Unlocking the Mystery: Why Multi-Family Property Management Can Make or Break Your Investment

Owning a multi-family property is often touted as a smart way to build wealth, but what happens when daily hassles, tenant turnover, and mounting expenses start turning your investment dream into a management nightmare? According to industry analyses, an overwhelming number of multi-family property owners face challenges that not only erode profitability but also chip away at valuable personal time and peace of mind. From the complexity of communicating with multiple tenants to upkeep, compliance, rent collection, and handling emergencies, the promise of passive income is anything but passive for many investors.

When it comes to multi-family property management, the stakes are amplified. Everything—maintenance, accounting, tenant relations, legal compliance—multiplies right alongside the number of units. A single oversight can cascade into costly repairs, legal headaches, or lost rental income. Yet, many owners are left navigating this intricate landscape without clear guidance or efficient processes, risking more than just their returns. This is where understanding the full scope of professional property management becomes not just helpful, but essential. This article will walk you through the true impact of expert management services—why they matter, what can go wrong without them, and how the right strategies can dramatically change your investment outcomes for the better.

Beyond Collecting Rent: What Multi-Family Property Management Really Entails

Multi-family property management is much more than simply collecting rent from several tenants. At its core, it’s a complex, strategic discipline that oversees the efficient operation of apartment buildings, duplexes, triplexes, and other multi-residence properties. The responsibilities range from tenant screening, legal compliance, and lease administration, to facilities maintenance, rent optimization, and resolving disputes. Embracing a full-service approach means ensuring every technical, financial, and human aspect of the property is operating like a well-oiled machine. Miss any element, and profitability can take an immediate hit.

The stakes are higher with multi-family units because inefficiency can affect multiple households at once, amplifying consequences and exposure for the property owner. For those unfamiliar with modern multi-family property management strategies, the results often include protracted vacancies, unhappy tenants, excess maintenance costs, and even legal disputes. Moreover, inadequate oversight of multi-resident properties can lead to physical decline, lost reputation in the marketplace, and a downward spiral in asset value. For property owners committed to long-term success, learning the full scope and sophistication of what multi-family management entails isn’t optional—it’s vital.

Why Modern Multi-Family Property Management Unlocks Profit, Reduces Stress, and Protects Assets

At the heart of successful real estate investing lies the ability to maximize both return and peace of mind—an outcome that expert-led multi-family property management consistently delivers. AllView Real Estate, for example, exemplifies a modern, comprehensive approach that transforms stress-prone investment experiences into streamlined, profitable ventures. Drawing from their extensive expertise, they have implemented highly sophisticated and tested processes that lift the short-term and long-term performance of every building managed.

The value of robust management extends beyond the basics. Comprehensive oversight guarantees that every unit is well-maintained, vacancies are minimized, rents are regularly collected, and compliance is never left to chance. This all-in approach not only secures your investment from risk but also enables owners to enjoy a portfolio that truly operates efficiently. By leveraging proven strategies, investors see direct improvements in rental income and a dramatic reduction in time-consuming headaches. The cumulative effect? Property owners spend less time putting out fires and more time reaping the rewards of a well-performing asset.

The Evolution of Multi-Family Property Management: From Reactive to Proactive Solutions

The world of property management has shifted significantly in recent years, moving away from a reactive model—where problems are simply addressed as they arise—to a far more proactive one. Gone are the days when hands-off management was enough; today’s property environment demands foresight and initiative. Industry leaders now recognize that anticipating tenant needs, scheduling preventative maintenance, and frequently evaluating rental rates are all key factors in staying ahead of the market.

Where issues once lingered and diminished property value, contemporary multi-family property management now hinges on systematized processes and data-driven decision making. Firms that have embraced this approach—such as offering annual property income and expense reports and delivering timely communications—allow investors to maintain vital clarity on the health and performance of their assets. This shift enables investors to make informed, mission-critical decisions and adapt quickly in a competitive landscape. For anyone still operating with last-decade management tactics, there’s never been a more urgent moment to upgrade.

Strategic Investment Consulting: The Hidden Asset in Multi-Family Real Estate

An often-overlooked advantage within multi-family property management is the layer of investment consulting that experienced firms can offer. Strategic guidance goes well beyond operational duties; it extends into helping owners identify lucrative opportunities, avoid market pitfalls, and implement targeted improvements that drive property value. When this service is integrated with property management, it creates a feedback loop where your investments continuously improve, adapt, and outperform market averages.

By offering insights grounded in thorough financial analysis and market trends, top-tier management providers help owners make the right moves at the right time. Whether it’s deciding if a renovation will yield higher rents, analyzing which units require attention, or simply clarifying the next best move, this consultative edge empowers property owners. In the rapidly changing world of multi-family real estate, such partnership ensures not just survival, but sustainable growth and leadership in a competitive field.

How Comprehensive Service Protects Owners from Costly Surprises

A common pain point for multi-family property owners is the unpredictability of emergencies and hidden costs. Experienced property management services address this by implementing prevention-driven protocols—routine inspections, responsive maintenance, and clear communication lines with tenants. This attention to detail prevents small issues from spiraling into major expenses and extends the lifespan of critical systems within the property.

Moreover, modern management platforms often include robust accounting and transparent reporting tools. Objective, timely statements on rental income and expenditure simplify tax preparation and financial oversight. When owners receive annual summaries and the necessary tax documents with ease, a process once fraught with anxiety becomes straightforward and manageable. These layers of services not only keep properties running smoothly but also instill confidence and trust throughout the investment relationship.

AllView Real Estate’s Leadership Philosophy in Multi-Family Property Management

AllView Real Estate operates with a philosophy grounded in trust, expertise, and a deeply invested approach to client success. Their mission centers on personalizing property management services, understanding that every client’s needs, goals, and portfolios are unique. This belief translates into comprehensive, all-inclusive solutions that cover every facet—allowing clients to hand over the complexities while retaining full confidence in the process.

The team is committed to reducing risk and stress for property owners by combining detailed market knowledge with a consultative mindset. By conducting thorough evaluations, constant communication, and regular customized reporting, AllView consistently delivers outcomes that prioritize both profitability and protection. Their approach sets a new standard in the industry—where efficiency is matched by transparency and long-term thinking outpaces short-term fixes. For owners seeking not only management but genuine stewardship, this philosophy is a major differentiator.

Precision is another pillar of their work: process-driven attention to maximized rental value, careful tenant selection, and ongoing asset analysis all combine to ensure each property reaches its fullest potential. With this fusion of innovation, reliability, and human insight, AllView Real Estate embodies leadership in the evolving field of multi-family property management.

Real Results: Multi-Family Property Owners Share Their Experience

The proof of effective multi-family property management is found in the real-world experiences of those who rely on it for their success. Owners and tenants alike often describe exactly how responsive, efficient, and thorough management makes a measurable difference. One review showcases this impact on a very practical level:

I've been searching for a rental property for 2 months, and during this process, no one person or agency, provided the level of customer service that AllView Real Estate has. They handled my application process extremely efficiently and quick. Their representatives were kind and patient with me, as I forgot to upload a few documents. Within 48 hours, I had an answer from them AND I was signing documents for my new rental. I would highly recommend their services to any landlord. They're an excellent property management company. I look forward to working with them.

For property owners determined to protect their investment—while reducing their own workload and worry—these stories provide a blueprint for what to expect. When management solves problems quickly, communicates transparently, and prioritizes owner results, the difference is not just noticeable; it’s transformative. Taking the next step to engage professional assistance could mark the turning point between daily struggles and long-term prosperity in your multi-family property journey.

What Smarter Multi-Family Property Management Means for Your Real Estate Future

Multi-family property management has transformed from a background necessity into a strategic driver of investment success. Strong, process-driven management not only relieves owners from risk and stress but lays the groundwork for continual growth and higher returns. Expert direction, such as the all-encompassing solutions established by AllView Real Estate, elevates both the performance of properties and the experience of ownership itself. For anyone looking to optimize their position in the competitive housing market, now is the ideal time to reconsider your approach, reassess your management strategy, and unlock the hidden profits in your real estate portfolio through purposeful, professional multi-family property management.

Property owners who embrace these philosophies find themselves moving away from overwhelm and towards a future defined by stability and profit. With the right guidance, multi-family property management is not just an obligation—but a strategic advantage.

Contact the Experts at AllView Real Estate

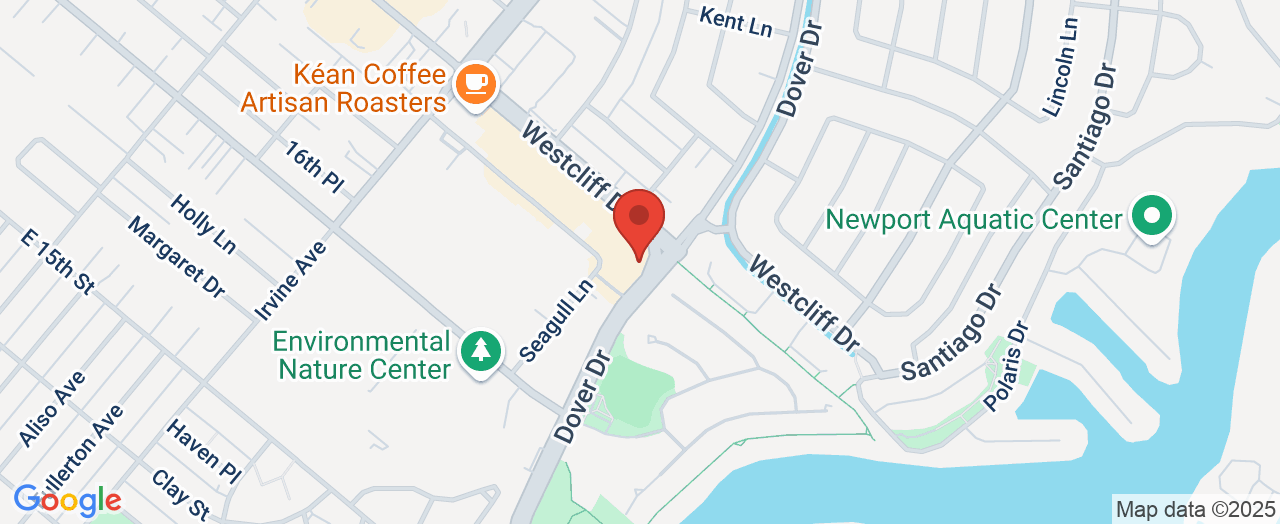

If you’d like to learn more about how multi-family property management could benefit your real estate investments, contact the team at AllView Real Estate. 📍 Address: 1501 Westcliff Dr, Newport Beach, CA 92660 📞 Phone: +1 949-400-4275 🌐 Website: http://allviewrealestate.com/

AllView Real Estate Location and Availability

Add Row

Add Row  Add

Add

Write A Comment