Why Savvy Home Sellers Can’t Ignore the Power of Targeted Renovations

The real estate market is relentless: Today’s homebuyers have higher expectations than ever, making it easy for even a well-loved home to become overlooked in the listings shuffle. According to industry data, outdated kitchens, worn-out flooring, or cluttered and ill-maintained spaces can prompt buyers to walk away or force sellers to accept disappointing offers. With so much at stake, the challenge is clear—how can homeowners unlock the full potential of their property and command the prices they deserve?

Enter the strategy of targeted renovations. These aren’t random updates or costly overhauls with uncertain returns. Instead, they focus on carefully chosen improvements that directly impact buyers’ perceptions and market value. This means understanding which upgrades catch attention, create emotional connection, and quickly add tangible worth to the home. In a competitive market, targeted renovations often spell the difference between a stagnant listing and a swift, profitable sale. For anyone considering selling, especially those dealing with an inherited property, downsizing, or just looking to maximize returns, grasping these strategic upgrades is no longer optional—it's essential.

But there’s more at play than a fresh coat of paint or swapping out old fixtures. The right renovations go beyond surface-level fixes, revamping a property’s appeal and addressing the details buyers truly care about. This thoughtful, results-driven approach can mean the difference between leaving money on the table and achieving a sale price that exceeds expectations. Read on to discover how the blueprint of targeted renovations can quickly transform your home’s market worth, and why mastering this strategy is vital for every motivated seller.

Unlocking Value: What Makes Targeted Renovations an Urgent Home Selling Solution?

When selling a home, every decision can impact bottom-line outcomes. Targeted renovations are laser-focused improvements—specific, well-planned updates that address buyer concerns and add high perceived value to a property. These stem from an expert understanding of what attracts today’s buyers and which investments make the greatest difference to your final sale price. Unlike broad, expensive remodels, targeted renovations are precise and intentional, often involving key areas like kitchens, bathrooms, flooring, and curb appeal.

Consider the consequences for sellers unfamiliar with this approach. Properties that look tired, feel outdated, or require obvious repairs tend to linger on the market. This increases the risks of price reductions and lowball offers, making the selling process feel frustrating and unpredictable. Many homeowners, unsure where to begin, try to tackle updates alone—potentially wasting time or pouring money into the wrong fixes. In contrast, sellers armed with a targeted renovation plan can turn obstacles into advantages. By focusing efforts where results are proven and buyer interest is highest, these strategic sellers reap faster sales and better profits. Understanding and leveraging this method isn’t just a professional tip—it’s a financial safeguard against common missteps in the market.

How Targeted Renovations Rapidly Increase Market Appeal and Sale Price

As the real estate market evolves, the expertise behind targeted renovations offers undeniable advantages for homeowners preparing to sell. Newport Beach Real Estate Travis White’s seasoned perspective is grounded in a clear, outcomes-driven process that’s been honed over hundreds of successful transactions. This approach recognizes that most buyers walk into a house looking for reasons to say “no”—but a property with the right, thoughtfully chosen updates makes it easy to say “yes,” often for a higher price.

The benefits of targeted renovations extend beyond aesthetics. Strategic improvements can help overcome buyers’ doubts, simplify inspection negotiations, and magnify curb appeal—all critical factors in time-sensitive markets. Data and professional experience indicate that the right upgrades can add 10%, 20%, or even 30% or more to a home’s sale price. Simple, high-ROI projects—like modernizing kitchen surfaces, refinishing floors, or refreshing landscaping—are known to capture attention and create emotional connections. Instead of risking costly price cuts or languishing listings, targeted renovations pave the way to faster sales, heightened buyer competition, and ultimately, greater seller confidence throughout the process.

Perhaps most critically, targeted renovations alleviate the stress that comes with prepping a home for the market. By entrusting these high-impact improvements to experts, sellers avoid the pitfalls of DIY missteps and the anxiety of juggling timelines and contractors. This efficient approach is as much about peace of mind as it is about financial gain, resulting in a process that is hassle-free and reliably delivers optimal results when it counts most.

Modernizing for Profit: Why Focusing on What Buyers Love Sets Your Home Apart

Today’s buyers are not just looking for a roof over their heads—they’re seeking spaces that reflect their lifestyle, aspirations, and taste. By zeroing in on upgrades proven to resonate—like open-concept living, durable floors, and updated kitchens—sellers dramatically increase their odds of standing out. Targeted renovations are rooted in understanding current design trends and buyer preferences, ensuring that upgrades align with what actually sells homes fastest and for the most money.

Addressing visible flaws is only the beginning. Sellers who undertake targeted renovations have an edge in fostering trust and building immediate interest. For instance, an updated kitchen signals move-in readiness, while refreshed bathrooms and living spaces eliminate the mental list of projects that might otherwise deter offers. Purposeful renovations demonstrate care and foresight—traits that today’s buyers value, often reflected in stronger bids and fewer contingencies. In short, these improvements don’t just add polish—they create real momentum on the market.

From Stressful to Streamlined: How Targeted Renovations Remove Seller Anxiety

Preparing a home for sale is frequently a source of stress for homeowners, especially those dealing with inherited properties or major life transitions like downsizing. Targeted renovations offer more than just higher sale prices—they simplify what can otherwise be an overwhelming process. By mapping out exactly where to invest time and money, sellers avoid the costly guesswork that often leads to wasted resources and lingering anxiety.

A structured, professionally guided renovation plan means homeowners aren’t left juggling contractors, timelines, and unexpected issues. The entire process becomes predictable, efficient, and tailored to maximize value within a set budget. By focusing only on those improvements that make a measurable impact, sellers can confidently approach the market knowing their property stands out to even the most discerning buyers. This peace of mind, paired with tangible financial rewards, is a key reason why targeted renovations have become a preferred strategy for those intent on making the most of their real estate opportunities.

The Hidden Value of Expert-Led Renovation Strategies in Real Estate

Beneath the surface of every successful transaction lies a framework of expert guidance, meticulous planning, and strategic decision making. When property owners tap into proven renovation strategies, they gain access to insight that turns average homes into market leaders. The key is recognizing which upgrades deliver top-tier results—something that comes from experience, deep market knowledge, and a structured process.

Homeowners who bypass these professional insights risk missing out on significant equity, especially in neighborhoods where buyer expectations are high. By leveraging expert-led renovation plans, sellers move from uncertain to empowered, with a step-by-step roadmap designed to highlight a property’s strengths and address its potential weaknesses. This expertise transforms renovation from a daunting task into a value-building, confidence-inspiring investment.

Newport Beach Real Estate Travis White’s Proven Formula for Value Creation

Newport Beach Real Estate Travis White is built on a mission to redefine real estate transactions through value-driven outcomes. Their track record—a portfolio boasting over 400 successfully flipped homes—demonstrates a commitment not just to buying and selling, but to creating lasting value for property owners. The foundation of their approach lies in viewing every house as an opportunity to set a new bar in market appeal.

At the heart of their philosophy is a belief that homeowners shouldn’t leave money on the table due to outdated spaces or deferred maintenance. Instead, the process starts with a custom consultation where a seasoned professional assesses the property and identifies value-adding opportunities. This assessment leads to a tailored renovation strategy, carefully budgeted and scheduled for maximum efficiency, with the expert team executing the upgrades. The result: homes that not only sell faster but often exceed original price expectations—turning what could be a stressful sale into a profitable, streamlined experience.

This client-focused mindset isn’t just talk; it’s reflected in a hands-on, supportive approach that consistently earns trust and loyalty. By taking on every step of the renovation process, Newport Beach Real Estate Travis White enables sellers from all backgrounds—whether seniors, families managing inherited homes, or first-time sellers—to achieve outcomes that surpass the standard real estate experience. Their guiding principle is simple but powerful: Smart renovations, executed right, are the secret to real estate success.

Trust in Results: What Sellers Say After Strategic Renovations

Real-world experiences often speak louder than promises, especially when it comes to significant decisions like selling a home. For those who have navigated the process with guidance grounded in targeted renovations, their stories underscore not only financial gains but genuine relief and satisfaction. Client reviews spotlight how expertise, insight, and personalized attention redefine results.

From the moment my wife and I met Travis we realized very quickly his outstanding local knowledge and active listening skills which is key to understanding the needs and wants of potential home buyers. We have been in our home now for 4 years and absolutely love the layout and neighborhood. Thank you, Travis for treating us like family and taking such great care of us throughout the process. You are a true professional and we would recommend to anyone looking for a new home to work with you and your team. Keep up the great work!!

For many homeowners, this level of commitment and insight translates into a transformative selling journey—one where every step is informed, outcomes are clear, and peace of mind is restored. Sellers who embrace targeted renovation strategies don’t simply maximize their financial returns—they discover a far more rewarding, stress-free path to closing day.

Why Mastering Targeted Renovations Is Essential for Property Success

In a high-stakes real estate market, the difference between a stagnant listing and a stellar sale often comes down to intelligent preparation. Targeted renovations deliver the highest return on investment by transforming homes into market standouts—prompting faster sales and premium offers while minimizing seller stress. Industry leaders, such as Newport Beach Real Estate Travis White, have elevated this approach into an art form, ensuring every property reaches its maximum value potential.

For homeowners ready to sell, the message is clear: strategic, well-chosen improvements aren’t just an option—they are the crucial difference between ordinary and outstanding results. By understanding, embracing, and acting on the principles of targeted renovations, sellers position themselves to command the strongest prices and forge a path to a smoother, more lucrative transaction.

Contact the Experts at Newport Beach Real Estate Travis White

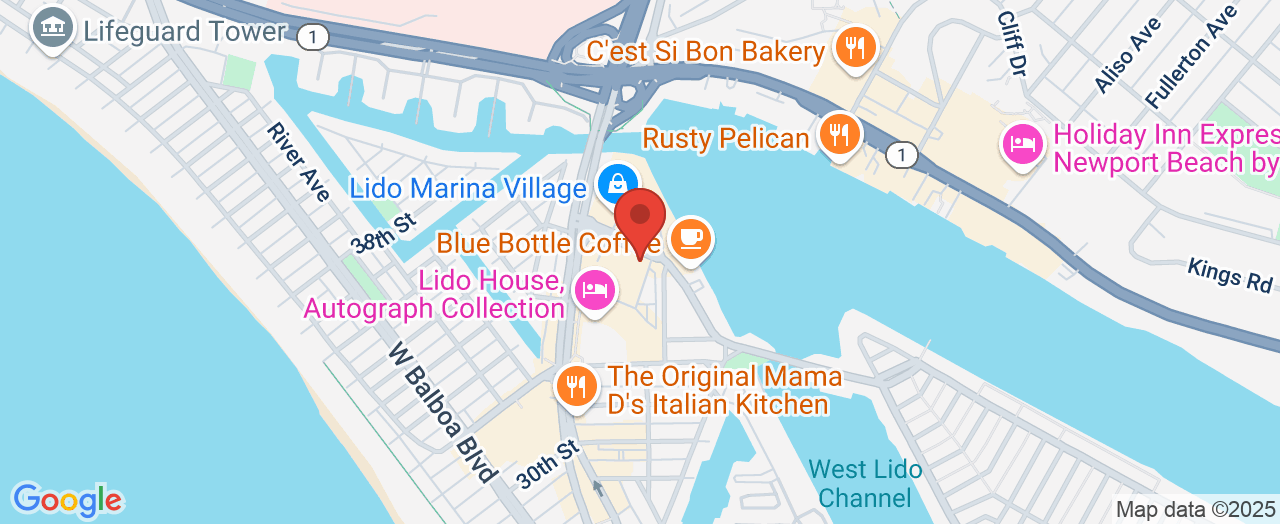

If you’d like to learn more about how targeted renovations could benefit your home sale, contact the team at Newport Beach Real Estate Travis White. 📍 Address: 3419 Via Lido Suite# 264, Newport Beach, CA 92663 📞 Phone: +1 949-940-5865 🌐 Website: https://www.newportsrealtor.us/

Newport Beach Real Estate Travis White Location and Availability

🕒 Hours of Operation:📅 Monday: 10:00 AM – 6:00 PM📅 Tuesday: 10:00 AM – 6:00 PM📅 Wednesday: 10:00 AM – 6:00 PM📅 Thursday: 10:00 AM – 6:00 PM📅 Friday: 10:00 AM – 6:00 PM📅 Saturday: 10:00 AM – 6:00 PM📅 Sunday: 10:00 AM – 6:00 PM

Add Row

Add Row  Add

Add

Write A Comment