize how prudent strategy ensures not just a successful sale—but a rewarding experience and maximum value. This guide examines the proven steps every buyer or seller must consider, highlighting why education, legal clarity, and strategic planning set the foundation for triumph in luxury real estate sales.

The High Stakes and Hidden Pitfalls of Navigating Luxury Real Estate Sales

Luxury real estate sales are a world apart from conventional residential transactions. The process involves not only negotiating higher price points, but also addressing the complexities of asset protection, multi-layered privacy needs, sophisticated marketing strategies, and the legal frameworks that underpin high-value exchanges. Unlike standard sales, luxury properties often require customized agreements, careful entity structuring, and nuanced attention to tax implications—matters that can jeopardize outcomes if mishandled. Terms like confidential transactions, trust and estate sales, and LLC formation are not mere legalese, but essential safeguards for sellers and buyers seeking both security and discretion.

For those unfamiliar with luxury real estate’s inner workings, misunderstanding these vital aspects can result in costly delays, public exposure of private data, and missed opportunities for generational wealth transfer. The reality is that buyers, sellers, and trustees in this realm face challenges such as IRS scrutiny during 1031 exchanges, complex inheritance scenarios, strategic property management demands, and ever-shifting local and federal regulations. The sheer breadth of considerations—from legal document drafting to global marketing—means that skipping a single crucial step, or failing to enlist the guidance of true experts, can undermine everything. Education is not just empowering here; it is essential protection.

Proven Advantages: How Expert-Led Luxury Real Estate Sales Maximize Value and Security

Expertise in luxury real estate sales doesn’t merely streamline the process—it fundamentally changes outcomes for clients at every stage of the journey. When sophisticated legal and tax guidance are integrated with real estate strategy, both sellers and buyers benefit from a seamless experience that streamlines negotiations, safeguards privacy, and ensures every dollar is accounted for. For instance, securing the right legal structures such as trusts, LLCs, or confidentiality agreements protects high-profile individuals and families from unnecessary exposure. Meticulous tax strategy, tailored to each client’s circumstances, can lead to substantial savings, particularly when leveraging tools like 1031 exchanges or Delaware Statutory Trusts for investment properties.

In an environment where every detail matters, global marketing reach and strategic pricing harness the full potential of luxury assets. Savvy representation ensures your listing connects to qualified, motivated buyers around the world—while nuanced negotiation skills help buyers stand out and secure coveted properties in competitive, often multiple-offer markets. Practical benefits also include asset protection through full-service property management, digital marketing that ensures world-class exposure, and the ability to navigate estate and trust sales without headaches. In sum, the right expertise in luxury real estate sales transforms stress and complexity into a journey of confidence, clarity, and exceptional results.

From Discretion to Exposure: The Dynamics of Selling High-Profile and Luxury Properties

Privacy is paramount in luxury real estate sales, especially for celebrities, public figures, and high-net-worth individuals. High-value transactions often require specialized legal vehicles such as third-party LLC management and robust confidentiality agreements to shield a seller’s or buyer’s identity from public view. Such measures are not just optional; they are increasingly expected by discerning clients wary of their personal information appearing in press releases or property records. But discretion must be artfully balanced with exposure—maximizing a property’s visibility across global media syndication networks without sacrificing the seller’s security.

Strategic use of targeted digital marketing, coupled with affiliation to premium luxury programs, connects properties to elite buyers worldwide while keeping sensitive details under wraps. For both sides of the transaction, this fusion of discretion and calculated publicity ensures peace of mind and a higher probability of achieving record-breaking results. It’s a nuanced choreography, where the success of a sale is defined by how expertly visibility and privacy are managed at every turn.

Legal and Tax Strategy: The Bedrock of Responsible Luxury Real Estate Sales

The importance of integrated legal and tax advice in luxury real estate sales cannot be overstated. Every high-value deal involves layers of documentation, entity formation, and compliance that, if mishandled, can invite disputes, excessive taxation, or even litigation. Knowledgeable practitioners recommend trust and estate planning, Prop 19 workarounds, installment sale strategies, and LLC compliance to ensure that assets are transferred cleanly and efficiently—whether the sales are for personal residences, investment properties, or part of family legacy planning. Buyers, too, benefit from legal review of custom addenda and specialized terms embedded in purchase agreements.

Ultimately, the consequences of ignoring or underestimating these facets can be profound. Tax missteps can erode the net proceeds from a sale, while legal oversights risk costly disputes or loss of privacy long after escrow closes. A well-rounded approach—integrating real estate law with transactional agility—remains the cornerstone for any client looking to thrive, not merely transact, in the luxury marketplace.

Market Savvy and Neighborhood Insight: Why Local Knowledge Drives Results

Luxury real estate, especially in distinctive areas such as Newport Beach, Eastside Costa Mesa, and Laguna Beach, demands a hands-on understanding of both the market and the micro-neighborhood trends that affect property values. Insight into local inventory, pricing history, and buyer demographics gives sellers a critical advantage in setting competitive, appealing prices. For buyers, boots-on-the-ground awareness of off-market opportunities and the nuances of HOA restrictions or upcoming zoning changes can mean the difference between frustration and securing a once-in-a-lifetime property.

Successful luxury sales teams live and work in the environments they serve—bringing their firsthand experience, as well as their communities’ connections, into every negotiation and advisory session. This hyperlocal expertise builds trust and positions their clients for the best possible outcomes, regardless of market volatility.

Lucas Real Estate’s Legal-Forward Philosophy in Luxury Real Estate Sales

A distinctive hallmark of Lucas Real Estate is the fusion of seasoned legal acumen and premier brokerage service, creating an approach where technical detail and market intuition are inseparable. At its foundation is the belief that exceptional client outcomes are built on deep legal and tax knowledge—not just salesmanship. This means every transaction is buttressed by comprehensive risk assessment: from drafting bespoke agreements to overseeing trust and estate administration, structuring LLCs for confidentiality, and navigating complex cross-state or multi-owner scenarios.

In practice, Lucas Real Estate positions clients’ interests at the center of the process, embracing a holistic view that covers asset protection, regulatory compliance, and long-term wealth preservation. Their mission is to “help clients buy, sell, and hold real estate—and navigate every legal and tax detail along the way.” Precision, integrity, and discretion define their ethos, trusted by clients ranging from celebrities to multigenerational families. This philosophy is demonstrated not only in sales results, but in proactive guidance, strategic solutions for 1031 exchanges and installment sales, and relentless commitment to client confidentiality.

Lucas Real Estate also recognizes the importance of adaptability, remaining at the forefront of changes in the industry—whether that’s shifts in buyer agency law or evolving tax codes. Through membership in global luxury networks and dedication to local stewardship in Orange County, the team ensures clients are prepared for both today’s challenges and tomorrow’s opportunities in luxury real estate sales.

Clients Speak: Navigating High-Stakes Sales With Trustworthy Guidance

What validates a service more than client success stories? Many buyers and sellers navigating luxury real estate sales recall how the right expert made the unthinkable seem routine—managing negotiations, documents, and even city compliance issues with relentless responsiveness. These experiences often transform stress into satisfaction and pave the way for lasting trust.

I recently worked with Devin Lucas and his team on a private party real estate transaction and was impressed from the very first interaction. Throughout the entire process, Devin was consistently available, professional, and helpful—ultimately ensuring we closed the deal on time and without any errors. What really stood out was his genuine commitment to helping me navigate the process. He never nickel-and-dimed me for every minute of his time, which is rare and deeply appreciated. Thanks to his guidance and support, I saved thousands of dollars in real estate commissions. I highly recommend Devin Lucas and his team to anyone looking for a reliable, knowledgeable, and client-focused real estate professional.

Testimonies like this highlight an essential truth: entrusting your luxury real estate sale to a team grounded in legal, tax, and market expertise protects your wealth, your privacy, and your experience from start to finish. Clients who take these steps don’t just close on their dream properties—they do so with confidence, clarity, and peace of mind that lasts long after papers are signed.

Elevate Your Approach: Why Mastering Luxury Real Estate Sales Means Never Leaving Success to Chance

The changing tides of luxury real estate sales demand more than charisma or a recognizable brand—they require a disciplined commitment to legal precision, tax wisdom, and market insight at every step. The difference between a good result and a truly exceptional outcome often rests on whether sellers and buyers recognize the intricacies lying beneath the surface of every high-end transaction. Leveraging expert guidance ensures not only superior financial returns, but lasting asset protection and a seamless experience regardless of challenges along the way.

As the luxury property arena continues to evolve, the influence of detail-oriented, legally astute professionals becomes the new benchmark for success. In Orange County and beyond, Lucas Real Estate has defined this standard, delivering a full-service, client-centered model that helps families, investors, and public figures reach real estate milestones with confidence. Whether considering your next move or preparing your legacy, understanding that luxury real estate sales are never just business—they are the art of maximizing value while minimizing risk.

Contact the Experts at Lucas Real Estate

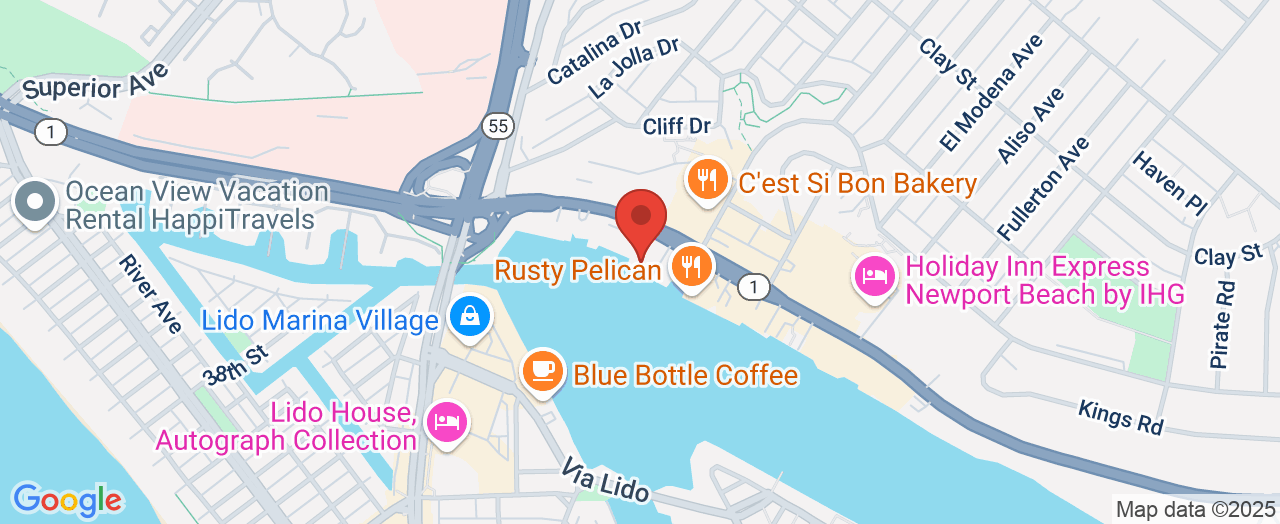

If you’d like to learn more about how luxury real estate sales could benefit your real estate journey, contact the team at Lucas Real Estate. 📍 Address: 2901 West Coast Hwy Suite 200, Newport Beach, CA 92663 📞 Phone: +1 949-478-1623 🌐 Website: https://lucas-real-estate.com/

Location and Hours for Lucas Real Estate

📅 Monday: 8:30 AM – 5:30 PM

📅 Tuesday: 8:30 AM – 5:30 PM

📅 Wednesday: 8:30 AM – 5:30 PM

📅 Thursday: 8:30 AM – 5:30 PM

📅 Friday: 8:30 AM – 5:30 PM

📅 Saturday: 10:00 AM – 5:00 PM

📅 Sunday: 10:00 AM – 5:00 PM

Add Row

Add Row  Add

Add

Write A Comment