Why Navigating Real Estate Can Feel Impossible—and What You Need to Know First

With the rapid shifts in today’s housing market, millions of Americans are left feeling anxious, unsure, or outright overwhelmed by the process of buying or selling a home. Every year, headlines tout record prices, shifting interest rates, and fierce bidding wars. But behind those headlines are real people with real goals—and real questions. How do you find the right home? How can you be confident you’re selling for the best possible value? What makes a skilled real estate agent indispensable in the age of online listings and instant offers?

The truth is, real estate isn’t just about properties and price tags—it’s about life transitions, protecting investments, and building a future. Every decision can have lasting effects for families and finances. Yet the process often feels shrouded in jargon, with pitfalls waiting for the unprepared. For both first-time buyers and seasoned sellers alike, understanding the realities of real estate is essential to making confident, stress-free decisions. This article unpacks why mastering the real estate process matters now more than ever and outlines the expert-backed principles critical to success.

What Everyone Gets Wrong About Real Estate—and the Secrets to Getting It Right

At its core, real estate is more than just buying or selling land or houses—it’s a complex interplay of local markets, human psychology, negotiation, and timing. While many believe the process is as easy as browsing listings online and making an offer, the reality is much more nuanced. Real estate is deeply influenced by market trends, community dynamics, and buyer behavior. Missing these intricacies can mean missed opportunities or expensive mistakes. For example, with luxury real estate seeing unprecedented volume in Southern California, properties can move at a dizzying pace, leaving unprepared buyers or sellers behind.

A bigger risk is failing to recognize just how important expertise, communication, and tailored strategy are to successful real estate outcomes. Too often, people navigate these high-stakes transactions solo, only to face appraisal surprises, failed inspections, or underwhelming offers. The consequences aren’t just financial; they can impact peace of mind, family plans, and long-term investments. In such a competitive and evolved landscape, understanding the core strategies and key market forces—and having a team that truly understands real estate—makes all the difference. Learning these truths upfront can save time, money, and regret down the road.

Why Choosing Real Estate Experts Produces Predictable, Record-Breaking Results

Industry leaders bring peace of mind to one of the most stressful and consequential transactions in life. With over $6 billion in sales volume since 2013 and a spot in the top quarter of 1% of agents nationwide, Tim Smith Real Estate Group stands as an expert contributor in the field. Their approach is rooted in delivering "record-breaking results and a perfect and predictable experience" for clients, not just in Orange County but across global real estate markets.

This commitment to a tailored approach means clients gain access to world-class marketing, data-driven pricing, and seamless communication at every touchpoint. By recognizing that every client’s needs are unique—from luxury waterfront listings to first-home purchases—real estate experts offer both peace of mind and measurable financial benefits. The end result: swift sales, strong negotiations, and positive, long-lasting outcomes for buyers and sellers alike.

Real estate isn’t just about the transaction—it’s about having confidence, clarity, and a sense of control over an unfamiliar process. Relying on expertise, clients are empowered to make smarter decisions, avoid costly mistakes, and maximize their opportunities in any market condition. In a landscape where mistakes are expensive and competition is fierce, real expertise is the most valuable advantage.

The Power of Expertise: How Real Estate Knowledge Protects What Matters Most

Most real estate pitfalls stem from a lack of information or improper guidance. The value of comprehensive, in-depth market knowledge simply cannot be overstated. In the real world, this goes far beyond understanding square footage or curb appeal. It means navigating local regulations, tracking shifting buyer trends, and anticipating the obstacles that can derail deals for even experienced homeowners. For investors, the consequences are multiplied—an overlooked nuance can transform a promising asset into a painful liability.

From pricing strategies that attract qualified buyers to staging techniques that elevate a home’s perceived value, every detail matters. Tim Smith Real Estate Group leverages over 300 years of combined industry experience, using a team model where each professional plays a vital, specialized role. There is no room for guesswork; each decision is based on real data, strategic insight, and a proven formula combining creative marketing with business-minded analysis. This dedication to knowledge and teamwork is why clients report record-high sales, quick closings, and seamless transitions.

Modern Marketing: Why Real Estate Success Demands More Than an MLS Listing

The evolution of digital and print marketing in real estate has been staggering. It’s not enough to push a listing to the basic real estate portals and hope for the best. Today’s buyers—and the highest-paying buyers in particular—are online, savvy, and searching in new ways. The Tim Smith Real Estate Group has responded by blending cutting-edge digital advertising with sophisticated print materials and proprietary tools, maximizing visibility for every property. Their strategies include targeted campaigns, dynamic social media outreach, and constant engagement tracking to foster genuine interest.

The strategic blend of art and science in these marketing efforts elevates properties above the clutter, reaching the right buyers at the right time with the right message. The best agents aren’t just selling homes—they’re creating stories, fueling competition, and making every home stand out in a crowded market. The return on this approach is visible in the numbers: swift sales at top dollar, record prices per square foot, and offers that come in multiples, even in shifting markets.

Teamwork as a Winning Formula: Behind the Scenes of Industry Leaders

The real estate process, though individual in outcome, is best executed as a team sport. The most successful real estate transactions aren’t merely the result of one star agent, but a network of specialized professionals, each with defined and critical skills. At Tim Smith Real Estate Group, collaboration among top agents, creative marketers, detailed-oriented transaction coordinators, and market-savvy negotiators forms a "well-oiled machine" drawing from 300+ years of experience.

Such a team model removes friction, ensures every detail is managed proactively, and makes complex transactions feel seamless for clients. This underlying philosophy—that “who you work with matters”—isn’t just a catchphrase. It’s a disciplined approach that transforms challenging processes into effortless ones. Clients note the difference: stress disappears, obstacles are handled quickly, and every member has a role in delivering first-class service and record-breaking results.

Tim Smith Real Estate Group’s Philosophy: Delivering Predictable Outcomes through Inspired Service

Underlying the group’s reputation is a mission built on delivering a “perfect and predictable experience” to clients. This ethos resonates in every transaction and every piece of their communication. By fusing inspired and relevant marketing with exceptional service, the group stays ahead of industry trends—setting, rather than following, local market standards. Each team member brings not only industry experience but diverse backgrounds in entrepreneurship, design, and strategy, enabling a unique ability to tackle complex property transactions and investments.

Commitment to first-class service isn’t limited to high sales volumes or luxury properties. It extends to every relationship, every communication, and every strategy designed for clients at every price point. Decision-making is informed by real-time data and a deep understanding of both global and hyper-local trends. The result is an unwavering consistency: clients know what to expect, every time. This transparency, coupled with forward-thinking marketing and absolute integrity, elevates the experience and protects client interests at every turn.

By embodying the belief that “who you work with matters,” the Tim Smith Real Estate Group leads by example, establishing trust and accountability that continually redefines what’s possible in real estate. Their proactive, detail-driven approach transforms industry complexity into clarity, comfort, and measurable success for every client they serve.

How Success Stories Prove the Power of Expert Real Estate Guidance

One of the most compelling ways to appreciate the impact of skilled real estate professionals is through the voices of those who have lived the journey. Real people, navigating real transitions, discover the true difference expertise can make—especially when selling or buying a home is more than just a financial transaction. Here’s how one recent experience illustrates this process:

I met Tim Smith in 2017 when he helped me sell my property in Corona Del Mar. He and his group were efficient, knowledgeable of the market, and were able to protect my interests to net the highest proceeds. So when it was time to sell my Long Beach property, I could not think of a better realtor to list my home than Tim Smith. Once again his team exceeded all expectations and in particular Maleny Rodriguez, and Andy Dane Carter whose meticulous attention to details, and market knowledge, led to an unprecedented record for the highest price per square foot in the neighborhood. For example, the one and only open house yielded 170 prospects, proof of their marketing genius. Within two days we received multiple offers, and in the next month we closed escrow effortlessly. Without a doubt, the Tim Smith Group is a well-oiled machine, every member has a role, and the execution is flawless. Kudos, Tim Smith and his group.

This review illustrates how a well-organized team, exceptional market insight, and strategic execution can lead to outcomes that would be near impossible to achieve alone. For anyone considering their next real estate move, these firsthand experiences affirm that the path to top-notch results is paved by working with those whose expertise and commitment are unparalleled.

Why Real Estate Mastery Is the Key to Confident Home Transitions

In a market defined by constant flux, truly understanding real estate—its processes, pitfalls, and potential—is what separates successful moves from stressful ones. Expert guidance not only reduces uncertainty but also unlocks hidden value, shortens timelines, and increases outcomes for buyers, sellers, and investors. The Tim Smith Real Estate Group’s deep-rooted commitment to transparent strategy, inspired marketing, and first-class service highlights what’s possible when industry leadership meets genuine care for clients’ outcomes.

Recognizing that “who you work with matters” isn’t just industry wisdom—it’s a lesson learned by every satisfied client and confirmed by every record-breaking sale. For those facing life’s big transitions, knowledge and expertise in real estate will remain their most powerful ally, paving the way toward bright, secure, and confident futures.

Contact the Experts at Tim Smith Real Estate Group

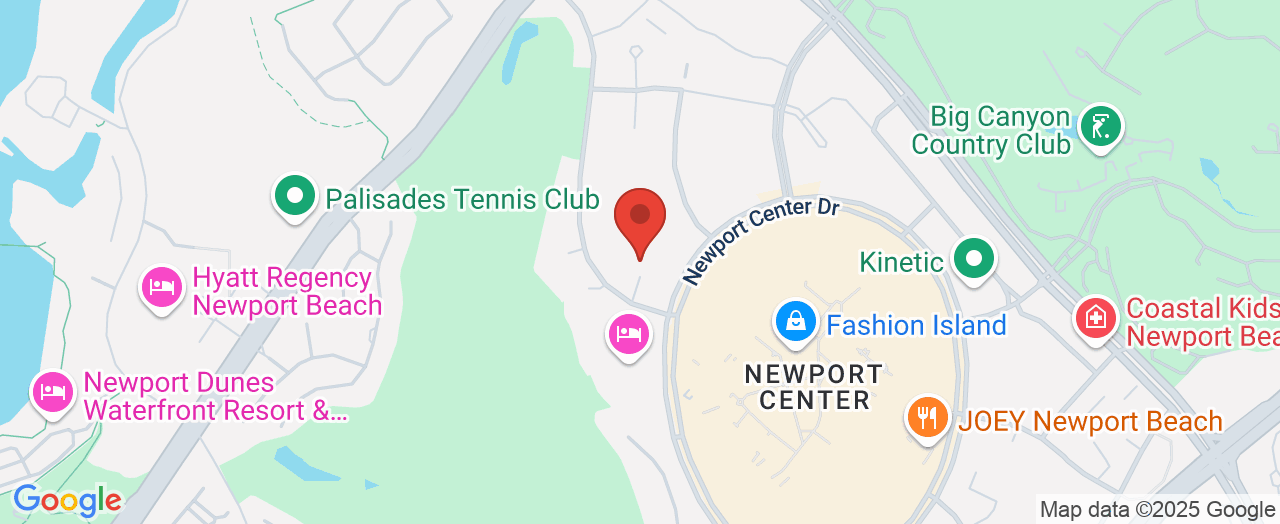

If you’d like to learn more about how real estate expertise could benefit your next home purchase, sale, or investment, contact the team at Tim Smith Real Estate Group. 📍 Address: 840 Newport Center Dr #100, Newport Beach, CA 92660, USA 📞 Phone: +1 949-478-2295 🌐 Website: https://timsmithrealestategroup.com/

Tim Smith Real Estate Group: Location and Availability

🕒 Hours of Operation:📅 Monday: 8:30 AM – 5:30 PM📅 Tuesday: 8:30 AM – 5:30 PM📅 Wednesday: 8:30 AM – 5:30 PM📅 Thursday: 8:30 AM – 5:30 PM📅 Friday: 8:30 AM – 5:30 PM📅 Saturday: ❌ Closed📅 Sunday: ❌ Closed

Add Row

Add Row  Add

Add

Write A Comment