Why Local Real Estate Expertise is the Ultimate Edge in the Property Hunt

Consider this: With home values fluctuating daily, neighborhoods evolving rapidly, and competition fiercer than ever, how can buyers and sellers be certain they’re making the right moves? Unfamiliarity with local market trends, neighborhood nuances, and hidden variables can cost thousands—or worse, result in missed opportunities for your dream home. The difference between landing a property that merely meets your needs and securing one that’s truly perfect often comes down to one thing: local real estate expertise.

Whether you’re relocating, downsizing, upgrading, or purchasing your very first home, the importance of hyper-localized knowledge cannot be overstated. Navigating real estate without this insight is a bit like setting sail without a compass: the options can seem endless, but the path forward is unclear. What ends up happening for many? Overpaying, settling for less, or facing regrets long after the sale. For most, real estate is the most significant financial investment they will ever make. Understanding how to leverage local expertise can protect that investment, simplify the process, and transform uncertainty into confidence. Throughout this article, we’ll uncover exactly why local real estate expertise isn’t just helpful—it's essential in building your future.

The Power of Hyper-Local Market Knowledge in Real Estate Success

Local real estate expertise represents an agent’s profound, day-by-day immersion in neighborhoods, school districts, community culture, and shifting market dynamics. This goes far beyond looking up recent sales or scrolling listings online. True local experts have nuanced knowledge about what makes certain streets or blocks unique, understand how timing and pricing shift by micro-market, and can reveal lifestyle opportunities buyers might otherwise overlook. In a place as diverse and sought-after as Orange County, with its oceanfront enclaves, artist communities, and family-friendly neighborhoods, having an ally who truly understands the lay of the land is indispensable.

Too often, buyers rely on generalized searches or agents with only a surface-level familiarity with their target area. The result? Missed opportunities, overpaying for homes with less upside, or settling in an area that doesn’t fit long-term goals or lifestyle preferences. Sellers, too, can misjudge optimal listing prices or effective marketing strategies, leading to longer market times and lower final sale prices. Without deep, local insight, both buyers and sellers expose themselves to avoidable stress and risk. This is precisely why prioritizing local real estate expertise becomes the differentiator for every step, from dreaming to closing.

How Local Real Estate Expertise Fuels Confident Decisions and Exceptional Outcomes

In the heart of Orange County, local real estate expertise is more than a catchphrase—it’s a tangible advantage that shapes every step of the buying or selling journey. By leveraging this depth of knowledge, buyers gain an insider’s view of the neighborhoods, schools, and amenities that best align with their lifestyle, ensuring they don’t simply purchase a house but feel at home from the first day. For sellers, the same nuanced understanding allows for strategic pricing, intelligent staging, and expertly targeted marketing, directly leading to faster transactions and stronger financial results.

Beyond statistics or sales data, it’s the day-to-day immersion in the local community, awareness of off-market opportunities, and well-established relationships with local vendors and service professionals that truly set expert real estate teams apart. This translates into guided property tours that highlight hidden gems, curated recommendations for every aspect of the move, and skillful negotiation to secure not just any deal, but the very best deal. The result? Clients who feel supported at every turn, empowered to make informed decisions, and free to enjoy what matters most—transitioning seamlessly to their next chapter.

From Neighborhood Know-How to Timely Market Moves: The Core Benefits of Local Insight

One of the greatest advantages of working with agents grounded in local real estate expertise is the access to tailored, actionable insights not available on generic listing platforms. These professionals combine years of hands-on experience with instinctive understanding of micro-market trends, ensuring every recommendation is grounded in real, up-to-date facts about the Orange County landscape. For buyers, this means being alerted not only to new listings, but also to subtle factors like future development, local school impacts, or shifting neighborhood dynamics that could influence property value or quality of life in ways that aren’t apparent on paper.

Sellers, too, reap enormous benefits. Strategic pricing informed by granular data, custom marketing that accentuates each property’s unique appeal within its local context, and deep networks that extend reach to the right audiences—all combine to deliver outstanding outcomes. Agents with local focus don’t just show homes; they introduce clients to communities, answer lifestyle questions, and bring imaginative solutions to each client scenario. The result is peace of mind, greater negotiating leverage, and outcomes that match or exceed even the most ambitious goals.

The Hidden Costs of Overlooking Local Real Estate Knowledge

Ignoring the importance of local expertise in real estate isn’t just an oversight—it can be costly. Buyers working with agents lacking deep knowledge often find themselves falling for surface-level perks while missing the underlying factors that will impact long-term satisfaction. This might mean unexpected noise, long commute times, or being distant from the amenities that fit their lifestyle. Sellers, on the other hand, risk mispricing their homes, overlooking valuable staging strategies, or underestimating how hyper-local timing can mean the difference between quick success and months of stress.

Local experts are also equipped to recommend trusted vendors, guide clients through legal complexities, and problem-solve when unexpected challenges arise. In Orange County, with its fast-evolving communities and market dynamics, relying on general knowledge is a shortcut to frustration and lost value. In truth, an investment in local real estate expertise becomes an investment in your own security, satisfaction, and ability to make fully informed decisions that withstand the test of time.

Personalized Service and Community Connection: Making the Process Seamless

One standout characteristic of local real estate experts is their unwavering commitment to providing not just a transaction, but a relationship. By taking the time to understand each client’s unique needs, ambitions, and concerns, these professionals lay the groundwork for trust, communication, and genuine partnership. The result is a customized strategy—whether buying or selling—that reflects the individual’s goals, family dynamics, and preferred lifestyle, rather than shoehorning them into a one-size-fits-all approach.

This personalized service extends well beyond closing. From answering follow-up questions to providing recommendations for local service providers, interior designers, or neighborhood groups, local experts remain a steady resource for clients as they settle into their new routines. The power of this community connection means every client feels truly at home—not just in their property, but in their new environment.

The Annie Clougherty Real Estate Team: A Unique Approach Rooted in Orange County’s Communities

The philosophy guiding Annie Clougherty Real Estate- Newport Beach and Coastal Orange County is built on providing luxury-level service at every price point, anchored by an unshakeable commitment to communication, transparency, and community involvement. Drawing from over twenty years of in-depth local experience, the team’s methodology focuses on providing personalized consultations to deeply understand each client’s lifestyle and long-term vision before any strategy or home search begins.

What sets this approach apart is the belief that real estate is fundamentally about people, not just properties. The team’s members live and raise their own families in Orange County, granting not just market knowledge but personal insight into the neighborhoods, schools, and lifestyle opportunities that define the area. This local immersion means clients receive relevant, up-to-the-moment guidance—whether it’s a curated list of dream homes tailored to their tastes, or strategic advice to secure top dollar on a sale.

Annie Clougherty Real Estate employs a comprehensive, white-glove process, seen in everything from market reports prepared by actual people to 24/7 availability and support for every unexpected twist along the journey. Sellers benefit from expert staging and strategic marketing reaching national and local networks, while buyers enjoy skillful negotiation, curated property tours, and a seamless partnership extending from first meeting to move-in and beyond. The team’s reputation for tenacity and results, backed by more than $750 million in career sales and a multitude of five-star reviews, reflects a true dedication to turning every client’s real estate dreams into reality.

When Expertise Makes All the Difference: A Client’s Story of Success

The value of authentic, local real estate expertise isn’t just theoretical—it’s proven in the lived experiences of homebuyers and sellers. One such example comes from a relocating family who discovered the impact of this guidance when moving from out of state:

We are in the process of relocating from the Chicago area to Orange County, and working with Annie Clougherty and her incredible team was truly the highlight of our home-buying journey. From the moment we connected, Annie’s professionalism, deep local knowledge, and genuine passion for helping clients stood out. She and her team went above and beyond to make our transition seamless. They helped us focus our search, provided expert insight into different neighborhoods, and were always incredibly responsive, attentive, and supportive. Annie truly listened to our needs and helped us find a home that not only checked every box—but exceeded our expectations. Thanks to her expertise and guidance, we felt confident every step of the way and ultimately landed a home we absolutely love. We can’t thank Annie and her team enough for their outstanding service. We highly recommend them to anyone looking to buy in Orange County—you’ll be in the best hands possible!

Stories like this reveal the depth of reassurance, trust, and satisfaction that comes when clients partner with real estate professionals born out of real local expertise. Whatever the complexity of the transition or the uniqueness of goals, those who benefit from local guidance step confidently through every part of the process, enjoying both immediate success and long-term peace of mind.

The Lasting Impact of Local Real Estate Expertise on Your Home Search

In a competitive and ever-evolving real estate scene like Orange County, local real estate expertise is not just a bonus — it’s an essential resource that underpins every wise decision. The ability to anticipate market shifts, understand micro-communities, and offer personalized advice transforms uncertainty into security. By choosing advisors who immerse themselves fully in the local landscape, clients ensure that their property search or sale isn’t just about closing a deal, but about achieving the best possible outcome for their lives and investments.

The influence of thoughtful, community-centered professionals like Annie Clougherty Real Estate- Newport Beach and Coastal Orange County shows just how powerful authentic, local insight can be. Whether buying, selling, or simply dreaming about your next chapter, there’s lasting value in placing your trust in those who understand every street, every nuance, and every possibility. Ultimately, local real estate expertise remains the key to unlocking the right home—today and for years to come.

Contact the Experts at Annie Clougherty Real Estate- Newport Beach and Coastal Orange County

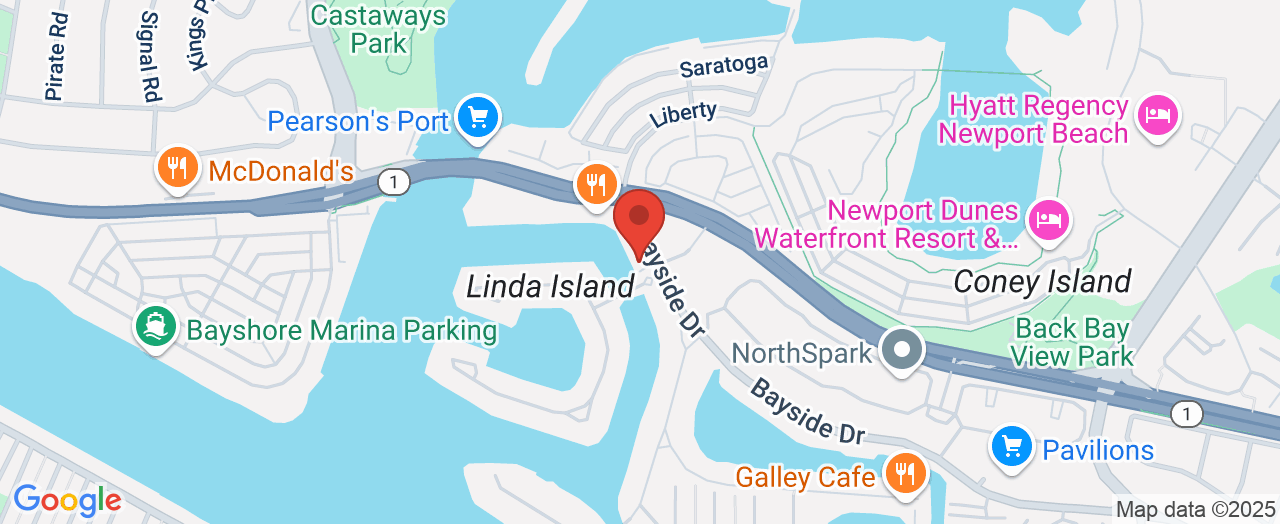

If you’d like to learn more about how local real estate expertise could benefit your home search or sale, contact the experts at Annie Clougherty Real Estate- Newport Beach and Coastal Orange County. 📍 Address: 341 Bayside Dr, Newport Beach, CA 92660 📞 Phone: +1 949-375-3037 🌐 Website: https://www.annieclougherty.com/

Annie Clougherty Real Estate- Newport Beach and Coastal Orange County: Location and Hours

Add Row

Add Row  Add

Add

Write A Comment