Why Real Estate Negotiation Skills Are The Key To Property Success

Imagine walking into a real estate deal and coming out with more than you hoped: a better price, favorable terms, and the confidence that you made every decision on solid ground. Yet, according to national reports, only a fraction of buyers and sellers feel they truly maximized their real estate experience. The gap isn't in the listings—they are everywhere—but in the negotiation. In a market as competitive and nuanced as Southern California’s, real estate negotiation is not just a skill; it’s a crucial differentiator between winning big and regretting the outcome.

Real estate negotiation touches every step of the process, whether you’re seeking a forever home in Newport Beach or selling a property in bustling Orange County. With shifting markets and fast-moving inventory, the ability to confidently strategize, communicate, and advocate for your own best interests becomes invaluable. Too often, buyers settle for listings that don’t check all their boxes, or sellers accept offers below their property’s true value—simply due to lack of negotiation savvy. Understanding what goes on behind the scenes, and arming yourself with expert negotiation insights, has never been more vital for anyone who wants lasting satisfaction from their real estate transactions.

Understanding Real Estate Negotiation: The Missing Ingredient in Every Transaction

At its core, real estate negotiation is more than a back-and-forth over price. It’s a dynamic conversation where art meets skill—where understanding market trends, anticipating objections, and leveraging local knowledge play an essential role. Negotiators must juggle competing interests, timing, and a host of unique property factors. In areas like Newport Beach and Orange County, this complexity is heightened by diverse property types, high demand, and the substantial financial stakes at play. Successfully navigating these negotiations means seeing the bigger picture, reading the emotional landscape, and knowing when to push ahead or pivot. Without this, even motivated buyers and sellers can miss out on achieving their ideal outcomes.

Many approach real estate deals believing the biggest obstacle is simply finding the right home or buyer. In reality, failure to grasp the nuances of negotiation leads to missed opportunities—agreements that feel lopsided, deals that fall through at the eleventh hour, or long-term regrets over concessions that seemed minor at the time. Empowering oneself with a negotiation mindset—bolstered by reliable data, clear priorities, and an understanding of market psychology—prevents costly mistakes. For anyone stepping into the current real estate climate, mastering negotiation is no longer optional if lasting satisfaction and success are the goals.

Why Expert Negotiation Skills Shape the Real Estate Experience for Buyers and Sellers

In the world of property transactions, negotiation expertise sets the foundation for deals that exceed expectations, improve financial outcomes, and build trust between parties. A Realtor specializing in Orange County and Newport Beach, who brings years of negotiation experience to the table, offers clients more than market access—they provide a strategic advantage. With extensive local insight, such professionals can pinpoint leverage points, navigate emotional high-stakes moments, and advocate fiercely for their clients’ interests, whether buying or selling.

Real estate negotiation is also about foresight and preparation. By anticipating potential challenges and proactively addressing common sticking points, seasoned negotiators keep the process smooth and reduce stress for all involved. Local expertise is especially critical in communities like Newport Beach, where property values and buyer expectations run high. By focusing on client priorities, understanding diverse community traits, and employing creative solutions for unique scenarios—whether it’s a probate sale or a luxury listing—the right negotiator turns possibilities into tangible results. This means achieving better prices, faster closings, and a much more satisfying journey from start to finish.

The Evolution of Negotiation: From Price Haggling to Strategic Advantage

Historically, real estate negotiation was often viewed as simple bargaining—a tug-of-war over percentage points on the sale price. Today, successful negotiation encompasses much more. It requires understanding local property trends, knowing how to highlight a home’s unique characteristics, and using complex contract terms to create win-win results. In competitive regions like Newport Beach, expertise in negotiation means being able to guide clients through competing offer situations, multi-party bids, and nuanced contingencies that can make or break a deal.

The sophistication of today’s real estate transactions demands a new approach—one that goes beyond traditional methods. Modern negotiators combine data-driven insights with personal rapport, develop innovative solutions to unexpected problems, and maintain clear communication to build trust at every step. This shift in negotiation style is what allows top agents to achieve record sales, set new market standards, and earn the trust of both first-time buyers and seasoned investors alike.

Trends In Real Estate Negotiation: Adapting to a Fast-Moving Market

The landscape of real estate negotiation is continually shaped by evolving market conditions, technology, and client expectations. With rising home values and competitive bidding wars escalating in regions like Orange County, negotiators must be both swift and creative. Strategies that worked a decade ago are now supplemented by real-time market analysis, digital communication, and enhanced contract tools. The result is a faster pace and higher stakes, requiring a more methodical, informed approach from all parties involved.

Adaptability is crucial—agents and buyers alike must be prepared to shift strategies as situations change. For example, understanding local regulations around probate sales or new construction developments can present unique opportunities or pitfalls. The most effective negotiators keep their fingers on the pulse of these changes, ensuring that their clients’ interests are protected and opportunities are seized as soon as they arise.

Local Knowledge: The X-Factor in Negotiating Newport Beach Real Estate

While negotiation skills form the backbone of any successful transaction, local market knowledge often tips the scales. In Newport Beach and surrounding coastal communities, factors like school districts, neighborhood amenities, and even seasonal buyer trends can significantly influence pricing and the final terms of a sale. Realtors attuned to these subtleties can guide their clients toward decisions that maximize value—whether that means promoting a home to the most desirable buyers or timing a purchase for optimal market conditions.

Understanding which neighborhoods offer the best perks for families, or how to navigate high-demand waterfront properties, are just part of this local expertise. When paired with strategic negotiation, this hyper-local focus ensures clients consistently benefit from choices grounded in reality, not guesswork. The result is a smoother, more transparent process with outcomes that match—or exceed—expectations, no matter which side of the table you’re on.

Dedication and Foresight: A Realtor's Philosophy in Practice

At the heart of every remarkable real estate negotiation is a philosophy that prioritizes adaptability, attention to detail, and a relentless dedication to client success. The approach taken by Nancy Andreason, Realtor in Newport Beach and Orange County, is marked by a genuine commitment to learning a client’s true priorities and championing those interests at every negotiation stage. Decades of experience—backed by industry awards and local accolades—point to a method where negotiation is performed hands-on, not delegated, and where each decision is grounded in market knowledge and strategic foresight.

The mission is clear: guide clients through complex sales, like probate and luxury homes, with unmatched personal service and transparency. Real estate negotiations are never one-size-fits-all—the process is tailored, adapting to anything from fast-moving market turns to highly emotional family situations. This philosophy relies on assembling an expert support team for logistical precision, while focusing energy on high-stakes negotiation moments. By blending high energy, deep knowledge, and a collaborative spirit, this approach advances client goals with confidence and care.

Real Stories, Real Success: Clients Reflect On Negotiation Results

In real estate, there is no greater testament to the value of expert negotiation than the words of those who have benefited firsthand. A recent client, Juny C., shared their experience highlighting not only the financial gains, but also the emotional reassurance provided every step of the way:

We had the absolute pleasure of working with Nancy to purchase our condo, and we couldn’t be more grateful for her guidance throughout the entire process. From the very beginning, Nancy was knowledgeable, patient, and incredibly responsive. She took the time to understand what we were looking for and found us the perfect property that checked all the boxes.

When expert negotiation is at the core of your real estate journey, the results speak for themselves—better deals, less stress, and a sense of empowerment that turns a major life decision into a positive memory. For anyone considering a property transaction, these stories underscore the value of partnering with a negotiator who brings both skill and care to the table.

Setting a New Standard for Real Estate Negotiation in Orange County

As the market continues to evolve at a rapid pace, those who master real estate negotiation will set themselves apart in every transaction. The ability to secure better deals, foster smoother relationships, and turn complex processes into seamless experiences is now a vital edge. Professionals like those at Nancy Andreason’s office have contributed to raising the bar—not just by achieving impressive results, but through a philosophy of service and strategic thinking that puts clients’ interests first. Every deal negotiated is another step toward redefining what buyers and sellers can expect in the Newport Beach and Orange County markets.

Real estate negotiation remains one of the most influential skills for anyone embarking on a property journey. As clients and agents alike embrace new strategies, technologies, and local insights, the future of property buying and selling will be shaped by those who understand—not just the value of a good deal—but the power of smart negotiation. Take control of your outcomes by starting every transaction with this knowledge at the forefront.

Contact the Experts at Nancy Andreason, Realtor in Newport Beach and Orange County

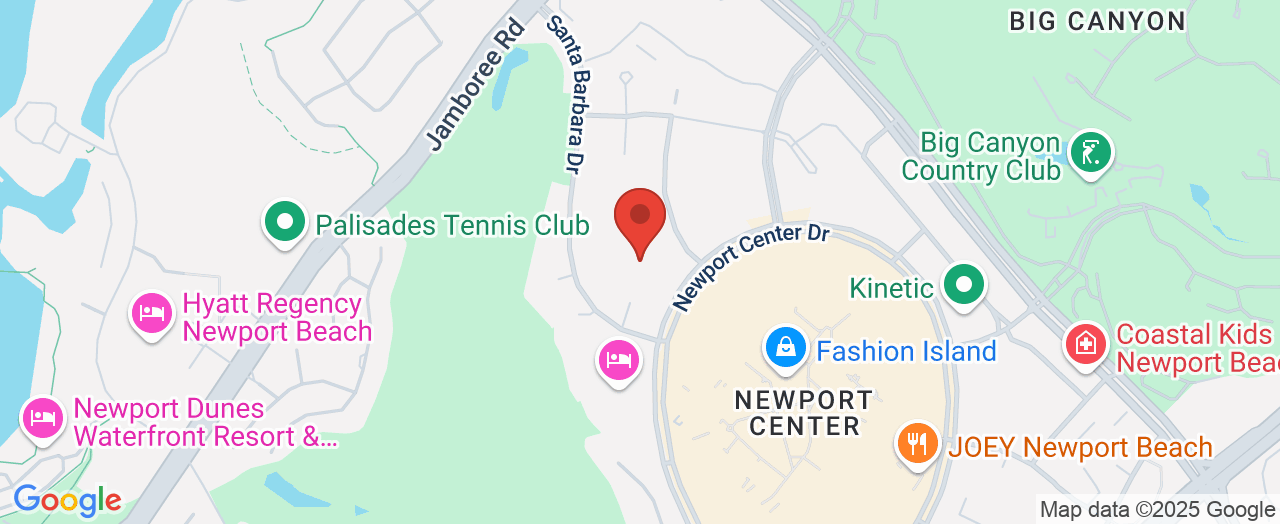

If you’d like to learn more about how real estate negotiation could benefit your property decisions, contact the team at Nancy Andreason, Realtor in Newport Beach and Orange County. 📍 Address: 840 Newport Center Dr #100, Newport Beach, CA 92660 📞 Phone: +1 949-519-4110 🌐 Website: https://andreasongroup.com/

Nancy Andreason, Realtor in Newport Beach and Orange County: Location and Availability

Add Row

Add Row  Add

Add

Write A Comment