Unlocking the Secrets Behind Orange County Homes and What Makes the Area Unmatched

It’s no secret that Orange County homes are among the most sought-after in California, attracting buyers for their unbeatable combination of coastal beauty, vibrant communities, and diverse architecture. But beneath Orange County’s palm-studded streets runs a more complex current: How do you find the neighborhood that suits your unique lifestyle when there are so many distinct enclaves, each offering its own character? The dilemma isn’t just about style or price—it’s about discovering a home that’s in sync with who you are, your family’s needs, and your vision for the future.

As more people search for their slice of the California dream, competition in the Orange County real estate market intensifies, sparking both excitement and uncertainty. Understanding what truly sets Orange County homes apart is crucial, not only for first-time buyers hoping to put down roots but also for seasoned homeowners considering their next move. From panoramic beachfronts to suburban hideaways, the choices are abundant, but so are the questions: Which neighborhood offers the best schools? How do you balance proximity to work with access to nature, nightlife, and community events? The journey to finding your perfect home in Orange County doesn’t just end with a beautiful kitchen or backyard—it’s about the life you’ll lead beyond your doorstep.

Whether you’re relocating for the sun-kissed lifestyle, seeking more space, or thinking about selling, understanding the full scope of the Orange County homes market can be daunting. But knowledge is power. The purpose of this article is to break down exactly what makes Orange County unique, what buyers and sellers can expect, and how you can navigate the hunt for your perfect neighborhood with confidence and clarity.

Beyond the Beaches: Why Orange County Homes Stand Out Among California Real Estate

At its core, Orange County homes represent more than just a location—they embody an array of lifestyles, opportunities, and enduring values that set this region apart. Stretching from the ocean’s edge in Huntington Beach to the inland tranquility of Tustin and Costa Mesa, Orange County delivers diversity in both geography and community. Each enclave offers a unique blend of amenities, school districts, and architectural charm, including everything from modern new builds to ranch-style classics and historic bungalows.

For anyone considering a move, understanding the nuances of each area is crucial. Subtle differences in community events, homeowner associations, and even weather patterns can greatly influence daily life and long-term satisfaction. A lack of insight can lead to rushed decisions or unanticipated challenges—from being surprised by HOA regulations to discovering a neighborhood dynamic that doesn’t fit one’s lifestyle. Orange County’s real estate market is dynamic; prices and trends shift quickly, making it more important than ever to enter the process armed with current knowledge about housing types, local market conditions, and even the contract process itself.

For those new to the scene, the sheer number of cities and neighborhoods in the county—each with its own identity and culture—can feel overwhelming. But it is precisely this variety that gives Orange County its distinct appeal, offering something for everyone if you look closely enough. From communities known for their surfing culture to family-centric enclaves and upmarket retreats, Orange County homes offer more than just shelter; they promise a new way of living. Fully understanding these variables is the key to finding a perfectly matched home—not just a perfect house.

How Orange County Homes Improve Everyday Living for Families and Individuals

As an expert in the Orange County market, Victoria Hill Real Estate brings an insightful perspective to navigating these choices. What sets Orange County homes apart isn’t just the picturesque exteriors or proximity to the coastline—it’s the practical, day-to-day benefits they bring. Buyers often find themselves drawn to the area’s highly rated schools, abundant parks, and walkable neighborhoods, all of which contribute to a higher quality of life and lasting satisfaction.

Practical outcomes make Orange County homes especially attractive for families and professionals alike. Access to diverse employment centers, recreational options ranging from world-class beaches to hiking trails, and vibrant shopping and dining districts all contribute to a comfortable, integrated lifestyle. Whether you’re looking for a Huntington Beach property with ocean access or a family-friendly Tustin address close to top-rated schools, the Orange County market provides tangible benefits for nearly every kind of homeowner.

The local real estate landscape also features a healthy blend of updated properties and classic architecture, ensuring long-term value whether you are seeking a first home, a larger living space for a growing family, or considering an investment. Guided expertise in buying or selling can mean the difference between settling for “good enough” and genuinely thriving. Real estate professionals in the area—especially those with firsthand, lifelong experience—are uniquely positioned to help individuals seize these advantages for a smoother, more rewarding home search or sale.

From Beach Bungalows to Suburban Retreats: Exploring the Variety in Orange County Homes

Orange County’s housing diversity is as notable as its landscape, presenting buyers with an array of choices to match every aspiration and budget. The coastal communities of Huntington Beach and Newport Beach deliver laid-back, surf-inspired homes within walking distance of the Pacific, while neighborhoods in Tustin and Costa Mesa showcase suburban comfort and roomy layouts perfect for family life or entertaining guests. Whether your ideal home is a contemporary condo, a ranch on a tree-lined street, or a multi-level house with panoramic views, Orange County offers each option in abundance.

This broad selection not only supports varied tastes, but also long-term planning. Downsizers can find single-level living while first-time buyers might prioritize townhomes or condos for affordability and ease. Communities like Rancho Santa Margarita and North Tustin highlight the region’s reputation for safety, community events, and neighborhood parks—qualities that translate to enduring home values and high resale potential. Matching the right residence to your personal timetable, future plans, and lifestyle is possible when you understand the full extent of what’s available—and who can help you access the best opportunities.

The Impact of Local Knowledge: Why Neighborhood Insights Matter Most

Navigating Orange County homes isn’t just about scanning listings; it’s about recognizing the subtleties that distinguish one neighborhood from another. Factors such as walkability, local community events, school reputations, and traffic patterns can deeply impact the satisfaction of daily life. Experienced local advisors are skilled at identifying these intangible aspects, ensuring buyers don’t just move into a house, but become part of a community that reflects their values and goals.

The difference in outcomes for homeowners is clear when guided by professionals who blend market expertise with neighborhood familiarity. An advisor who’s participated as a resident and real estate resource brings a heightened awareness to issues like changing zoning laws, school district boundaries, or upcoming developments—details that can dramatically influence a property’s value or a family’s happiness. Trusted guidance allows individuals to anticipate concerns and make decisions that endure well beyond escrow.

From Open Houses to Sold Signs: A Timeline of Orange County Real Estate Success

For many residents, the journey to finding or selling the right property begins with curiosity and ends with satisfaction—or even celebration. Orange County’s robust real estate market is reflected in the array of homes recently bought and sold across its cities, with transactions ranging from cozy two-bedroom condos to expansive six-bedroom estates. Recently sold properties, like a five-bedroom home on Castilian Drive in Huntington Beach or a family-friendly house on Neff Ranch Road in Yorba Linda, showcase the region's enduring appeal and dynamic options for buyers in every life stage.

The significance of this timeline is more than transactional; it’s a testament to the stability and desirability of Orange County as a long-term investment. Owners are rewarded not just with beautiful homes but also thriving communities and friendships built over backyard grills, book clubs, and shared volunteer efforts. With the right guidance, both sellers and buyers can enjoy the peace of mind that comes from knowing every detail—from initial listing to final signature—was handled with care and expertise.

Victoria Hill Real Estate’s Integrity-Driven Philosophy in an Ever-Changing Market

The philosophy behind Victoria Hill Real Estate is anchored in above-and-beyond service, integrity, and individualized attention. Drawing on deep roots as a Huntington Beach native and as someone who lives the lifestyle, the core belief centers on a hands-on approach—always putting “your property, her priority.” This means responsiveness that is measured in seconds, not days, and an unwavering commitment to providing world-class experiences for every client, from young families seeking their first house to seniors downsizing after a lifetime in the area.

The perspective provided by a background in private investigation translates to a heightened level of diligence and attention to detail. Every transaction is managed with an investigative eye—ensuring clients are protected by anticipating issues and finding the best paths forward. The commitment extends far beyond contracts, with assistance that reaches into decluttering homes, booking appointments for repairs or upgrades before closing, and recommending vetted contractors. This deeply personalized, transparent, and proactive approach defines a distinctive style that builds lasting relationships and trust.

Victoria Hill Real Estate also integrates a broader vision of community engagement—co-founding local book clubs and volunteering through programs like Meals on Wheels. This holistic dedication means clients are advised by someone who values not just the real estate process, but the lived experience of Orange County homes in all their diversity. The result: satisfied clients who become longtime neighbors and friends.

Real Owners Share Their Journey: Orange County Homes in Their Words

By far, the strongest endorsement for Orange County homes comes from those who have navigated the experience themselves. When clients reflect on their journey, it underscores how expert guidance and genuine care transform the complex undertaking of home buying or selling into a journey defined by confidence and comfort. One recent client shared their gratitude after successfully selling and buying in the area—even when the market felt daunting.

We can't recommend Victoria highly enough! We set a goal to sell our townhouse and purchase our first single family home, and from the very beginning, she impressed us with her professionalism and knowledge of the market. Victoria took the time to understand our needs and goals, both for selling our existing home and finding our perfect new one. We bought our house in a market that wasn’t extremely friendly to buyers and she helped walk us through all of the negotiations with a very experienced skill set that eventually helped us get a price on our purchase that we were happy and comfortable with. She was attentive to detail and proactive in her approach which kept the process smooth. Victoria was also willing to go the extra mile by referring us to contractors and different workers that were needed on our new house - she even went as far as to help us book appointments during escrow so we could get straight to work when we got the keys. Victoria wasn't just our realtor; she was a trusted advisor and friend throughout the entire process. She was always available to answer our questions, no matter how big or small, and her calm demeanor kept us feeling confident even during stressful moments. If you're looking for a real estate agent who is professional, knowledgeable, and truly cares about their clients, you’ve found her! We are so grateful for Victoria’s help in finding our dream home and selling our old one.

This real-life perspective highlights not only the unique stressors of the market but the confidence and support that skilled, compassionate guidance can provide. Future buyers and sellers can trust that a thoughtful approach, combined with market insight, can turn a complex process into one filled with gratitude and rewarding results.

The Evolving Promise of Orange County Homes for Families, Professionals, and Dream-Seekers

Orange County homes continue to set the standard for what buyers expect in comfort, community, and lifestyle. The real estate market’s appeal lies not just in location, but in the value it brings for generations—from excellent schools and thriving businesses to recreational opportunities and lifelong friendships. Industry leaders like Victoria Hill Real Estate help translate these potentials into reality for clients, ensuring each step is anchored in thorough expertise and unwavering attention to client goals.

As Orange County continues to evolve, so too do the opportunities for home ownership, investment, and community involvement. With the guidance of experienced, integrity-driven local experts, the dream of finding your place in the region becomes more accessible and rewarding than ever. Orange County homes aren’t just listings—they’re living chapters in the ongoing story of those ready to embrace all that this dynamic region has to offer.

Contact the Experts at Victoria Hill Real Estate

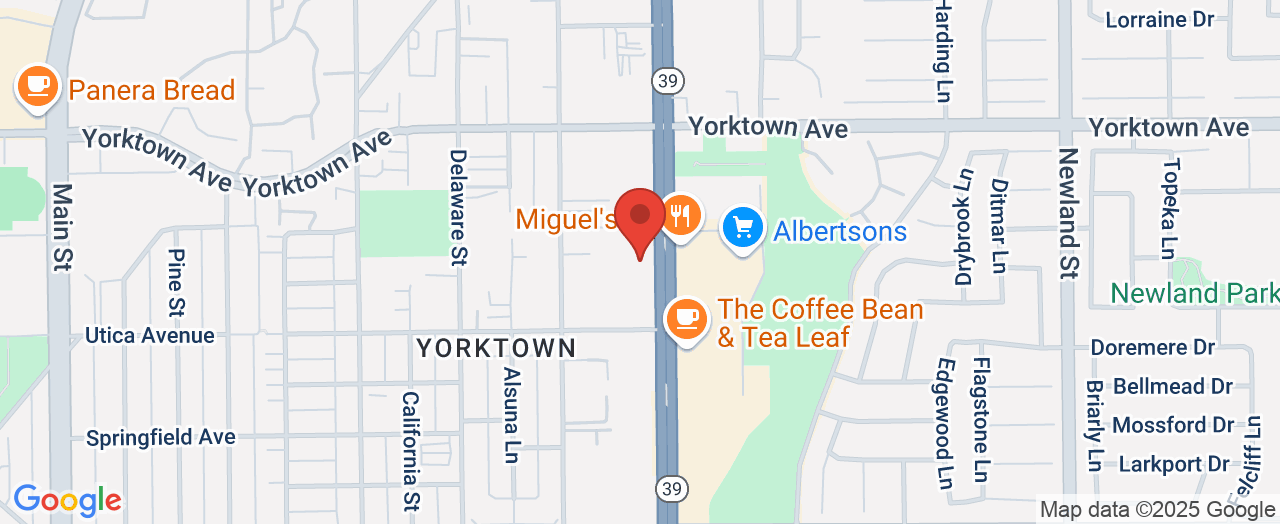

If you’d like to learn more about how Orange County homes could benefit your real estate plans, contact the team at Victoria Hill Real Estate. 📍 Address: 19671 Beach Blvd Ste 100, Huntington Beach, CA 92648 📞 Phone: +1 714-654-1779 🌐 Website: http://www.victoriahillre.com/

Victoria Hill Real Estate Location and 24-Hour Availability

Add Row

Add Row  Add

Add

Write A Comment