Unlocking Your Dream Home: Why the Search for Personalization Matters More Than Ever

Imagine walking into a home that feels as if it was designed specifically for you—the perfect blend of location, layout, and amenities aligning with your unique needs. For many buyers today, this isn’t just a wish; it’s an expectation. The journey to finding such a property can be both thrilling and overwhelming, especially in vibrant, diverse markets where choices seem limitless but personalization feels elusive. Personalized home buying is emerging as the answer, transforming the once generic house hunt into a process tailored for individual preferences and lifestyles.

In the ever-competitive landscape of real estate, one-size-fits-all solutions no longer suffice. With an increasing demand for customization and neighborhood-specific expertise, more buyers are seeking representation that goes beyond listing sheets and open houses. They want an expert who understands not just the market, but their personal story—someone who takes the time to listen, assess, and strategize for their unique vision. Understanding the ins and outs of personalized home buying is essential for anyone hoping to make a purposeful investment, avoid costly missteps, and secure a property that truly feels like home.

This article uncovers the strategies and deeper value behind truly personalized home buying experiences, peeling back the curtain on professional methods and approaches that can make all the difference for buyers at every stage. If you’re contemplating a move, or simply curious about what a truly bespoke approach to real estate looks like, read on to find out how this philosophy not only eases the buying process but elevates it into something far more rewarding.

Transforming Expectations: How Personalized Home Buying Sets a New Standard in Real Estate

Personalized home buying is more than just matching a buyer’s budget with a property—it’s the art and science of aligning real-world options with a buyer’s deepest priorities. This approach integrates MLS listings and customizable search tools with an expert’s knowledge of local nuances, community cultures, and hidden opportunities in neighborhoods like those found in Huntington Beach, Costa Mesa, or Seal Beach. As a result, buyers enjoy a targeted, time-efficient process that turns the daunting task of finding a home into a curated journey that saves time, reduces stress, and avoids the pitfalls of compromise.

Those who misunderstand or underestimate the value of personalization risk more than inconvenience—they can end up with ill-fitting homes, hidden headaches, or missed financial advantages. Knowing exactly what you want is just the starting point; having an experienced partner to guide you through dynamic markets, prepare winning offers, and advocate for your interests can mean the difference between settling for less and arriving at a home that feels unmistakably yours. Failure to recognize these nuances may result in regretful decisions, higher costs, or a protracted search, highlighting the critical importance of working with professionals who prioritize your individuality throughout the process.

In real estate, every client’s situation is distinct—whether you’re relocating for work, seeking a family-friendly neighborhood, or investing in a coastal retreat. Personalized home buying recognizes this diversity, treating every client’s goal as unique and deserving of thoughtful, knowledgeable attention. The stakes are high; homes shape lives, anchor communities, and serve as the backdrop for our most important milestones. Choosing a personalized process in home buying isn’t an extravagance—it’s an essential step toward a secure, satisfying future.

The Real-World Payoff: Why a Personalized Home Buying Experience Changes Everything

Working with experts who champion personalized home buying goes beyond checking boxes on a wish list; it forges a partnership where your goals lead the way. The Scott J. Miller Team exemplifies this with their one-on-one approach, ensuring clients are guided through every stage—from the initial needs assessment to closing day. Their process starts with an in-depth conversation to uncover not just what you want, but why you want it, then crafts a strategy uniquely matched to your priorities. This method brings real, practical benefits: fewer wasted hours viewing unsuitable homes, more confidence when navigating offers, and a sense of empowerment throughout the journey.

An essential advantage comes from harnessing powerful, customizable search tools paired with deep local insights. These tools allow for real-time access to the full MLS, while expertise in neighborhoods across Orange County and L.A. ensures your search is targeted to both where and how you want to live. Whether envisioning a beachside escape, an investment opportunity, or a forever family residence, a personalized approach aligns market realities with your vision, making your search more efficient and ultimately more successful. By focusing on both the tangible and intangible aspects of homeownership, the process reduces stress and increases overall satisfaction.

Ultimately, the outcome of a personalized home buying experience is not just about the property acquired but the journey itself. Buyers report higher levels of confidence and contentment, empowered by both market education and advocacy. Aligning each step with your unique timeline, lifestyle, and financial plan ensures that when the process ends, you find yourself not just holding keys but feeling truly at home.

Community Matters: How Hyperlocal Focus Shapes the Perfect Home Search

The foundation of successful personalized home buying lies in the ability to match individual needs with the character of specific communities. Orange County and Los Angeles offer a mosaic of neighborhoods, each with its own lifestyle and amenities—from the serenity of Huntington Beach’s SummerLane to the vibrant streets of Costa Mesa or the coastal charm of Seal Beach and Newport Beach. Local expertise isn’t just about knowing what’s on the market; it’s about understanding the culture, schools, recreation, and investment opportunities that make one neighborhood a better fit than another for a particular buyer.

By leveraging a community-focused approach, buyers gain access to nuanced insights that go well beyond listing photos. It means information on emerging trends, renovation potentials, coastal lifestyle perks, and deeper context on what it really feels like to live in a chosen area. For those moving to a new city, this support is invaluable: it ensures not just a smart investment but a smooth transition and a quick sense of belonging from day one.

Tech-Driven Tools Meet Human Insight: Maximizing Every Step of Your Search

In today’s rapidly-evolving market, technology is a powerful enabler of personalized home buying—but its real impact is realized when fused with expert guidance. The home search tools available from skilled realtors allow clients to filter MLS listings based on personal criteria in real time, drastically narrowing the field to properties that genuinely fit their lifestyles. Yet, these digital advances are only truly effective when supported by seasoned agents who interpret data trends, provide objective advice during negotiations, and anticipate challenges before they arise.

The result is a buying process that is both data-rich and deeply human: buyers remain in control of their journey while benefiting from an advocate’s experience. Such a blend means smarter offers, strategic timing, and access to exclusive or off-market opportunities—all factors that can make a major difference in today’s competitive coastal markets.

Building Confidence: How Market Education Shapes Successful Homeowners

An often underestimated facet of personalized home buying is the emphasis on market education. It’s not just about touring homes or reviewing listings—it’s about equipping buyers with a clear understanding of value, negotiation tactics, and long-term trends. Agents committed to education demystify the process, helping clients discern where their budget goes furthest and what compromises actually matter. This level of guidance leads to smarter, more empowered decisions, decreasing the odds of buyer’s remorse and increasing satisfaction years after the sale.

Knowledge is particularly powerful when moving to a new area, where local nuances affect everything from home values to quality of life. Professional teams draw from decades of combined experience and collaborative knowledge, sharing insights that help buyers feel like experts in their own right. The outcome is a smoother process, less stress, and a stronger start to life in a new home.

Scott J. Miller Team’s Model: Personalization, Partnership, and Proven Results

The Scott J. Miller Team emphasizes that personalized home buying is the core of their philosophy and approach. This mindset is built on partnership—forming lasting relationships with clients rather than pursuing transactional outcomes. With over 50 years of combined experience and a commitment to individualized service, the team guides buyers at every stage through a collaborative strategy session that uncovers not only needs and preferences, but also dreams and potential future plans. This dedicated, one-on-one approach is reinforced by in-depth local knowledge, particularly in the distinct and sought-after coastal communities of Orange County and L.A.

What sets this team apart is a proactive blend of technology and human insight—using customizable search tools, robust marketing, and analytical skills honed over years of real estate investment and business experience. The philosophy is simple but impactful: by really listening, adapting, and delivering world-class service combined with advanced tools, clients achieve the best possible outcomes. Buyers benefit from support that doesn’t end at closing, but continues as part of a trusted network deeply invested in their long-term satisfaction and financial wellbeing.

Real Stories, Real Results: A Homebuyer Shares Their Journey

One of the most powerful ways to understand the value of personalized home buying is to hear it directly from those who have experienced it. Here’s how one client described their recent journey:

My husband and I were in a unique situation and Scott walked us through the whole process beginning to end. He met our needs and kept us on track and to stay in our budget which I very much appreciated and we are now in a beautiful forever home. All the people he recommended to us from the inspector to movers were wonderful. I would recommend Scott to anyone that I know who is selling or buying a home.

This testimonial highlights a central truth: the search may start with a wish list, but success is achieved through trust, effective guidance, and solutions created just for you. Every homebuyer’s experience is different, but those who embrace a personalized process often discover outcomes exceeding their expectations—secure in the knowledge that every step has been informed by expertise and genuine care.

Personalized Home Buying as a Transformative Investment

The value of personalized home buying reaches far beyond just acquiring property—it’s about achieving the confidence, peace of mind, and satisfaction that come from having your true needs met. In today’s landscape, working with advisors committed to personalization isn’t a luxury, but a smart strategy for navigating competitive environments, avoiding costly mistakes, and making informed decisions that last. Drawing from decades of expertise and a deep respect for client individuality, the personalized approach championed by experts like Scott J. Miller raises the standard for what buyers can expect in Southern California and beyond.

Whether you’re a first-time buyer or searching for your next move along the coast, the path to success begins by demanding more from your real estate experience. With personalized home buying, every decision is informed, every process is streamlined, and every outcome is designed to fit the unique story you want your next home to tell.

Contact the Experts at Scott J. Miller | Real Estate Agent in Huntington Beach CA

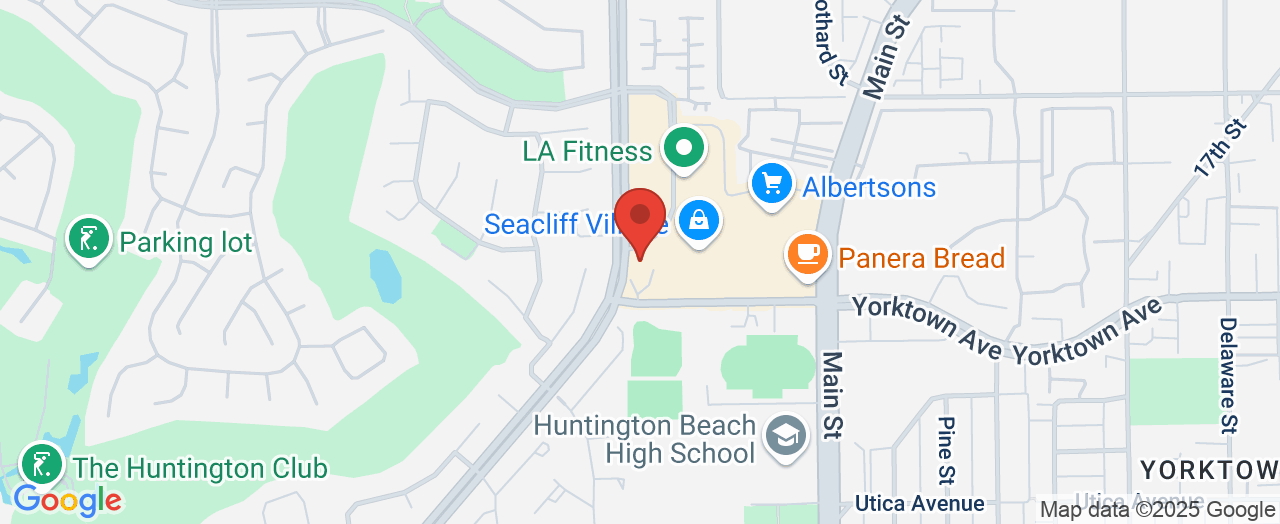

If you’d like to learn more about how personalized home buying could benefit your real estate journey, contact the team at Scott J. Miller | Real Estate Agent in Huntington Beach CA. 📍 Address: 19440 Goldenwest St, Huntington Beach, CA 92648 📞 Phone: +1 714-801-2111 🌐 Website: http://www.realestatebyscottmiller.com/

Scott J. Miller | Real Estate Agent in Huntington Beach CA Location and Availability

📅 Monday: Open 24 hours

📅 Tuesday: Open 24 hours

📅 Wednesday: Open 24 hours

📅 Thursday: Open 24 hours

📅 Friday: Open 24 hours

📅 Saturday: Open 24 hours

📅 Sunday: Open 24 hours

Add Row

Add Row  Add

Add

Write A Comment