Understanding Today’s Real Estate Market: Why Staying Informed Matters More Than Ever

Have you ever wondered why some people seem to always buy or sell real estate at just the right moment? The secret often comes down to a deep understanding of the real estate market—tracking shifts, identifying patterns, and making decisions grounded in solid information. In a world where property is typically the largest investment one makes, grasping the rhythms and signals of the market can mean the difference between securing a smart deal and missing out on a golden opportunity. Whether you're hoping to purchase your dream home, make a lucrative investment, or simply avoid common pitfalls, understanding the current real estate climate is a skill that pays dividends for years to come.

But why is there so much pressure to get it right in real estate? Because markets fluctuate based on economic forces, local trends, and even global events—creating uncertainty for first-time buyers and seasoned investors alike. Anyone entering the field unprepared may find themselves overwhelmed by terminology, surprised by price swings, or left behind as neighborhoods transform. By learning to read the signals and understand the mechanisms behind these changes, you give yourself an edge—one based on knowledge, not luck. That’s why the real estate market remains one of the most closely analyzed topics, and why keeping up with its shifts is essential in making informed, confident decisions.

What Drives Residential Property Success? Unpacking Real Estate Market Trends and Insights

At its heart, the real estate market is a complex engine shaped by supply and demand, local economies, and shifting lifestyles. Knowing how these forces interact can illuminate why certain neighborhoods surge in value or why some investments outperform others. Trends—whether rising home prices, growing rental demand, or revitalized communities—reflect more than numbers; they tell stories about what people want, what’s available, and which regions are poised for growth. To those unfamiliar, the stakes are high: a lack of understanding can turn dreams into headaches, especially when missing subtle but crucial indicators.

Two essential themes dominate current conversations: the impact of local amenities and changing community dynamics. Factors such as proximity to beaches, walkable neighborhoods, easy access to shops, or vibrant entertainment all influence not just value, but also quality of life. Ignoring these elements may mean missing emerging opportunities or buying into areas on the decline. The market does not stand still; what’s considered a “hot” spot today may shift as new transportation, development, or policy changes take hold. The best way to avoid regret and maximize outcomes? Become fluent in the language of real estate trends and stay attentive to evolving patterns. This awareness will protect your investment and position you to act with confidence—before the next big wave hits.

Why Understanding the Real Estate Market Can Transform Your Financial Future

Within the rapidly changing landscape of residential property, those who master the real estate market gain much more than investment returns—they acquire security, flexibility, and peace of mind. Guided by the expert experience and resources found through local authorities such as Balboa Realty in Newport Beach, buyers and sellers unlock key advantages. These advantages include accurate market forecasting, tailored property matching, and clarity about when to act or hold. Unlike relying on rumor or guesswork, learning from seasoned professionals empowers individuals to make choices that reflect both market realities and personal aspirations.

Real world benefits go beyond short-term profit: understanding the nuances of property trends helps individuals and families secure homes in desirable areas, access valuable communities, and build lasting personal wealth. For investors, the steady interpretation of data coupled with insider knowledge can mean the ability to identify undervalued assets or sell ahead of downturns. The trust built with a responsive professional who understands unique local demands ensures clients avoid costly missteps and capitalize on opportunities, leading to less stress and more successful outcomes in the long term.

How Local Amenities Shape Real Estate Market Hotspots

One of the most defining features in any real estate market is location—and that means more than just geography. The presence of beaches, scenic boardwalks, bustling shopping centers, and popular eateries are powerful magnets that drive demand and shore up property values. In dynamic coastal communities like Newport Beach, proximity to the sand and surf isn’t just a luxury—it’s often the differentiator that separates high-performing properties from average ones. Buyers and renters seek not just a place to live, but a lifestyle, and neighborhoods offering walkability, convenience, and access to recreational activities consistently rank high on wish lists.

Easy access to these local highlights shifts the equation for both short- and long-term returns. Whether a buyer is looking for a forever home or investors are scanning for income-generating rentals, thriving locations supported by entertainment, retail, and leisure options command strong interest. Over time, as neighborhoods develop and new projects take root, areas once considered secondary can quickly become prime, demonstrating how attentive awareness of amenities remains essential for anyone hoping to succeed in the fast-moving real estate market.

Rental Demand: The Unsung Force Behind Property Investment Value

While home buying and selling often take center stage, rental demand significantly shapes the health and prospects of any real estate market. High occupancy rates point to strong neighborhoods; surges in rental interest often foreshadow rising property values. For regions like Newport Beach, recurrent demand for vacation properties and long-term rentals highlights the area’s enduring appeal—not just for tourists, but for those who envision a balanced lifestyle near the water. Understanding what renters seek (clean, well-maintained, conveniently located homes) provides buyers and investors with vital clues on how to upgrade, price, and market their properties to maximize returns.

The ongoing shift in living preferences—more remote work, prioritization of wellness, and the desire for community ties—means expectations are evolving. Smart property owners tune in to these subtle changes, adjusting their offerings to match new demands. By recognizing and responding to the factors driving rental choice, anyone can strengthen their position in the real estate market, whether their goal is steady passive income or long-term appreciation.

The Power of Transparency in Real Estate Transactions

Navigating the real estate market may seem daunting, but clarity and transparency have become defining values for the most trusted professionals in the field. Making major life decisions—whether buying, selling, or renting—requires confidence that every detail is communicated and understood. Professionals who foster open dialogue, provide timely responses, and guide clients at each step contribute to a stress-free experience, paving the way for smarter, more satisfying outcomes.

Transparent communication also safeguards everyone involved, reducing the risk of surprises and ensuring that agreements are both fair and firmly understood. Clients who work with experts known for honesty and attention to detail are far more likely to recommend services, reflecting the deeper value of trust in an industry where every transaction counts. The lesson is clear: informed choices and clear processes are the foundation for building both strong investments and lasting relationships.

Balboa Realty’s Approach: Elevating Real Estate Experiences with Expertise and Integrity

When analyzing standout philosophies in the real estate market, one theme rises to the top: a relentless focus on client needs coupled with deep local knowledge. Balboa Realty embodies this by placing professionalism, transparency, and client satisfaction at the heart of every transaction. Their method is not about quick wins or volume—it’s about building trust through responsive communication, careful listening, and tailored property solutions. The staff makes an effort to understand individual circumstances, ensuring everyone from first-time renters to seasoned investors feels confident and supported.

Balboa Realty’s dedication to seamless processes is matched by a genuine commitment to efficiency, honesty, and positive client outcomes. Their approach dispels the myth of real estate as an overwhelming process, showing instead that with the right guidance, clients can enjoy smooth and rewarding experiences, whether searching for a rental, investing in property, or navigating more complex market decisions. This unwavering attention to transparency and integrity sets a strong example of what outstanding real estate service should deliver—empowering clients to engage with the market on their own terms.

Real People, Real Results: A Story of Confidence and Clarity in the Real Estate Market

Understanding the impact of professional guidance in real estate becomes even clearer with firsthand stories from those who have benefitted from expert support. One reviewer recently shared their experience, highlighting the rewards of working with industry professionals who communicate, listen, and guide every step of the way—a reminder that the right partnership can turn uncertainty into a positive and empowering journey.

I recently had the pleasure of working with Balboa Realty for a rental property, and I couldn’t be more pleased with the experience. From the very beginning, their professionalism stood out. The team was responsive, attentive, and guided me through the entire process seamlessly. Communication was clear, and they took the time to understand my needs, offering options that were exactly what I was looking for. What impressed me most was how efficiently everything was handled — from initial inquiries to signing the lease, the process was smooth and stress-free. I was particularly grateful for the transparency and honesty throughout, which made me feel confident in my decisions. Overall, my experience with Balboa Realty was excellent, and I would absolutely recommend them to anyone looking for a reliable and professional real estate service.

Their feedback echoes what so many seek in navigating the real estate market: a sense of security, comprehensive guidance, and open communication that takes the stress out of major decisions. Choosing to approach real estate with education and support can transform even challenging journeys into positive experiences, and for many, it’s the key to turning market trends into personal success.

What Successful Real Estate Market Decisions Mean for Your Long-Term Goals

The real estate market is more than numbers and contracts—it is the intersection of dreams, financial goals, and life-changing decisions. By learning from those with proven expertise and keeping up with the latest trends, buyers, sellers, and investors alike gain advantages that set them up for enduring success. The track record of established experts demonstrates how transparency, efficiency, and attentive service dramatically shift outcomes for the better. Embracing the full value of market knowledge today means laying a solid foundation for tomorrow’s achievements, all while navigating with confidence and clarity crucial to meaningful progress in real estate.

The journey does not end with a single transaction; it evolves as markets shift, needs change, and communities grow. By remaining engaged with reputable local experts, individuals and families ensure they always have access to the latest data and trusted advice. Ultimately, those who prioritize informed real estate market decisions gain more than property—they unlock opportunity, stability, and a strong path forward in life’s most significant endeavors.

Contact the Experts at Balboa Realty

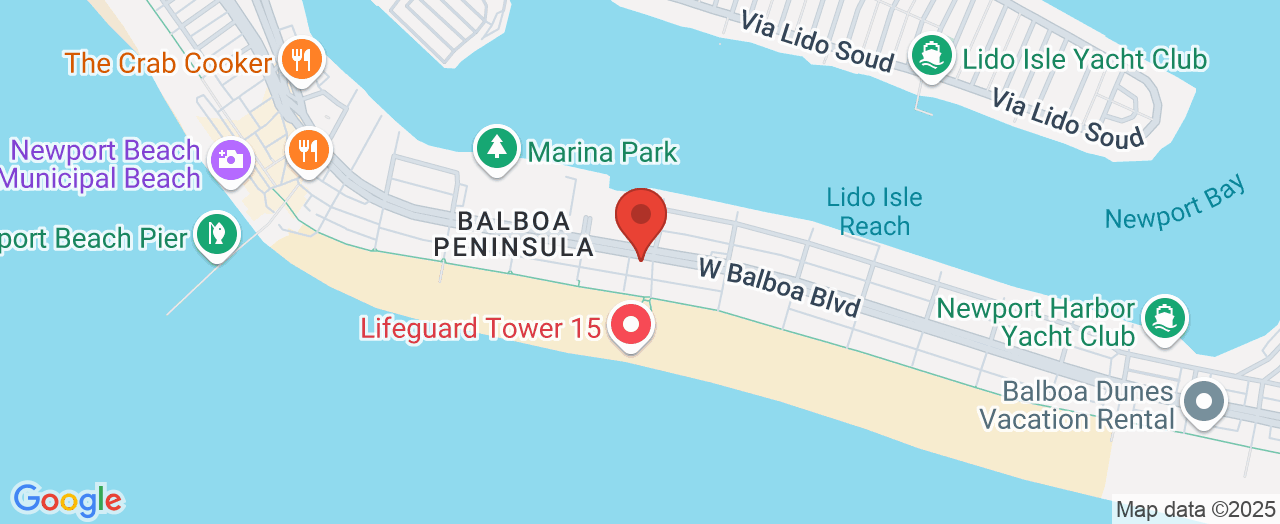

If you’d like to learn more about how the real estate market could benefit your personal or investment goals, contact the team at Balboa Realty. 📍 Address: 1501 W Balboa Blvd, Newport Beach, CA 92663 📞 Phone: +1 949-704-6459 🌐 Website: https://www.newportbeachvacationproperties.com/real-estate

Balboa Realty Location and Hours

🕒 Hours of Operation:

📅 Monday: 9:00 AM – 5:00 PM

📅 Tuesday: 9:00 AM – 5:00 PM

📅 Wednesday: 9:00 AM – 5:00 PM

📅 Thursday: 9:00 AM – 5:00 PM

📅 Friday: 9:00 AM – 5:00 PM

📅 Saturday: ❌ Closed

📅 Sunday: ❌ Closed

Add Row

Add Row  Add

Add

Write A Comment